-

frank

19kIve been reading about Rome's economic ills toward the end of its life and it's had me pondering debt, taxation, and democracy.

frank

19kIve been reading about Rome's economic ills toward the end of its life and it's had me pondering debt, taxation, and democracy.

In short, Rome's problem was that they didn't manufacture anything to trade for all the wealth they imported. Instead, they conquered for a living. This worked well until they started running out of places to loot. By Nero's time, they had already fully explored debasing their currency and they next turn to looting themselves. High taxes put farmers out of business and ultimately many had no choice but to sell their children or themselves into slavery.

Today we don't conquer for money. We go into debt. European countries starve themselves to pay their debts, but the US just keeps ballooning out its debt like it's meaningless. Is this a flaw in a democracy that has the power to be self determining? Would the US government have already turned on its own population if it weren't democratic?

Whats the solution? -

BC

14.3kThere seem to be dramatic different ways of interpreting the significance of national debt, varying from crisis to indifference. Some kinds of debt make sense: a mortgage at reasonable interest rates makes sense. At unreasonable interest, no. Steadily accumulating credit card debt doesn't make sense: one should restrict one's spending to one's income, with only small amounts of short-term debt being tolerated.

BC

14.3kThere seem to be dramatic different ways of interpreting the significance of national debt, varying from crisis to indifference. Some kinds of debt make sense: a mortgage at reasonable interest rates makes sense. At unreasonable interest, no. Steadily accumulating credit card debt doesn't make sense: one should restrict one's spending to one's income, with only small amounts of short-term debt being tolerated.

National debt seems more like credit card debt to me. Some of it may be as necessary as a mortgage, but a lot of it is living beyond one's income. Now, the US Government could, if politicians were willing, increase its income through taxation, and could put a ceiling on its debt or lower its indebtedness. It would be a good thing, because the interest on the national debt is huge, and costs us the opportunity to accomplish worthwhile goals.

Here is a chart from the Australian Government on world debt: I don't find much solace in it.

General government net debt 2010

-

BC

14.3kHere is the 2015 US budget chart (from the Science web site)

BC

14.3kHere is the 2015 US budget chart (from the Science web site)

According to this chart, 6% of the budget is being spent on debt. 6% on debt may not seem all that large, but it isn't discretionary spending. It's part of the very large non-discretionary spending on social security, medicare, medicaid, and non discretionary defense spending. Without more taxation (and there are rich people to tax) spending on good discretionary projects like science, education, the environment, R&D, transportation, Centers for Disease Control, and so on will have to be cut.

The solution is to increase taxation (long since reduced) on the richest portion of Americans who have more wealth than the rest of the population. I have looked deep into my heart and I find that I can stand their unwilling sacrifice of ... let's say, hmmm, $50 trillion. You can rest, assured that after being so fleeced, they will still be able to enjoy fine wines, excellent meals, haute couture, and so on. They might have to put up with a slightly smaller yacht, a less pretentious collection of houses, and so on. They would not be reduced to eating beans and wieners (unless, of course, they preferred beans and wieners).

But then again, if we can get $50 trillion dollars out of the super rich, we might as well take the rest of it too, and let them be grateful to make soup out of wiener water. -

Rank Amateur

1.5kNational debt, in a country with a fiat currency, that has lender confidence, has absolutely nothing at all I in common with personal, or local government debt. Completely apples to oranges. The only thing that should impact the increase or decrease in the deficit should be the employment rate.

Rank Amateur

1.5kNational debt, in a country with a fiat currency, that has lender confidence, has absolutely nothing at all I in common with personal, or local government debt. Completely apples to oranges. The only thing that should impact the increase or decrease in the deficit should be the employment rate. -

MindForged

731National debt seems more like credit card debt to me. Some of it may be as necessary as a mortgage, but a lot of it is living beyond one's income. Now, the US Government could, if politicians were willing, increase its income through taxation, and could put a ceiling on its debt or lower its indebtedness. It would be a good thing, because the interest on the national debt is huge, and costs us the opportunity to accomplish worthwhile goals. — Bitter Crank

MindForged

731National debt seems more like credit card debt to me. Some of it may be as necessary as a mortgage, but a lot of it is living beyond one's income. Now, the US Government could, if politicians were willing, increase its income through taxation, and could put a ceiling on its debt or lower its indebtedness. It would be a good thing, because the interest on the national debt is huge, and costs us the opportunity to accomplish worthwhile goals. — Bitter Crank

