-

Benkei

8.1kActually, I think Spain is less corrupt in some areas. It's for instance much more open about what it pays for public procurement. Over 80% is published, which is about 45% for the Netherlands. If you're not transparent, you're more likely to act corrupt.

Benkei

8.1kActually, I think Spain is less corrupt in some areas. It's for instance much more open about what it pays for public procurement. Over 80% is published, which is about 45% for the Netherlands. If you're not transparent, you're more likely to act corrupt.

Edit; correction, 85% and 52%, more or less. -

javi2541997

7.2kIt is a big issue on what governments should do and a big dilemma about what we (the voters) are looking for when we go to vote. Is it easy rule a country? No, it isn't. Probably, I wouldn't know what to do if I were a PM but at least being the more efficient, possibly.

javi2541997

7.2kIt is a big issue on what governments should do and a big dilemma about what we (the voters) are looking for when we go to vote. Is it easy rule a country? No, it isn't. Probably, I wouldn't know what to do if I were a PM but at least being the more efficient, possibly.

Every government has corruption. It is something wrong have to accept. I don't know how to explain it but when politicians reach the power they get corrupt.

But, one of the paradoxes here, is the fact that Spain when was ruled by a very corrupt political party, our economy was between 10th and 7th worldwide and the salaries were ok. The current government kicked out the previous one just for being corrupt not in terms of efficiency. This is why there are some Spaniards who have nostalgia about the previous prime minister. So it is interesting, there are people who rather have corrupt politicians than useless ones. -

javi2541997

7.2k@Benkei

javi2541997

7.2k@Benkei

In the other hand, please let me show you a good example of efficient politics.

Naoto Kan was the PM of Japan when Fukushima nuclear disaster took place. Kan was always been a politician focused in the ending of Japanese nuclear power. After the disaster, his reputation had decreased a lot. Nonetheless, before his resignation (just the act of resign is very honourable) he approved two important laws in japanese parliament to help the people recover from this disgrace. After the resignation, he said sorry to japanese citizens for not reaching the end of nuclear power.

He told a parliamentary investigation in 2012 that the nuclear industry had "shown no remorse" for the disaster, and was trying to push Japan back to nuclear power.

This man is a good example of a politician: honesty and efficiency for the people. Naoto Kan.

(I am even nearly in tears while writing this)

-

Benkei

8.1kSuch politicians are a product of culture. We lack leadership and fidelity towards others. Not in the sense of vision but someone that can bind society together and respect for others. Moral behaviour is minimalism in western society. It's let me do everything I like as long as I don't harm another (too much because everybody should be tolerant so mostly it's others not being tolerant that's the problem, according to them). You get that sort of individualism married to toxic (monetary) value systems. We even see outgrowths of that in philosophy, specifically free speech absolutism and anti-natalism, which is just me-me-me.

Benkei

8.1kSuch politicians are a product of culture. We lack leadership and fidelity towards others. Not in the sense of vision but someone that can bind society together and respect for others. Moral behaviour is minimalism in western society. It's let me do everything I like as long as I don't harm another (too much because everybody should be tolerant so mostly it's others not being tolerant that's the problem, according to them). You get that sort of individualism married to toxic (monetary) value systems. We even see outgrowths of that in philosophy, specifically free speech absolutism and anti-natalism, which is just me-me-me.

It reminds me of the universe 25 experiments with mice basically. -

javi2541997

7.2kSuch politicians are a product of culture. We lack leadership and fidelity towards others — Benkei

javi2541997

7.2kSuch politicians are a product of culture. We lack leadership and fidelity towards others — Benkei

I couldn't have said it better.

one of the main problems is our educational system. We don't have the culture of group and community. If Japanese people were able to recover from TWO nuclear bomb attacks is due to their millennial culture. They quickly thought that they only way to promote themselves was act collectively. Now: they are a country to consider of without any doubt.

I wish we copy more aspects of japanese culture rather than stupid "survival" or "entrepreneurs" savage capitalism prism... -

javi2541997

7.2kI just read an interesting quote from a book (Trickle Down" Theory and "Tax Cuts for the Rich", Hoover Institution Press, 2012, pp.10-11) related to this thread, it says:

javi2541997

7.2kI just read an interesting quote from a book (Trickle Down" Theory and "Tax Cuts for the Rich", Hoover Institution Press, 2012, pp.10-11) related to this thread, it says:

The very idea that profits "trickle down" to workers depicts the economic sequence of events in the opposite order from that in the real world. Workers must first be hired, and commitments made to pay them, before there is any output produced to sell for a profit, and independently of whether that output subsequently sells for a profit or at a loss. With many investments, whether they lead to a profit or a loss can often be determined only years later, and workers have to be paid in the meantime, rather than waiting for profits to "trickle down" to them. The real effect of tax rate reductions is to make the future prospects of profit look more favorable, leading to more current investments that generate more current economic activity and more jobs.

Those who attribute a trickle-down theory to others are attributing their own misconception to others, as well as distorting both the arguments used and the hard facts about what actually happened after the recommended policies were put into effect. — Thomas Sowell, -

NOS4A2

10.2kAnyone who understand taxation to be immoral has to contend with Liam Murphy and Thomas Nagel’s argument against “everyday libertarianism”, which they describe as the common inclination “to feel that what we have earned belongs to us without qualification, in the strong sense that what happens to that money is morally speaking entirely a matter of our say-so”.

