-

ssu

9.8kThere has not been an economic crisis since the recession of the early 90's (and even that one was semi-bailed). I am talking about a proper depression (people jumping off of buildings, etc.). — synthesis

ssu

9.8kThere has not been an economic crisis since the recession of the early 90's (and even that one was semi-bailed). I am talking about a proper depression (people jumping off of buildings, etc.). — synthesis

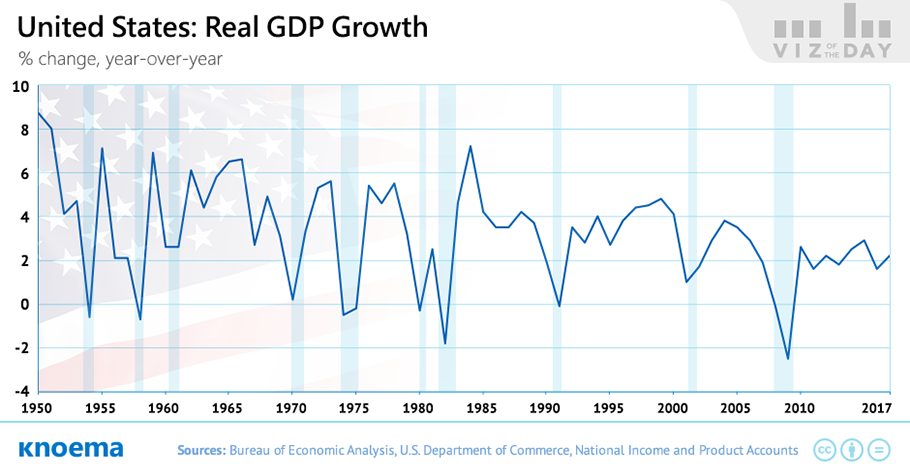

Forgetting the 2008 Financial Crisis and the recession? (Ah yes, I do see the small blip of the 1990's recession)

Guess last year the GDP growth was something like -3,5% in the US. -

synthesis

933There is too much socialism in this system now. Add more and it will become even more inefficient. This system desperately needs to cleans itself by going through a massive recession (depression) which will allow it to at least work the best it can. Right now it's a complete farce, a combination of mafia politics and corporatism.

synthesis

933There is too much socialism in this system now. Add more and it will become even more inefficient. This system desperately needs to cleans itself by going through a massive recession (depression) which will allow it to at least work the best it can. Right now it's a complete farce, a combination of mafia politics and corporatism.

— synthesis

Such as..? Actually, this is derailing ssu's thread. It would be welcome on mine though if you want to grind it out, old man :p — Kenosha Kid

Such as?? Old man,eh? You'll will be me soon enough! -

synthesis

933There has not been an economic crisis since the recession of the early 90's (and even that one was semi-bailed). I am talking about a proper depression (people jumping off of buildings, etc.).

synthesis

933There has not been an economic crisis since the recession of the early 90's (and even that one was semi-bailed). I am talking about a proper depression (people jumping off of buildings, etc.).

— synthesis

Forgetting the 2008 Financial Crisis and the recession? (Ah yes, I do see the small blip of the 1990's recession) — ssu

There hasn't been real economic growth in this country since the 60's. It's mostly debt, counterfeiting, and statistical gymnastics designed to make the majority think that what they are seeing with their own eyes is a phantasm.

2008 was simply an interruption in the flow of money that caused all kinds of reciprocal havoc. Nothing that couldn't be fixed by pouring trillions into the system.

And you really don't believe government statistics, do you? -

ssu

9.8k

ssu

9.8k

Well, you had a politician, Richard Nixon, declaring money isn't what it had used to be for thousands of years...and that was planned just for a temporary time.There hasn't been real economic growth in this country since the 60's. It's mostly debt, counterfeiting, and statistical gymnastics designed to make the majority think that what they are seeing with their own eyes is a phantasm. — synthesis

Perhaps the debate should be just how stupid the idea of deflating/devaluing everyone to prosperity is. The real issue here is who gets the money first. Inflation is great only for those who buy an asset that doesn't devalue in price or can use the money before it loses value, but for savers it's a problem. An economy needs savings too.