The problem is a government (the U.S. government especially) is not like a household. Households cannot produce their own currency that others will accept, a government can (and does) do so, and can (and does) do so entirely independent of whether it spends more than it takes in in taxation (what the government sets as it's budget is a political decision). The analogy breaks down at any relevant level so I don't think it's a good one. It ignores how governments actually go about attaining and using its money. -

frank

19kThe solution is to increase taxation (long since reduced) on the richest portion of Americans who have more wealth than the rest of the population. — Bitter Crank

frank

19kThe solution is to increase taxation (long since reduced) on the richest portion of Americans who have more wealth than the rest of the population. — Bitter Crank

This goes straight to my question:

1. The Roman Empire is a model of a totalitarian state with a massive chronic trade deficit which reached the point of being unable to pay for its government and military. Being totalitarian, it was able to raise taxes and tribute until it began to undermine its own health.

2. The US is a model of a democratic state with a massive chronic trade deficit which has reached the point of being unable to adequately fund its government and military, but it isn't able to raise taxes (or tribute). Instead, it just has a debt which would take out the global economy were it to default.

But as you point out, cultural degradation is still on the horizon for the US as the interest on the debt takes priority over Medicare, Social Security, and other social safeguards.

What governmental/economic system would be an improvement over 1 and 2? Or are we just looking at an inevitable process? What do you think, BC? -

Jake

1.4kWhats the solution? — frank

Jake

1.4kWhats the solution? — frank

Pain.

We'll just keep on being reckless until we finally hit a wall and enter a period of great crisis. After enormous suffering common sense will once again be imprinted upon the group consensus. That will work for awhile, until all those who lived through the crisis die off, and the times are once again good, and then we'll start the predictable journey back towards the next crisis.

Or, the great crisis will trigger a global nuclear war and that will end the cycle for a much longer period, perhaps forever.

There's really little evidence that we're all going to wake up someday soon before a crisis and decide on our own to be responsible. -

BC

14.3kIt ignores how governments actually go about attaining and using its mone — MindForged

BC

14.3kIt ignores how governments actually go about attaining and using its mone — MindForged

National debt, in a country with a fiat currency, that has lender confidence, has absolutely nothing at all I in common with personal, or local government debt. — Rank Amateur

I understand that personal or corporate debt isn't the same as national debt. However, the fact is that national debt is a recurrent item of discussion among economists and politicians, both.

I have difficulty believing that there are no consequences to an steadily growing nation debt. fiat currency or not. After all, we have paid off the debts from past wars: $4 trillion from WWII, for instance was paid off sometime by the late 1960s. (The cost of WWII was $350 billion in 1945 dollars. That was something like twice government spending since 1776. A lot, in other words.) Other countries seem worried about their own and others' debts.

Printing money generally has the effect of devaluing a currency. If last year there was $1.5 trillion in circulating currency, and another 1.5 trillion dollars worth of money is printed, then a dollar can't continue to have the same purchasing power.

Granted, fiat currency doesn't have any inherent value, but obviously a country can not become fabulously rich by magically creating huge amounts of money. If that were so, then every country would be printing their way to financial heaven.

So, explain how debt is not a problem. -

BC

14.3k2. The US is a model of a democratic state with a massive chronic trade deficit which has reached the point of being unable to adequately fund its government and military, but it isn't able to raise taxes (or tribute). Instead, it just has a debt which would take out the global economy were it to default. — frank

BC

14.3k2. The US is a model of a democratic state with a massive chronic trade deficit which has reached the point of being unable to adequately fund its government and military, but it isn't able to raise taxes (or tribute). Instead, it just has a debt which would take out the global economy were it to default. — frank

The United States IS able to raise taxes. The fact is the politicos in Washington don't want to raise taxes. It wasn't that long ago that the wealthy high earners (the top 5%) paid much more in taxes. In 1965 the tax rate on the wealthiest individuals was 91%. The current level of taxation on high incomes was recently lowered from 39% to 37%. 91% is what it takes to actually balance the budget and pay off old debts.

During the Vietnam war there was much discussion of "guns vs. butter" -- the cost of war vs. the costs of domestic programs. Johnson didn't want to choose either one, he wanted both. As a result a significant amount of debt was piled on just as old debt was being retired. During Reagan's administration (1980-88) tax cuts were combined by the ruinously expensive and pointless arms race called 'star wars'. More debt. Clinton was able to balance the federal government some years; I may be mistaken, but his budgets may have been the last ones.

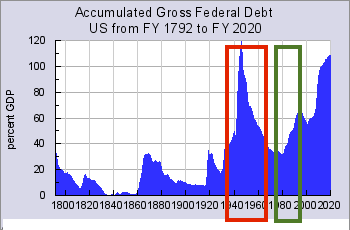

red rectangle: WWII; green rectangle: star wars and tax cut

-

Relativist

3.6kI assume you realize that "printing" money is not the issue, it is the money supply - which mostly consists of figures in computers.