NOS4A2

10.2kAnyone who understand taxation to be immoral has to contend with Liam Murphy and Thomas Nagel’s argument against “everyday libertarianism”, which they describe as the common inclination “to feel that what we have earned belongs to us without qualification, in the strong sense that what happens to that money is morally speaking entirely a matter of our say-so”.

According to the authors this is a “conceptual problem”, later viewing it condescendingly as a confused delusion. They explain:

“There is no market without government and no government without taxes; and what type of market there is depends on laws and policy decisions that government must make. In the absence of a legal system supported by taxes, there couldn’t be money, banks, corporations, stock exchanges, patents, or a modern market economy—none of the institutions that make possible the existence of almost all contemporary forms of income and wealth.

It is therefore logically impossible that people should have any kind of entitlement to all their pretax income. All they can be entitled to is what they would be left with after taxes under a legitimate system, supported by legitimate taxation— and this shows that we cannot evaluate the legitimacy of taxes by reference to pretax income.

The Myth of Ownership

Murphy and Nagel

In following their reasoning one can end up at a cross-road, maybe a dead end. There is no government without taxes, and no taxes without government. There is no market without government, and no government without a market. At what point on this circle should we jump on and jump off?

They explain in the following passage:

The tax system is not like an assessment of members of a department to buy a wedding gift for a colleague. It is not an incursion on a distribution of property holdings that is already presumptively legitimate. Rather, it is among the conditions that create a set of property holdings, whose legitimacy can be assessed only by evaluating the justice of the whole system, taxes included. Against such a background people certainly have a legitimate claim on the income they realize through the usual methods of work, investment, and gift— but the tax system is an essential part of the background which creates the legitimate expectations that arise from employment contracts and other economic transactions, not something that cuts in afterward.

The circle is squared. The tax system is not an “incursion on a distribution of property holdings that is already presumptively legitimate”. It is not something that cuts in after our transactions and takes our property. Rather, the tax system creates the “legitimate expectations” that, like a feeling, “arise from our transactions”. The system is in the background, just there, perhaps everywhere, providing us all with the conditions that create a set of property holdings, like nature itself. So who cares if they take your income? In fact, your pre-tax income was never yours to begin with.

We can first contrast “everyday libertarianism” with Nagel and Murphy’s “everyday statism”, the feeling that what we have earned belongs to the state without qualification, in the strong sense that what happens to that money is morally speaking entirely a matter of the State’s say-so. In doing so it makes clear that there is a competing property claim between everyday libertarianism and everyday statism. Whose income is it?

The authors state that it is “logically impossible” that someone should have entitlement to their pre-tax income. Without a system supported by taxes there wouldn’t be markets and income in the first place. The question-begging character of Everyday Statism begins to reveal itself upon a cursory glance at history.

It isn’t true that the tax system is not an incursion on legitimate property holdings. It is, in fact and in practice, “something that cuts in after”. In America for example, the 16th amendment, which gives congress the right to levy income taxes, didn’t arrive until the 20th century. Until then “pre-tax income” was just “income”, and income in the form of remuneration distributed between consenting adults was a legitimate property holding, and a legal one. The government “cut in” to the distribution of legitimate property holdings by giving themselves the constitutional right to do so.

If there is no market without a government, why was the second law of the United States a tariff? Why would they lay duties on imported goods if there was not already a market? We know why. There was a market, a distribution of wealth, of property holdings, and the government was willing to restrict the market in order to get some of it, to pay debts, to fund wars, or otherwise to take from people their income in order to benefit the state.

The conceptual and moral problem for Everyday Statism is this: the tax system is an active and ongoing incursion on a distribution of property holdings that was already presumptively legitimate. It is not an essential part of the background. It is something that cuts in afterword, imposed upon the background, and upon all dealings which have heretofore been legitimate. -

Mikie

7.3kThe real effect of tax rate reductions is to make the future prospects of profit look more favorable, leading to more current investments that generate more current economic activity and more jobs. — javi2541997

Mikie

7.3kThe real effect of tax rate reductions is to make the future prospects of profit look more favorable, leading to more current investments that generate more current economic activity and more jobs. — javi2541997

Except this doesn’t happen. We’ve seen the “real effects” of tax cuts over and over again. The latest round in 2017 resulted mostly in stock buybacks. Real wages and investments and job growth — not so much. Predictably.

Sowell. Another market fundamentalist in the Friedman tradition who gives cover for the wealthy to continue their fleecing of the American people. No thanks. -

javi2541997

7.2kI think it depends on the country and even the context we are deating about. The paper that I had read was related to the big increase in both GDP and rents in Estonia. Some economists made a critical argument in this country because of the laxi of taxation. Nonetheless, the prime minister answered to this in the following way as it appears quoted in the paper I mentioned:

javi2541997

7.2kI think it depends on the country and even the context we are deating about. The paper that I had read was related to the big increase in both GDP and rents in Estonia. Some economists made a critical argument in this country because of the laxi of taxation. Nonetheless, the prime minister answered to this in the following way as it appears quoted in the paper I mentioned:

- Toomas Hendrik Ilves, President of Estonia, a graduate of Columbia University, in response to a blog post by the Keynesian Paul Krugman about the"incomplete recovery" of Estonia from the European recession, June 6, 2012.Let's write about something we know nothing about & be smug, overbearing & patronizing: after all, they're just wogs... Guess a Nobel [i.e. Paul Krugman's] in trade means you can pontificate on fiscal matters & declare my country a "wasteland." Must be a Princeton vs Columbia thing.