In the Nordic countries (we are talking the era from the 50's to the 90's) usually it went like this: The export industry noticed that they had problems to compete in the global market. Hence they drove the market to devaluate the currency to gain an pricing advantage in their goods. Great, good times again! Unfortunately this made later also the imported resources more costly and finally the trade unions noticed that wages hadn't kept up with the prices and demanded higher wages. After costly strikes the employers were ready to raise wages and the situation was at the same as it was in the first place.

Then something changes: thanks to the deregulation of the financial sector the speculative bubble got so big that this model didn't work anymore. Low interest rates didn't cause inflation. Why?

Because once the bubble burst the banks simply didn't lend the money, which was poured into them. And by the 90's the labour movement wasn't anymore what it had been earlier. In the US the situation was even worse as there hardly is a labour movement to negotiate about the wages. Yet the money had to go somewhere and where it went was into asset inflation: to the stockmarket, to real estate again. Yet without the increase in wages etc. the influx of money didn't find it's way to the real economy. The system serves those who are rich, not the poor. Hence now we have a situation where the real economy and the financial realm are living in totally different worlds. Or it seems so.

Yet I don't think that this can go on perpetually. Sooner or later there is a system crisis. And likely now it's sooner than later.

(why do we think that perpetual inflation is good?

2008 was simply an interruption in the flow of money that caused all kinds of reciprocal havoc. Nothing that couldn't be fixed by pouring trillions into the system. — synthesis

And after trillions come quadrillions and quintillions. Do people think the future Elon Musk/Jeff Bezos is so much richer when he is a quadrillionaire and the US deficits are counted in quintillions of dollars? -

synthesis

933why do we think that perpetual inflation is good? — ssu

synthesis

933why do we think that perpetual inflation is good? — ssu

Thank you for the very short history of the previous several decades, and although I could comment on a number of things, no need to beat a dead horse.

Of course, inflation is simply a tax on the masses and a nifty way of shrinking ones debt for the government.

The FEDs 2% inflation target is like saying that we wish to confiscate all of your wealth...eventually (which is exactly what they have been doing for the last century). -

ssu

9.8kWell, to say it is a tax is actually is one easy way to understand it, yet the phenomenon is actually far more complex. Who actually benefits isn't so easy to understand as with taxes. How it is measured also raises a bit of doubts as it is a highly politicized indicator, just like unemployment, and is tended to be represented to be far better than in reality by statistical methods.

ssu

9.8kWell, to say it is a tax is actually is one easy way to understand it, yet the phenomenon is actually far more complex. Who actually benefits isn't so easy to understand as with taxes. How it is measured also raises a bit of doubts as it is a highly politicized indicator, just like unemployment, and is tended to be represented to be far better than in reality by statistical methods.

Even if one isn't an investor, it's actually important to understand the possible perils in this economic situation and that things aren't going to go the way as before as we are in quite new territory. How deflation and a possible crack up boom will turn out is something we may see.

If inflation really would be 2% you get a return on your investment of over 2% + the interest paid on the debt, then you are the winner in this system. The positive effect of gearing works wonders. Yet with the lowest interest rates in known history of mankind ought to make people think where this all is going.The FEDs 2% inflation target is like saying that we wish to confiscate all of your wealth...eventually (which is exactly what they have been doing for the last century). — synthesis

The powers at be have been thinking of an answer, and as dubbed in Davos, it's "The Great Reset" The term the Great Recet isn't invented by the critics, it's really the phrasing used for example by an IMF manager here (just to take one example).

One idea would be to float Special Drawing Rights (SDR) as a cryptocurrency, if trust in the present fiat-system is shaken. Of course the SDR's are made of a basket of current fiat-currencies, but anyway. Those in power through the present monetary system would stay in power through a new system.