Relativist

3.6kI assume you realize that "printing" money is not the issue, it is the money supply - which mostly consists of figures in computers.

If the money supply grows at the same rate as GDP, then dollars retain their value. Adding to the money supply can stimulate the economy because more is then available for investment. Conversely, shrinking the money supply would constrain investment, lower growth and risk recession.

If the debt is paid down, the risk is that it could reduce the supply of money available for investment, but the risk can be managed (e.g. commensurately increasing the money supply). The real problem with the debt is servicing it: paying the interest. If the debt grows faster than the economy, these interest payments will be on an unsustainable growth path - debt service will eventually overwhelm the budget, causing hyperinflation and economic collapse. -

BC

14.3kIf adding to the money supply is so harmless, then why don't we just pay the interest on the debt with freshly created money? Or is it the case that there are some limits to what fiat currency can accomplish in the world?

BC

14.3kIf adding to the money supply is so harmless, then why don't we just pay the interest on the debt with freshly created money? Or is it the case that there are some limits to what fiat currency can accomplish in the world? -

BC

14.3kI assume you realize that "printing" money is not the issue, it is the money supply - which mostly consists of figures in computers. — Relativist

BC

14.3kI assume you realize that "printing" money is not the issue, it is the money supply - which mostly consists of figures in computers. — Relativist

For god's sake, don't be such a literalist. Of course I understand that only a certain kind of money (paper currency) is actually printed. -

Relativist

3.6kThat would increase the money supply beyond what is needed for growth, and therefore be inflationary.

Relativist

3.6kThat would increase the money supply beyond what is needed for growth, and therefore be inflationary.

It is complicated, and the main thing I want to convey is that intuition will lead you astray. National debt is not like household debt. We don't necessarily need to pay it off. We depend on perpetual growth of the economy to make it work. And fiat currency is not really a problem - we're still bartering things of value (ie the stuff that money can buy). -

BC

14.3k

BC

14.3k

From Marketplace (NPR) But for now, interest rates are still low. The markets continue to gobble up our debt. The U.S. dollar is the world reserve currency. Is anybody out there saying the U.S. isn't a good bet fiscally?

David Primo: And that's sort of the benefit of being the United States and also the risk of being the United States. So the benefit, as you just said, is right now we have the ability as a country, because we are the world's reserve country, to perhaps take on more debt than other countries can. American debt by comparison is very, very safe. And as a result, there's still a lot of demand for our debt. Interest rates are low right now. But a lot of this debt that's being issued is short-term debt. What happens when that debt has to be reissued, and interest rates that other countries and individuals will demand to buy up that debt goes up all of a sudden? All right, the fiscal picture gets gloomier. And, you know, there isn't an announcement that's made, oh tomorrow, the rest of the world is going to stop buying up U.S. debt. It can happen very suddenly.

How can we know if there's a crisis coming?

David Primo: That's the risky part; what economists like to call a creeping risk. Today it's not going to affect us, tomorrow it's not going to affect us, but it builds up over time and eventually you end up in a crisis situation. If our national debt doubles again, as it's predicted to do as a share of the economy in the next 30 years, for the average American it's going to have an effect on the ability for the federal government to undertake the activities that Americans think are important. So there's a lot of talk about how Republicans want to, you know, eviscerate entitlements. -

MindForged

731I understand that personal or corporate debt isn't the same as national debt. However, the fact is that national debt is a recurrent item of discussion among economists and politicians, both. — Bitter Crank

MindForged

731I understand that personal or corporate debt isn't the same as national debt. However, the fact is that national debt is a recurrent item of discussion among economists and politicians, both. — Bitter Crank

It's more a concern of politicians, but even then that's more in the public sphere. When they're doing budget allocations they aren't actually constrained by the debt. That's how you can have things like Trump arbitrarily upping the defense budget by 10s of billions on whim. It's a choice of politics how much money to spend and where to allocate it. The Republicans have never been the party of small deficits, it's provably just a cudgel they use against the weakling Democratic Party so that they don't do anything during their reign while the opposition starts wars on a whim (again, trillions to throw around on a whim; that money is just invented). The dollar has investor confidence, other countries would rather have dollars than not so it works out even if it's used for stupid reasons (not toe pick on GOP, I can use idiot Democrat examples too). -

unenlightened

10kHere's a question. Most, if not all countries are in debt. Who is the creditor? What kindly body is lending to us all, ET?

unenlightened

10kHere's a question. Most, if not all countries are in debt. Who is the creditor? What kindly body is lending to us all, ET? -

Rank Amateur

1.5kHere is a very good article on MMT. Worth a read for those interested

Rank Amateur

1.5kHere is a very good article on MMT. Worth a read for those interested

http://neweconomicperspectives.org/2014/06/modern-money-theory-basics.html

It is very counter intuitive to how we generally think about money, but it is the best explanation of how the economy really work. To be clear MMT is not a framework some one or government is following, it is an explanation of what is happening.