Yet, the paper is ten years old and now Estonia suffered a decreasing in both GDP and tax recollection.

- OECD Secretary-General Mathias Cormann.“Estonia’s economy rebounded strongly last year, after weathering the pandemic better than peer countries. Now, the economic impact of Russia’s war against Ukraine is hurting growth, fanning inflation and heightening poverty challenges. This makes structural reforms to reduce labour shortages, protecting labour market flexibility and addressing skills mismatches even more important and more pressing,”

Maybe when it says "protecting labour flexibility" some economists defend a reduction of tax income. At least, it helped them some years ago... -

javi2541997

7.2kI am currently reading papers and essays on taxation. There is an interesting study that I want to share in this thread. The article starts basically saying that: "This paper reports the first empirical evidence that fiscal reform efforts in transition countries have positive effects"

javi2541997

7.2kI am currently reading papers and essays on taxation. There is an interesting study that I want to share in this thread. The article starts basically saying that: "This paper reports the first empirical evidence that fiscal reform efforts in transition countries have positive effects"

The study analyses different East European countries. The economists and law experts agree on the big problem of corruption inside public entities: Hellman et al analyzed the BEEPS I data on both the frequency of firms admitting to paying bribes and, conditional on that admission, the percentage of revenues paid in bribes. They report summary statistics for each country in the survey. The percentage of firms admitting to ever paying bribes spans the range from approximately 45% in Slovenia and Belarus

One of the most interesting analysis is the situation and social context of Moldova. The paper warns: Furthermore, the complexity of fiscal reform has involved a limited ability to quickly implement a broad-based low-rate tax structure that is effectively administered. The challenge has been that of instituting a new tax system that fosters compliance among new and restructured enterprises, before they are driven

underground. In one study of tax evasion Anderson and Carasciuc examined evidence from the Republic of Moldova and found quite predictable effects, with greater measured tax evasion in sectors of the economy where audit frequencies were lower and/or where the real value of fines and penalties were lower.

How this situation can end up?

There is an empirical evidence that fiscal reforms are effective in reducing the amount of tax bribes paid by firms. Nonetheless, those firms do not hesitate to keep corrupt behaviours, because the study proofs: Of course, the fact that firms pay less in tax bribes in countries where fiscal reforms have been more extensive does not mean that the firms pay less in overall bribes. Further research is needed to consider whether the reduction in tax bribes is accompanied by a change in other types of bribes and unofficial payments. It could be that a reduction in tax bribes is accompanied by an increase in other types of bribes.

So, we can conclude that fiscal reforms are not the solution if the enterprises and communities are already corrupt. Even, there is evidence that in some countries with soft taxation have better and transparent public administration such as Switzerland, Luxembourg, Liechtenstein, etc...

Maybe the solution is on ethics and not only in taxation of the richest. -

Count Timothy von Icarus

4.3k

Count Timothy von Icarus

4.3k

This is a very old old post, but I can't help but note that this seems like cherry picking. First, Switzerland has the fifth highest top marginal tax rate of any country in the world.

Second, countries by HDI today are:

Switzerland, 47th highest taxes to GDP

Norway, 12th highest taxes to GDP

Iceland, 15th highest taxes to GDP

Australia, 49th highest taxes to GDP

Denmark, 2nd highest taxes to GDP

Sweden, 4th highest taxes to GDP

Ireland, 73rd highest taxes to GDP

Germany, 16th highest taxes to GDP

Holland, 9th highest taxes to GDP

Finland, 5th highest taxes to GDP

The countries at the top a predominantly are near the top on taxation (and other high tax countries have high HDI), even when accounting for their high incomes. Two of the exceptions are major tax havens, and obviously not every country can run that game, while natural resources extraction makes up a huge share of Australian GDP in comparison to most developed countries.

Of course there is a "chicken and the egg" problem here because only high functioning states can actually collect a large share of GDP in taxes. But to correct for that we can look at US states.

US states look similar. Massachusetts would rank 5th on HDI of all nations (it and Connecticut were ahead of ALL nations until recently), third in education, and has a per Capita GDP of just under $100,000 (more than twice the poorest state), but one of the highest state and local tax burdens (and because income is higher, people there also pay higher federal rates).

The list of states by HDI is even closer to the list by tax burden when looking just at the US. This is despite the fact that the low HDI US states tend to get much more in federal aid than they pay in federal taxes, while the reverse is true for the high HDI states (e.g. Kentucky where I live gets $1.89 in funding for every $1 tax dollar paid while in Massachusetts it's $0.56 per $1).

Obviously, high taxes don't necessarily lead to high quality of life, but they are more common in the happiest/most well off countries.

That all said, part of the issue is that people only support high taxes if there is a competent state. At the same time, competent states are expensive, and they also do better at stopping tax evasion, so it seems like there is a bit of a positive feedback loop that likely exists. -

Outlander

3.1kThey think it is not profitable paying taxes because they are losing money just to plump the State. Are they right? — javi2541997

Outlander

3.1kThey think it is not profitable paying taxes because they are losing money just to plump the State. Are they right? — javi2541997

The State? You mean that thing that educates and feeds your children, maintains your roads, public infrastructure and media, provides you clean water and sanitation services, provides you a safe (enough-usually) society to walk the streets without a club in your hand, always watching your back so you are free to relax, mentally focus on something other than the primal mindset of killing and being killed, and pursue your desires, dreams, and goals freely and would provide your kid a safe and healthy home if you and your spouse were to die or become incapacitated? That state?