They're not leaving the crisis to waste. -

synthesis

933Even if one isn't an investor, it's actually important to understand the possible perils in this economic situation and that things aren't going to go the way as before as we are in quite new territory. How deflation and a possible crack up boom will turn out is something we may see. — ssu

synthesis

933Even if one isn't an investor, it's actually important to understand the possible perils in this economic situation and that things aren't going to go the way as before as we are in quite new territory. How deflation and a possible crack up boom will turn out is something we may see. — ssu

I and many others have been following this since the 70's. How it has possibly gotten to this point is beyond me. Obviously, there is no way to pay back the debt (and hasn't been since the 80's), but as you probably know, countries never really intend on paying back debt. They deal with it by inflating it away and/or rolling it over (forever). It is rumored that the BoE never paid off their original debt from 1696. Wouldn't doubt it.

The take home lesson here is that all systems are designed by the few in their own interests. It has never been any other way. The political system is simply a way to keep the masses distracted and their appetites somewhat satiated via the crumbs flicked off the Elite's banquet table.

No "-ism" is going to change any of this. -

ssu

9.8k

ssu

9.8k

I think that when the US basically defaulted on the Bretton Woods system, the people deciding it genuinely thought that it would be a temporary move, that the World wouldn't accept the USD having the status that it had. But nobody didn't want to rock the boat, so the US could get away with it. For the Saudi's opting to take the fiat Dollars was a smart decision: decades later the US did arrive to defend them from their neighbor in the North, who had captured Kuwait and with it had the largest oil reserves...for some months.How it has possibly gotten to this point is beyond me. — synthesis

I also think that the Saudis, the Japanese and finally now the Chinese have been happy to use those dollars to buy assets in the US, hence the system has gone on. And of course American politicians, even having the hilarious hypocrite theater of "raising the debt ceiling" every once in a while, naturally will exploit the situation where they can recklessly spend without no limit.

(They still have those trillion plus, but now the largest owner of US debt is the Federal Reserve:)

Technically the debts are paid back. For example, the UK paid it's last debts from WW2 back to Canada and the US in 2006. From that time:It is rumored that the BoE never paid off their original debt from 1696. Wouldn't doubt it. — synthesis

(BBC News, 29th December 2006) Britain will settle its World War II debts to the US and Canada when it pays two final instalments before the close of 2006, the Treasury has said. The payments of $83.25m (£42.5m) to the US and US$22.7m (£11.6m) to Canada are the last of 50 instalments since 1950.

The amount paid back is nearly double that loaned in 1945 and 1946. "This week we finally honour in full our commitments to the US and Canada for the support they gave us 60 years ago," said Treasury Minister Ed Balls. "It was vital support which helped Britain defeat Nazi Germany and secure peace and prosperity in the post-war period. We honour our commitments to them now as they honoured their commitments to us all those years ago," he added.

The last payments will be made on Friday, the final working day of the year. -

ssu

9.8kYou would want that? :wink: Those who rule make the decisions.

ssu

9.8kYou would want that? :wink: Those who rule make the decisions.

If people don't know much about economics, here is one of the best simple explanations of what is happening from Ray Dalio, founder of one of the largest hedge-funds. It isn't the economics taught in schools, but captures the present system quite well. At start the video starts from the very basics, but later goes to quite complicated issues like the effect of deleveraging. Dalio explains the system objectively and without sounding like a doomsday prophet (as many permabear commentators do). If people have 30 minutes to spare, worth wile watching.

-

Kenosha Kid

3.2kHow it has possibly gotten to this point is beyond me. Obviously, there is no way to pay back the debt (and hasn't been since the 80's), but as you probably know, countries never really intend on paying back debt. — synthesis

Kenosha Kid

3.2kHow it has possibly gotten to this point is beyond me. Obviously, there is no way to pay back the debt (and hasn't been since the 80's), but as you probably know, countries never really intend on paying back debt. — synthesis

My country has been effectively bankrupt since WWII, doubly so since Thatcherism. Before the pandemic, we were still the fifth largest economy and had the fourth highest growth. So yeah... never going back. There are few alive who recall an economy not based on debt. -

synthesis

933My country has been effectively bankrupt since WWII, doubly so since Thatcherism. Before the pandemic, we were still the fifth largest economy and had the fourth highest growth. So yeah... never going back. There are few alive who recall an economy not based on debt. — Kenosha Kid

synthesis

933My country has been effectively bankrupt since WWII, doubly so since Thatcherism. Before the pandemic, we were still the fifth largest economy and had the fourth highest growth. So yeah... never going back. There are few alive who recall an economy not based on debt. — Kenosha Kid

I would bet that if you had a currency printing press in your basement that there might be a few bogus bills floating around in your wallet, as well.