Some teasers:

A sovereign government can never become insolvent in its own currency

The government can burn every tax dollar it gets, and still buy anything it wants

Every single dollar of the deficit is now a dollar in someone's pocket

The government only taxes to control inflation

The government only borrows to control the overnight into rate

The government spends money into existence and taxes it out

The objective of government spending should be full employment

This one is not part of MMT, or the article. But the concern for the disparity in income is a very real economic, political, and social problem. If many of these dollars the government spends into existence to stimulate economic activity and increase employment only go into a growing rich guys account they become meaningless. Economic activity is based on spending- not investment. Private investment needs spending to buy the goods or services. Very very rich people do not spend vey much as a percentage of their reserves. While their billions looks cool on the Forbes list, it is a drag on the economy- very very rich people should be very heavily taxed. -

Rank Amateur

1.5kI understand that personal or corporate debt isn't the same as national debt. However, the fact is that national debt is a recurrent item of discussion among economists and politicians, both. — Bitter Crank

Rank Amateur

1.5kI understand that personal or corporate debt isn't the same as national debt. However, the fact is that national debt is a recurrent item of discussion among economists and politicians, both. — Bitter Crank

Because it makes great politics, and very bad economics. -

frank

19kThe United States IS able to raise taxes. The fact is the politicos in Washington don't want to raise taxes. — Bitter Crank

frank

19kThe United States IS able to raise taxes. The fact is the politicos in Washington don't want to raise taxes. — Bitter Crank

Neither do their constituents. That was the point of comparing a democracy to a totalitarian state. In Rome, the power and will to raise taxes existed, but the long term outcome was that Rome gutted itself to support the government and a super wealthy untaxed class.

In a self-determining democracy like the US, there isnt any sustained will to raise taxes. Rome systematically raised taxes over centuries. It's true that the Great Generation was more financially responsible than we are, but the democratic system allows irresponsibility and I would argue that it's greed that will win in the end.

The result is a debt that will never be paid. It will just disappear in the next economic breakdown as Britain's post WW1 debt disappeared during the Great Depression. -

Rank Amateur

1.5kThe result is a debt that will never be paid. — frank

Rank Amateur

1.5kThe result is a debt that will never be paid. — frank

It would serve no economic purpose, but the government could pay the entire debt with a keystroke if it chose to. -

frank

19kHey, in the 1960s the rate on big wealth was 91%. What do you mean, the government can't effectively tax wealth? — Bitter Crank

frank

19kHey, in the 1960s the rate on big wealth was 91%. What do you mean, the government can't effectively tax wealth? — Bitter Crank

The Romans also had moments of violent frugality as parties occasionally grasped the meaning of the signs.

It's what the system does in the long run that I was focusing on. -

LD Saunders

312Typically, the high tax rates on the wealthy occur during periods of war. This is because lower-income people are risking their lives while the wealthy don't. So, to be "fair," it is felt that they could pay a larger percentage of their income in taxes.

LD Saunders

312Typically, the high tax rates on the wealthy occur during periods of war. This is because lower-income people are risking their lives while the wealthy don't. So, to be "fair," it is felt that they could pay a larger percentage of their income in taxes.

I'm not so sure it is fair to tax the wealthy simply because they are wealthy. After all, some of the richest people started off poor and earned their wealth lawfully, and fairly. I do think when it comes to inheritance that the taxes should be high, as a person inheriting their wealth did not earn it and with too much inequality, we end up with a handful of rich people using their wealth to set political policy in their favor and against the vast majority of people in the country. -

frank

19kI'm not sure there is any way to keep that handful of rich people from taking over financial policy with or without inheritance tax. Once they exist, they discover how to get around inheritance taxes as they do with taxes in general. This insidious situation might obscure an interesting fact: taxation of any kind tends to suppress economic activity. It diminishes incentives that drive free markets. So reaganomics is correct: whether anything trickles down or not, lowering taxes will heat up an economy, and people at the bottom will benefit from that.

frank

19kI'm not sure there is any way to keep that handful of rich people from taking over financial policy with or without inheritance tax. Once they exist, they discover how to get around inheritance taxes as they do with taxes in general. This insidious situation might obscure an interesting fact: taxation of any kind tends to suppress economic activity. It diminishes incentives that drive free markets. So reaganomics is correct: whether anything trickles down or not, lowering taxes will heat up an economy, and people at the bottom will benefit from that.