I know people who would do all these things for free. Thing is. In modern society, very few would. In the United States, any and all taxpayer funds not allocated to classified government agencies or functions can be requested by any citizen by a FOIA request and shipped to your doorstep. Often for free.

I don't know what race has to do with anything other than if you are a citizen you are equal under the Constitution for all intents and purposes and if discriminated against have an array of legal and in these days social options to rectify any perceived wrongdoing be it real or imagined. Any non-citizen be they black, white, or what have you naturally has a different set of rules and restrictions. -

javi2541997

7.2kObviously, high taxes don't necessarily lead to high quality of life, but they are more common in the happiest/most well off countries.

javi2541997

7.2kObviously, high taxes don't necessarily lead to high quality of life, but they are more common in the happiest/most well off countries.

That all said, part of the issue is that people only support high taxes if there is a competent state. At the same time, competent states are expensive — Count Timothy von Icarus

It is close to universal empirical evidence that the countries with high income tax are, at the same time, the ones which work better and society is more advanced. Having these premises... should we implement tax reforms in transition countries? Does this help them to become more democratic?

Well, some countries have experienced good results, such as the Czech Republic or Slovakia, but others don't, like Moldova or Romania. The essays prove that controlling the taxation of enterprises in those countries, don't prevent them from paying other types of bribes and "unofficial" payments.

What is wrong then? They are making the effort of raising taxes to become a more developed country. -

javi2541997

7.2kThe State? You mean that thing that educates and feeds your children, maintains your roads, public infrastructure and media, provides you clean water and sanitation services, provides you a safe (enough-usually) society to walk — Outlander

javi2541997

7.2kThe State? You mean that thing that educates and feeds your children, maintains your roads, public infrastructure and media, provides you clean water and sanitation services, provides you a safe (enough-usually) society to walk — Outlander

Understandable. Yet to see if each state really provides the goods you are talking about. High taxation doesn't lead to effectiveness. There are other parameters that we should take into account. High income taxation countries such as Sweden, Norway, Denmark, etc... are, at the same time, countries with high democratic and cultural values. It goes further than just collecting a lot of amounts just to taxation.

The paper that I shared previously shows such a fact. They agree with the principle that a good tax reform has positive effects, but this is not the only solution. Moldova shows that, despite the effort to implement high taxation on firms, these enterprises tend to pay bribes in other sectors of the society. What is wrong with Moldova then? Why aren't they becoming a welfare state like Denmark?

Well, it is obvious that democracy is pretty recent in Moldova and there are a lot of things to do... not just taxation.

Does the "state" - as you imagine - exist in Moldova? Because they are increasing taxes but the state doesn't work well yet... -