This is exactly what was expected when the politicians allowed (viz., were paid off) the most vile members of society (bankers) to print money out of thin air. The fact that they destroyed the entire global economy was as predictable as knowing that the sun is going to rise in the eastern sky in the morning. -

ssu

9.8kThis is exactly what was expected when the politicians allowed (viz., were paid off) the most vile members of society (bankers) to print money out of thin air. The fact that they destroyed the entire global economy was as predictable as knowing that the sun is going to rise in the eastern sky in the morning. — synthesis

ssu

9.8kThis is exactly what was expected when the politicians allowed (viz., were paid off) the most vile members of society (bankers) to print money out of thin air. The fact that they destroyed the entire global economy was as predictable as knowing that the sun is going to rise in the eastern sky in the morning. — synthesis

And more is coming...

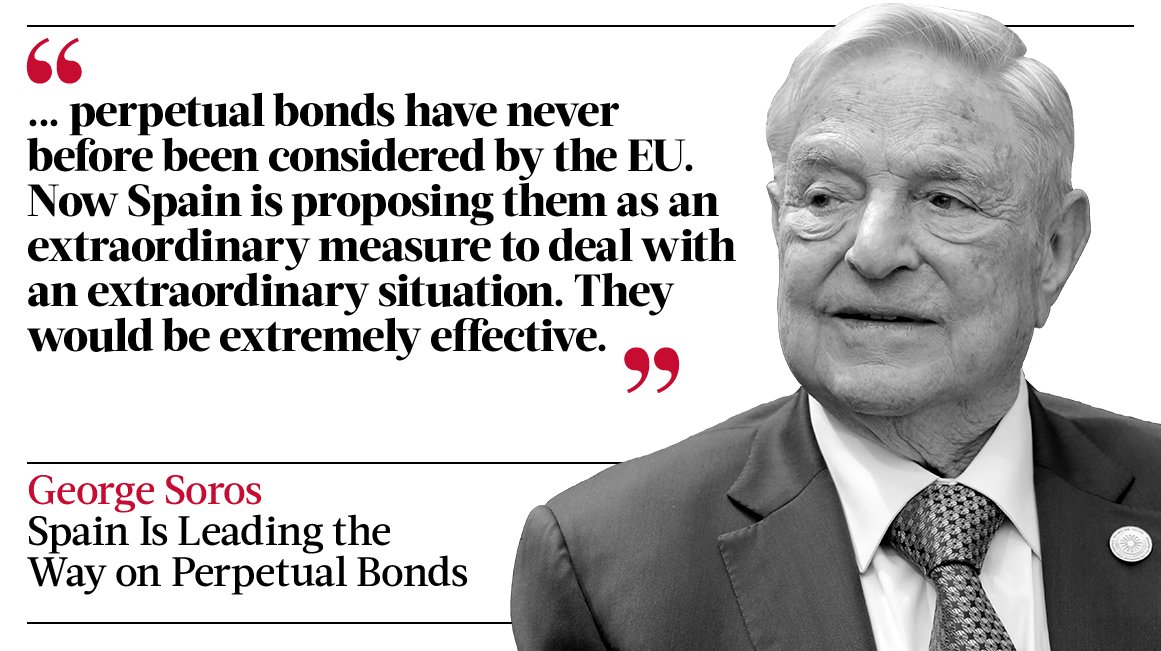

George Soros personally has argued the following (last year):

See Opinion: Soros: The EU should issue perpetual bonds to fund the economic recovery from coronavirusEuropean Commission President Ursula von der Leyen has announced that Europe will need about €1 trillion ($1.1 trillion) to fight the COVID-19 pandemic. This money could be used to establish a European Recovery Fund. But where will the money come from?