So the real situation is pretty complex and full of two-edged swords. -

LD Saunders

312Frank: Your proof that taxes always reduce economic activity? If a person is making $8.00 an hour and barely getting by, and has to take home less than $8.00 an hour, due to payroll taxes, as an example, why would that person work less as opposed to more, to get by? Also, since when did Reagan ever originate any economic policy? He never did. And why would lowering taxes necessarily heat up an economy? If I now get to take home more money as a result of reduced taxes, why would that cause me to work longer hours as opposed to fewer hours?

LD Saunders

312Frank: Your proof that taxes always reduce economic activity? If a person is making $8.00 an hour and barely getting by, and has to take home less than $8.00 an hour, due to payroll taxes, as an example, why would that person work less as opposed to more, to get by? Also, since when did Reagan ever originate any economic policy? He never did. And why would lowering taxes necessarily heat up an economy? If I now get to take home more money as a result of reduced taxes, why would that cause me to work longer hours as opposed to fewer hours? -

Shawn

13.5kA sovereign government can never become insolvent in its own currency — Rank Amateur

Shawn

13.5kA sovereign government can never become insolvent in its own currency — Rank Amateur

This is dangerous to implement. It creates conditions for hyperinflation and such. -

Rank Amateur

1.5kThis is dangerous to implement. It creates conditions for hyperinflation and such. — Posty McPostface

Rank Amateur

1.5kThis is dangerous to implement. It creates conditions for hyperinflation and such. — Posty McPostface

MMT is not a plan that you implement - it is an explanation of what is happening. -

Shawn

13.5kMMT is not a plan that you implement - it is an explanation of what is happening. — Rank Amateur

Shawn

13.5kMMT is not a plan that you implement - it is an explanation of what is happening. — Rank Amateur

I see. So, what does it have to say about excessive credit and debt levels in the US, and how those can be solved? Can too much credit ever be a problem for MMT? -

Rank Amateur

1.5kthere is a link above that does a good job of explaining it -

Rank Amateur

1.5kthere is a link above that does a good job of explaining it -

but the basics - According to MMT

governments spend money into existence, and tax it out of existence - but it has to be spent first - before it can be taxed. This balance is the control on inflation.

interest rates are controlled by the movements in the government bond market. Banks reduce reserves by buying bonds, the overnight rate is adjusted to incentive or dis incentive these sales

and the purpose of government spending should be to obtain full employment.

the deficit is neither good nor bad independent of employment. Government spending should decrease in time of full employment and increase in time of higher un-employment.

there is no such thing as an excessive credit or deficit - they don't need to be solved

the only debt issues with MMT , and all fiat economy is they rest on the confidence in the governments ability to meet its obligations. There is no economic reason, this could happen, but there are political ones - like artificial debt ceilings that are 100% political - they are about votes not money.

Welcome to The Philosophy Forum!

Get involved in philosophical discussions about knowledge, truth, language, consciousness, science, politics, religion, logic and mathematics, art, history, and lots more. No ads, no clutter, and very little agreement — just fascinating conversations.

Categories

- Guest category

- Phil. Writing Challenge - June 2025

- The Lounge

- General Philosophy

- Metaphysics & Epistemology

- Philosophy of Mind

- Ethics

- Political Philosophy

- Philosophy of Art

- Logic & Philosophy of Mathematics

- Philosophy of Religion

- Philosophy of Science

- Philosophy of Language

- Interesting Stuff

- Politics and Current Affairs

- Humanities and Social Sciences

- Science and Technology

- Non-English Discussion

- German Discussion

- Spanish Discussion

- Learning Centre

- Resources

- Books and Papers

- Reading groups

- Questions

- Guest Speakers

- David Pearce

- Massimo Pigliucci

- Debates

- Debate Proposals

- Debate Discussion

- Feedback

- Article submissions

- About TPF

- Help

More Discussions

- Biological Determinism As The Fundamental Pedagogy of National Socialist Thought (Half of Chapter 1)

- Biological Determinism As The Fundamental Pedagogy of National Socialist Thought

- National Debt and Monetary Policy

- Are International Human Rights useless because of the presence of National Constitutions?

- Other sites we like

- Social media

- Terms of Service

- Sign In

- Created with PlushForums

- © 2026 The Philosophy Forum