ssu

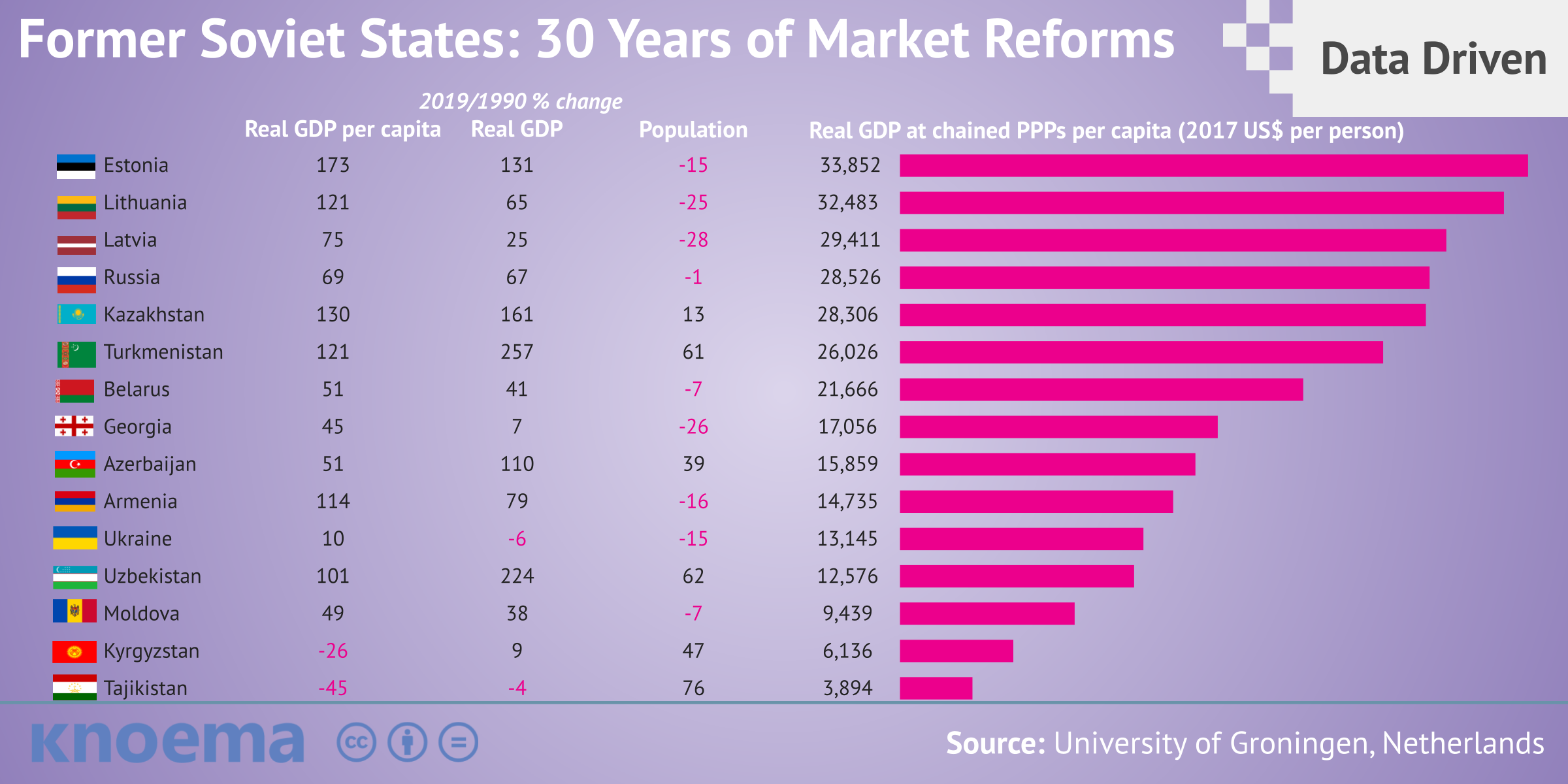

9.8kEstonia is actually a very interesting example as it had so much experience of inept socialism under the Marxism-Leninism of the Soviet Union, that it might be one of countries that most happily enforced capitalism and free market in Europe. And that has paid off as it didn't fall into the pit of crony capitalism. That means that when a global recession has hit, it has been hit hard, but then has very quickly recovered. It has been the most successful ex-Soviet republic:

ssu

9.8kEstonia is actually a very interesting example as it had so much experience of inept socialism under the Marxism-Leninism of the Soviet Union, that it might be one of countries that most happily enforced capitalism and free market in Europe. And that has paid off as it didn't fall into the pit of crony capitalism. That means that when a global recession has hit, it has been hit hard, but then has very quickly recovered. It has been the most successful ex-Soviet republic:

And what is noteworthy is that Estonian population has decreased during this time substantially. No easy task for a country to grow economically while losing a lot of it's population. -

javi2541997

7.2kI agree. Estonia is a good example and it is amazing the recovery they have experienced after the fall of Soviet Union. A while ago, I read some papers and opinions about Estonian recovery. Some "experts" (Keynesian hehe :snicker: ) stated that Estonian recovery is weak/soft or even "incomplete" because of the low collection and let's see what happens with the role of the State in difficult times (some economists are obsessed with public intervetion, for Christ's sake...)

javi2541997

7.2kI agree. Estonia is a good example and it is amazing the recovery they have experienced after the fall of Soviet Union. A while ago, I read some papers and opinions about Estonian recovery. Some "experts" (Keynesian hehe :snicker: ) stated that Estonian recovery is weak/soft or even "incomplete" because of the low collection and let's see what happens with the role of the State in difficult times (some economists are obsessed with public intervetion, for Christ's sake...)

Then, the PM of Estonia replied: Let's write about something we know nothing about & be smug, overbearing & patronizing: after all, they're just wogs... Guess a Nobel [i.e. Paul Krugman's] in trade means you can pontificate on fiscal matters & declare my country a "wasteland." Must be a Princeton vs Columbia thing. :lol: -

Count Timothy von Icarus

4.3k

Count Timothy von Icarus

4.3k

An important distinction is "high tax rates" versus "high tax revenues." High tax revenues relative to GDP track much better with quality of life. A high rate that no one actually pays is indictive of an ineffective or corrupt state.

Again, this is a chicken and egg problem. Just changing tax systems won't give you a state that can effectively collect those higher taxes, although it can help. You get endemic corruption in places like the DRC due to bad corruption enforcement, sure, but also because government employees don't get paid for long periods and so bribes are their only means of supporting themselves. I recall some qualitative paper about people not minding bribes as much because "they need them, our government will never pay the employees in this region anyhow." And of course you can actually pay your employees easier if you collect more taxes.

The other confounding problem is that it is much, much easier for a handful of very rich people to avoid paying taxes in any state than it is for millions of middle class people. The US has high marginal rates when you combine the higher state rates and high federal brackets, but the wealthy have innumerable ways to avoid paying their taxes. Corporations have it even easier, e.g. Apple does almost all their value added work in the US still, produces in the US, but is an "Irish" company now.

Another feedback loop. Higher taxes = greater redistribution is possible = higher share of taxes actually collected because high income helps you avoid taxes. The US could chop its massive debt down by almost a third ($8 trillion) by just collecting prior year taxes already owed to it; taxes owed mostly by the wealthy.

Of course, in the US case, when the bottom 50% of your population only earns 8-12% of all income and only holds 3% of all wealth, while the top 1% holds more wealth than the 91-98% bracket or the bottom 90% (the ranking going bottom 90%, next 9%, 1% at top, with the 1% holding 15 times the wealth of half the population), it makes collections far harder because you need to get a lot of your revenue from a small cadre with lots of resources. But of course, inequality is only so bad in the first place because the wealthy can often pay lower marginal rates than the middle class and even the poor.