I propose that the European Union should raise the money needed for the Recovery Fund by selling “perpetual bonds,” on which the principal does not have to be repaid (although they can be repurchased or redeemed at the issuer’s discretion). Authorizing this issue should be the first priority for the forthcoming European Council summit on Thursday.

It would, of course, be unprecedented for the EU to issue perpetual bonds, especially in such a large amount. But other governments have relied on perpetual bonds in the past. The best-known example is Britain, which used consolidated bonds (Consols) to finance the Napoleonic Wars and war bonds to finance World War I. These bond issues were traded in London until 2015, when both were redeemed. In the 1870s, the U.S. Congress authorized the Treasury to issue Consols to consolidate already existing bonds, and they were issued in subsequent years.

The EU is facing a once-in-a-lifetime war against a virus that is threatening not only people’s lives, but also the very survival of the Union. If member states start protecting their national borders against even their fellow EU members, this would destroy the principle of solidarity on which the Union is built.

Instead, Europe needs to resort to extraordinary measures to deal with an extraordinary situation that is hitting all of the EU’s members. This can be done without fear of setting a precedent that could justify issuing common EU debt once normalcy has been restored. Issuing bonds that carried the full faith and credit of the EU would provide a political endorsement of what the European Central Bank has already done: removed practically all the restrictions on its bond purchasing program.

Soros has later argued for perpetual bonds this year on January 18th in the Independent

The only way out, according to Soros. In other words, let the printing machines print!!! -

Benkei

8.1kI've been involved in the Dutch existing perpetual bonds actually and my advice was shelved due to COVID because now there's no time to deal with them. Had a major row with the legal department of the ministry of finance for being stupid uncooperative dicks (after my research showed they were giving the wrong advice for 15 years) which played a large role in me changing jobs. Good times!

Benkei

8.1kI've been involved in the Dutch existing perpetual bonds actually and my advice was shelved due to COVID because now there's no time to deal with them. Had a major row with the legal department of the ministry of finance for being stupid uncooperative dicks (after my research showed they were giving the wrong advice for 15 years) which played a large role in me changing jobs. Good times! -

ssu

9.8kThe system works for him. Those that get the money before inflation kicks out are the winners in this World. Notice that there wasn't huge inflation in the 1920's or in Japan prior for the speculative bubble bursting. With perpetual bonds, you don't need to roll over that debt. So fix in on the lowest rates in written history for a million years or more!

ssu

9.8kThe system works for him. Those that get the money before inflation kicks out are the winners in this World. Notice that there wasn't huge inflation in the 1920's or in Japan prior for the speculative bubble bursting. With perpetual bonds, you don't need to roll over that debt. So fix in on the lowest rates in written history for a million years or more!

As long as the velocity of money doesn't start picking up and there is ample confidence in the currencies, everything is great for the extremely rich. Not that the money printing does anything good for the actual economy, but that isn't important. The monetary policy has brought asset inflation, and that is good for rich people like Soros.

It would be interesting to hear about that major row as this is a very important issue to understand. As the thread's header states, these times economics, financial and monetary policy isn't in the ordinary realm we have been taught they would be.I've been involved in the Dutch existing perpetual bonds actually and my advice was shelved due to COVID because now there's no time to deal with them. Had a major row with the legal department of the ministry of finance for being stupid uncooperative dicks (after my research showed they were giving the wrong advice for 15 years) which played a large role in me changing jobs. Good times! — Benkei

What I've learned is that this situation where we find us is a very complex one: QE and other forms of money printing haven't caused hyperinflation, but on the other hand the money hasn't gone into the real economy. -

synthesis

933What I've learned is that this situation where we find us is a very complex one: QE and other forms of money printing haven't caused hyperinflation, but on the other hand the money hasn't gone into the real economy. — ssu

synthesis

933What I've learned is that this situation where we find us is a very complex one: QE and other forms of money printing haven't caused hyperinflation, but on the other hand the money hasn't gone into the real economy. — ssu

When things get this ugly, the trick is to become as independent as you can by simplifying your life economically and otherwise. If possible, tune it out for about ten years and do things that create contentment in your life (while everybody else is going to be running around like their hair's on fire!).

No need to suffer more than need be for other people's avarice and stupidity. -

ssu

9.8k

ssu

9.8k

Well, running around like their hair's on fire has been the new normal. I've already seenIf possible, tune it out for about ten years and do things that create contentment in your life (while everybody else is going to be running around like their hair's on fire!). — synthesis

- a huge banking crisis, real-estate bubble bursting and economic depression in my own country.

- The Tech bubble bursting

- The Great Recession of 2008-2009, real-estate bubble bursting in the US and economic depression

- Covid-19 economic depression ...

And between those crashes, three decades of huge asset inflation where nearly anything you have invested in gained a good profit and a lot of euphoria and silly talk. So that's the World we live in. So why tune out for a decade? Then what on the 11th year?

Perhaps people are a bit melodramatic. If we have a market crash or a currency crisis in the future, it basically would be something similar we already have seen. In the end the reality would be simply 'normal' to us. Just think of before last year describing the start of the 2020's to people and how scary it would feel with a pandemic with lockdowns and even curfews, mobile morgues made from semitrailers and riots reaching a fever pitch with a huge mob breaking into the Capitol. That all would sound very scary, when considering how things were in the middle of the 2010's. In similar fashion a stock-market crash, financial market collapse, banking crisis or currency crisis sounds scary, but in the end it isn't. And after a storm, the sun shines again... -

synthesis

933And after a storm, the sun shines again... — ssu

synthesis

933And after a storm, the sun shines again... — ssu

...the 11th year.

What most people fail to realize is that the crisis (the lying, cheating, and stealing that has defined the past 50 years) has already taken place. What has been on-going coincidentally for the past 20 years is the reaction to the crisis which has a ways to go (ten years?). -

ssu

9.8k

ssu

9.8k

Oh, that sounds just like what an economist of the Finnish Central bank (when there was an independent one) said about the worst economic depression the country was in: "The unemployed won't revolt. Unemployment is seen as an independent stigma as others still have jobs. Hence there isn't going to be like a revolution." He was correct, actually, the unemployed didn't revolt, even if 50 000 construction workers never found work afterwards. So to keep the price of food and clothing "decent" may be the answer. That likely may be handled for instance giving subsidies to large retail chains: again the rich profit and the poor muddle through it."price stability will prevent crises" we were told. It's really time to revise the charter of Central Banks. — Benkei

Yet revising the charter of the Central Banks? I fear this is something that won't happen.

The thing is that the role of the central banks and monetary policy simply isn't understood. This is something that isn't taught in school. History has again and again shown that the delirious accusations of the "speculators" being behind inflation, and not the governments and central banks always prevails. Or then it's the ugly foreigners, perhaps China in this case. The media will go with that story as the media is linked to the government (even here in the West). If the inflation gets ugly, at first what is demanded is that there are money transfers to the poorest of people to help them. Then there will be the demands to ration basic necessities and a public denouncement campaign against "hoarders", "speculators" and the "black market". Ah, the black market speculators...how evil are they!

Above all, when, as correctly points out, the fuel for the future rise of inflation has already been spread earlier, people cannot understand the link. Then when it actually happens, the link to earlier actions is hazy as the economy is so complex, that likely isn't understood. -

synthesis

933Above all, when, as ↪synthesis correctly points out, the fuel for the future rise of inflation has already been spread earlier, people cannot understand the link. Then when it actually happens, the link to earlier actions is hazy as the economy is so complex, that likely isn't understood. — ssu

synthesis

933Above all, when, as ↪synthesis correctly points out, the fuel for the future rise of inflation has already been spread earlier, people cannot understand the link. Then when it actually happens, the link to earlier actions is hazy as the economy is so complex, that likely isn't understood. — ssu