I personally think the OECD needs some sort of tax alliance for individuals and organizations that can help enforce taxation across wealthy nations and small tax havens. These states can easily freeze assets on the Cayman Islands, etc. If billionaires want to chance running off to China or Russia they can show themselves the door. Given Jack Ma, the Chinese Bezos, made some very mild critiques of the Chinese banking system and got disappeared, while Russian oligarchs around the world need to be wary of "falling out of windows," I think the elites will learn the value of rule of law their taxes help support very quickly. There is a reason the rich in China either flee outright our buy up "lifeboats" of property and citizenship in the West. -

javi2541997

7.2klike the DRC due to bad corruption enforcement, sure, but also because government employees don't get paid for long periods and so bribes are their only means of supporting themselves. — Count Timothy von Icarus

javi2541997

7.2klike the DRC due to bad corruption enforcement, sure, but also because government employees don't get paid for long periods and so bribes are their only means of supporting themselves. — Count Timothy von Icarus

Exactly. This is the point I wanted to share in this thread. If the accounts of the state are in deficit and they even collect low taxes... how do they maintain literally everything? Well, the paper I have read explains that in some countries like Moldova they are just used to such living. Between 1999 and 2002, this country did ambitious tax reform. Yes, it had positive effects, but the problem is still there. There is empirical evidence that rich firms and lobbies can pay bribes in other circumstances, making an imbalance in the effort of collecting to taxes. Then, it creates a vicious circle that seems to not have an ending. How can we help those citizens? Do their institutions need to be managed by others?

And of course you can actually pay your employees easier if you collect more taxes. — Count Timothy von Icarus

I disagree and there is empirical evidence that proves exactly the contrary. Paying public employees depends more on the management of public spending, not on collecting more or less taxes. We can perceive millions or even trillions thanks to taxation, but if we live in a dictatorship, what is the "real" value of those digits? I guess this is the problem that exists in Saudi Arabia, Iran, Qatar, etc...

I personally think the OECD needs some sort of tax alliance for individuals and organizations that can help enforce taxation across wealthy nations and small tax havens. — Count Timothy von Icarus

Good purpose, but I see more chances not to achieve it. In the European Union, there is supposedly a "common" law and market. But, in practice and real life, each country holds its own competence and some countries are soft in taxation and others heavy. For example: the Spanish company "Ferrovial" just changed their headquarters to the Netherlands because of taxation. Are they evil? Should the Spanish government do something in this matter? What about the freedom to choose whatever country for your headquarters?

There is a lot of complexity regarding this issue, and many authors and experts have debated about it since 1648 when the "modern" state was born. -

Count Timothy von Icarus

4.3k

Count Timothy von Icarus

4.3k

I disagree and there is empirical evidence that proves exactly the contrary. Paying public employees depends more on the management of public spending, not on collecting more or less taxes. We can perceive millions or even trillions thanks to taxation, but if we live in a dictatorship, what is the "real" value of those digits? I guess this is the problem that exists in Saudi Arabia, Iran, Qatar, etc...

You are correct. I was thinking specifically of states like the DRC of CAR, extremely low income and patchy state control of territory, where the state simply lacks the revenue or means to pay public employees. Obviously, when you per capita income is below $2,000 per year you also run into an issue where even high rates of taxation can't provide that much in services, while any taxation is quite literally taking food out of people's mouths. Simply put, you can't pay for services if total revenues, even before misuse is factored in, aren't adequate.

However, I think natural resource revenues are a confounding variable for the overall trend anyhow. When a state can extract revenue from natural resources it has fewer incentives to invest in the population and it is easier to siphon off revenue since it is highly concentrated. So, in low capacity states part of the problem is that resource revenues aren't even fully realized because they cannot regulate extraction and armed groups take control of resources.

There is a wealth of literature on "the resource curse," and how high amounts of natural resources are associated with poorer quality government and slower economic development. Clearly, it's not always a barrier, as Norway, the United States, Canada, and Australia all have a huge amount of natural resource revenue, but it can be.

So, here it is states having poor public management because of their high revenues, rather than the other way around. Pilfering revenues doesn't undercut profiteers in the state because the meaningful revenues come from foreign companies taking resources in exchange for funding. -

javi2541997

7.2kSo, in low capacity states part of the problem is that resource revenues aren't even fully realized because they cannot regulate extraction and armed groups take control of resources. — Count Timothy von Icarus

javi2541997

7.2kSo, in low capacity states part of the problem is that resource revenues aren't even fully realized because they cannot regulate extraction and armed groups take control of resources. — Count Timothy von Icarus

So, here it is states having poor public management because of their high revenues, rather than the other way around. — Count Timothy von Icarus

Good points and clear argument. That's why I think the only way to solve the problems of those countries is to look into ethics, rather than just taxation. Collecting money from the richest is important and it causes positive effects. Yet, there are a lot of factors which we have to consider. You put the Democratic Republic of the Congo as an example. Well, this Central African country is a failed state, so we cannot expect that much from their public management. Their GDP is $128 billion, but the Human Development Index is low, 0.479.

Mobutu institutionalized corruption to prevent political rivals from challenging his control, leading to an economic collapse in 1996. Mobutu allegedly stole up to US$4 billion while in office (War, Hunger, and Displacement: The Origins of Humanitarian Emergencies. Nafziger, E. Wayne; Raimo Frances Stewart, 2000)

...

Imagine how much development could be accomplished with US$4 billion, right? -

javi2541997

7.2kMore tax pressure on Japanese workers. The government of Kishida expects to collect 110 trillion yen ($753 billion). The draft needs the approval of the House of Representatives in December. I will post the final decision here, in this thread, if someone would be interested regarding this topic.

javi2541997

7.2kMore tax pressure on Japanese workers. The government of Kishida expects to collect 110 trillion yen ($753 billion). The draft needs the approval of the House of Representatives in December. I will post the final decision here, in this thread, if someone would be interested regarding this topic.

It's a mystery to me why this country, which is both developed and industrialized, is facing a significant amount of inflation and a government that is heavily indebted.

Japan budget requests likely to top 110 trln yen as rates rise.

The annual budget requests, to be submitted to the finance ministry by the end of August, highlight the difficulty of streamlining spending for the industrial world's most heavily-indebted government.

Under persistent pressure to reflate the world's third-largest economy, the finance ministry will scrutinise the budget requests before it compiles the draft annual state budget in December. This fiscal year's budget stood at 114 trillion yen.

Debt-servicing costs and defence spending will increase 10% each from this year's initial budget, while social security outlay, estimated at 33.7 trillion yen, will rise due to the snowballing costs of supporting Japan's fast-ageing society. -

javi2541997

7.2kI am Interested in what @Hailey and @guanyun can explain to us regarding Chinese tax system. Please, if you do not mind, and only when you were able to do so, I would like to know how taxes work in your country.

javi2541997

7.2kI am Interested in what @Hailey and @guanyun can explain to us regarding Chinese tax system. Please, if you do not mind, and only when you were able to do so, I would like to know how taxes work in your country.

I found out the following information on Chinese tax policy: Taxes provide the most important revenue source for the Government of the People's Republic of China. Tax is a key component of macro-economic policy, and greatly affects China's economic and social development. With the changes made since the 1994 tax reform, China has sought to set up a streamlined tax system geared to a socialist market economy.

But the main paper is critized for not being clear regarding citation style and needs more verification.

I would be very appreciated if you can share with us your perspective on Chinese tax system. -

ssu

9.8k(a late response) It is interesting to see how the Baltic States and other Eastern European countries will change through time. Because now those who have lived through Marxism-Leninism start to be older and people under 30 have no recollection about it, only what they have heard from their parents.

ssu

9.8k(a late response) It is interesting to see how the Baltic States and other Eastern European countries will change through time. Because now those who have lived through Marxism-Leninism start to be older and people under 30 have no recollection about it, only what they have heard from their parents.

Hence when they have just experienced the "capitalist" modernity, socialism, and with that I mean Western social-democracy and not Marxism-Leninism, seems understandable and fair. It's all about curbing the "excesses of capitalism", right?

It's always the devil you have experienced that makes you want for something else. -

javi2541997

7.2kssu, I appreciate your answer and contribution to my thread.

javi2541997

7.2kssu, I appreciate your answer and contribution to my thread.

On the other hand, I agree that Baltic states and Eastern European countries are good examples regarding this topic. A few months ago, I read a paper calledReform and its Firm-Level Effects in Eastern Europe and Central Asia by John E. Anderson. Sadly, one of them is that despite of having reforms on taxation this doesn't lead necessarily to a "fairer" country. Culture depends a lot on this issue and some states as Romania or Moldova are facing this problem which they drag since the Soviet era. It is very common the use of bribes on whatever public administration activities. So, it is a solution that depends more on cultural matters than tax policies.

Austria and Netherlands ban Romania to join EU. We do not really know the aims of these countries in their refuse, but I guess the opacity of their collection is one of them...

It's all about curbing the "excesses of capitalism", yes. Yet, I want to highlight Ireland as a good example of equilibrium. Personal Income Taxes and Corporate Taxes are high, but consumption and property (where the use of wealth really goes) are low. I think this is they key of a successful tax policy.

-

Hailey

69I don't know enough about this subject to comment. However, I do think that Chinese fail to fully see the importance and value of taxes. Because reasonably, if you pay the taxes, you should care about and have a say in how to spend them. But here, it is not the case.

Hailey

69I don't know enough about this subject to comment. However, I do think that Chinese fail to fully see the importance and value of taxes. Because reasonably, if you pay the taxes, you should care about and have a say in how to spend them. But here, it is not the case. -

javi2541997

7.2kAlright Haley, it is OK. I understand that this topic is not everyone's cup of tea. Some even see it as boring and are not interested in public affairs. :razz:

javi2541997

7.2kAlright Haley, it is OK. I understand that this topic is not everyone's cup of tea. Some even see it as boring and are not interested in public affairs. :razz: -

ssu

9.8k

ssu

9.8k

Tax laws just like laws in general don't have same results in different societies. Hence it's not just to change the laws if you have severe problems, huge wealth gaps, weak institutions, no social cohesion etc. in the society. Comes to my mind that actually Liberia has a very similar Constitution as the US has. Just having the same Constitution doesn't make countries similar.Sadly, one of them is that despite of having reforms on taxation this doesn't lead necessarily to a "fairer" country. Culture depends a lot on this issue and some states as Romania or Moldova are facing this problem which they drag since the Soviet era. It is very common the use of bribes on whatever public administration activities. So, it is a solution that depends more on cultural matters than tax policies. — javi2541997

That picture is very interesting. Because it assume's the opposite of what you're saying (if I understood you correctly).It's all about curbing the "excesses of capitalism", yes. Yet, I want to highlight Ireland as a good example of equilibrium. Personal Income Taxes and Corporate Taxes are high, but consumption and property (where the use of wealth really goes) are low. I think this is they key of a successful tax policy. — javi2541997

And aren't in Ireland corporate taxes low, actually? It's like 12,5% whereas in my country the similar tax rate is 20%and in Germany 29,8%. Only Hungary has a lower corporate tax rate in Europe (9%) than Ireland.