Despite the trillions in reserves, I believe this is going to continue to be a deflationary depression-like event (excepting asset prices) for all the reasons of which you must be familiar, i.e., bountiful cheap labor (produced by expanding labor markets and exploding industrial technology) keeping labor-induced commodity price inflation at bay (or negative in real terms) for the foreseeable future. -

ssu

9.8kThe deflationary aspect in my view comes from the speculative bubble bursting or when it bursts. At least we do have the euphoria, which typically happens before a market crash. Stock market crashing does have serious effects on the real economy too. If banks are again on the brink, then the taps then finance the economy, not just for speculation, close. And people will naturally save. Saving rates have been historically high with a personal savings rate of 33%. That naturally will ease inflationary tension for now. And the labour movement seems to be dead and buried in the US, so wages naturally won't rise, could even fall. Hence inflation isn't the real worry now, but deflation. But then what?

ssu

9.8kThe deflationary aspect in my view comes from the speculative bubble bursting or when it bursts. At least we do have the euphoria, which typically happens before a market crash. Stock market crashing does have serious effects on the real economy too. If banks are again on the brink, then the taps then finance the economy, not just for speculation, close. And people will naturally save. Saving rates have been historically high with a personal savings rate of 33%. That naturally will ease inflationary tension for now. And the labour movement seems to be dead and buried in the US, so wages naturally won't rise, could even fall. Hence inflation isn't the real worry now, but deflation. But then what?

The real question is that how much adding that debt and QE and lending to banks will start to erode the confidence on the dollar. Or more generally, in the whole system. And here we come to the question I've been pondering for some time: how reasonable is the Modern Monetary Theory? The idea of just printing money to prosperity feels missing some fundamental understanding of how the economy works. The argument that inflation, if it happens, can be dealt with interest rate hikes sounds not very convincing if the debt is so huge that the interest on the debt would severely cut back other government spending.

Or then, the whole monetary policy is there only to prop up the banks, the owners of the federal reserve, and nobody else. It's not even supposed help the real economy, just to help Wall Street. That may actually be the real answer. -

ssu

9.8kHow monetary policy has become basically the method of assisting the stock markets and the financial market is explained quite well in this interview of William R White, who worked in the Canadian central bank and in the Bank for International Settlements (BIS). White tells how the change happened during the Greenspan years and how it has continued to the present and how this has created the excesses we see everywhere now. Central banks have become market makers of last resort, not only lenders of last resort. Yet keeping the normal recessions and sustaining a boom might (and I think will) result in the end in larger economic crashes, which have a political cost.

ssu

9.8kHow monetary policy has become basically the method of assisting the stock markets and the financial market is explained quite well in this interview of William R White, who worked in the Canadian central bank and in the Bank for International Settlements (BIS). White tells how the change happened during the Greenspan years and how it has continued to the present and how this has created the excesses we see everywhere now. Central banks have become market makers of last resort, not only lenders of last resort. Yet keeping the normal recessions and sustaining a boom might (and I think will) result in the end in larger economic crashes, which have a political cost.

What is also discussed are the effects on productivity, the support of zombie companies and effects of loose monetary policy to the global economy.

Welcome to The Philosophy Forum!

Get involved in philosophical discussions about knowledge, truth, language, consciousness, science, politics, religion, logic and mathematics, art, history, and lots more. No ads, no clutter, and very little agreement — just fascinating conversations.

Categories

- Guest category

- Phil. Writing Challenge - June 2025

- The Lounge

- General Philosophy

- Metaphysics & Epistemology

- Philosophy of Mind

- Ethics

- Political Philosophy

- Philosophy of Art

- Logic & Philosophy of Mathematics

- Philosophy of Religion

- Philosophy of Science

- Philosophy of Language

- Interesting Stuff

- Politics and Current Affairs

- Humanities and Social Sciences

- Science and Technology

- Non-English Discussion

- German Discussion

- Spanish Discussion

- Learning Centre

- Resources

- Books and Papers

- Reading groups

- Questions

- Guest Speakers

- David Pearce

- Massimo Pigliucci

- Debates

- Debate Proposals

- Debate Discussion

- Feedback

- Article submissions

- About TPF

- Help

More Discussions

- Other sites we like

- Social media

- Terms of Service

- Sign In

- Created with PlushForums

- © 2026 The Philosophy Forum