What makes it interesting is that consumption taxes are the ones that hurt people who are poorer starting from the fact that everybody has to eat and the amount needed doesn't actually differ. Hence consumption taxes, VAT taxes etc. hit the poorer and poorest people.

Yet in a World of Globalization, meaning extremely low transportation costs and ease of trade, raising corporate taxes indeed will make corporations look for less expensive places (ie lower taxes). -

javi2541997

7.2kJust having the same Constitution doesn't make countries similar. — ssu

javi2541997

7.2kJust having the same Constitution doesn't make countries similar. — ssu

I agree, but I put Romania and Moldova as examples because they want to be part of the European Union and one of the main characteristics of this community is trying to work together in the same direction. Despite that those states are doing their best to "behave" like an EU member, it is clear that the problem is deeper than we tend to think regarding East European countries.

I think it is fascinating how European Central Bank and European Commission rule on very different countries. When they raise Euro area bank interest, it produces effects to each of 27 members, but the results in the long run are clearly different. Over the course of just over a year, the ECB has increased rates from -0.5% to 3.75% in order to combat a surge in inflation. Yet, this Interest Rate policy will affect each state differently. It is very complex to achieve a common path.

That picture is very interesting. Because it assume's the opposite of what you're saying (if I understood you correctly). — ssu

I know I explained myself with an amount of complexity. I tried to meant that direct taxes (income and corporate ones) are high in Ireland while indirect (property and consumption tax) are low. Maybe this is a good equilibrium and I think that Ireland has been increasing its development since the big crisis of 2008, where the so called "P.I.G.S" suffered a lot. Ireland is no longer part of this club.

Note: I just realised that the image I posted above has a title that says which tax affects economic growth the most? I understand know why you didn't understand me. I didn't put the title and of course I disagree with the title itself. I guess I didn't see it when I downloaded the picture to post it here.

And aren't in Ireland corporate taxes low, actually? It's like 12,5% whereas in my country the similar tax rate is 20%and in Germany 29,8%. Only Hungary has a lower corporate tax rate in Europe (9%) than Ireland. — ssu

Exactly. The Corporate Tax Rate in European Union stands at 21.30 percent. Ireland Corporate Tax Rate is 12 % that we should not consider it as "low". It is not equal the amount of collection of Corporate Tax Rate on Germany than in Ireland. Different purchasing power.

What makes it interesting is that consumption taxes are the ones that hurt people who are poorer starting from the fact that everybody has to eat and the amount needed doesn't actually differ. Hence consumption taxes, VAT taxes etc. hit the poorer and poorest people. — ssu

I agree. I think VAT is one of the most complex to put in practice. Here in Spain is 21 %, that it is similar to most of the EU members. While in Hungary, they hold the higher percentage with 27 % paradoxically. They are just doing the opposite of why I try to defend with my arguments. :lol: -

ssu

9.8k

ssu

9.8k

Ummm....Romania is part of the EU. It and Bulgaria have been EU members since 2007. What Romania isn't is part of the Schengen treaty and in the Euro-zone.I agree, but I put Romania and Moldova as examples because they want to be part of the European Union — javi2541997

Moldova's situation is hugely different: It has the frozen conflict of Transnistria and hence Russian forces are still in the country. It is really not a member of the EU and cannot be in NATO, hence Putin has a lot of influence in the small country.

(For Transnistrian's, Soviet Union still lives...sort of)

Ok, you got my point.Note: I just realised that the image I posted above has a title that says which tax affects economic growth the most? I understand know why you didn't understand me. I didn't put the title and of course I disagree with the title itself. I guess I didn't see it when I downloaded the picture to post it here. — javi2541997

VAT's effect is obvious when we think about for example food: higher food prices mean a lot to a poor person, but for a rich person it's just a nuisance.I agree. I think VAT is one of the most complex to put in practice. Here in Spain is 21 %, that it is similar to most of the EU members. While in Hungary, they hold the higher percentage with 27 % paradoxically. They are just doing the opposite of why I try to defend with my arguments. — javi2541997

With corporate taxes and wealth taxes one has to understand that money can move around easily and if these taxes are really punitive (let's say 75% to 90% tax on profit), people simply won't sell and wait for the taxes to be lowered while corporations can also postpone profits.

Welcome to The Philosophy Forum!

Get involved in philosophical discussions about knowledge, truth, language, consciousness, science, politics, religion, logic and mathematics, art, history, and lots more. No ads, no clutter, and very little agreement — just fascinating conversations.

Categories

- Guest category

- Phil. Writing Challenge - June 2025

- The Lounge

- General Philosophy

- Metaphysics & Epistemology

- Philosophy of Mind

- Ethics

- Political Philosophy

- Philosophy of Art

- Logic & Philosophy of Mathematics

- Philosophy of Religion

- Philosophy of Science

- Philosophy of Language

- Interesting Stuff

- Politics and Current Affairs

- Humanities and Social Sciences

- Science and Technology

- Non-English Discussion

- German Discussion

- Spanish Discussion

- Learning Centre

- Resources

- Books and Papers

- Reading groups

- Questions

- Guest Speakers

- David Pearce

- Massimo Pigliucci

- Debates

- Debate Proposals

- Debate Discussion

- Feedback

- Article submissions

- About TPF

- Help

More Discussions

- Other sites we like

- Social media

- Terms of Service

- Sign In

- Created with PlushForums

- © 2026 The Philosophy Forum