-

ssu

9.8kTo show how to the point of absurdity the present economic situation has gone, two small quotes:

ssu

9.8kTo show how to the point of absurdity the present economic situation has gone, two small quotes:

Now, Tesla has become not only the most valuable car company in the world but also more valuable than the next six automakers combined with a valuation of $631.29 billion at the time of writing.

Worldwide, that means Tesla is more valuable than Toyota, Volkswagen, Daimler, and General Motors, plus China-based BYD and NIO which are also publicly traded on the U.S. stock market. And Tesla's value becomes even more apparent by looking at automakers who actively conduct consumer-facing business in the U.S., as that trades BYD and NIO for Ferrari, BMW, and Honda.

This was written in December last year. The Tesla stock has gone even higher now. The other example:

This was from last October. And of course the Federal Reserve as a Central Bank hasn't been alone in this. But those 3 trillion did result of a V-shaped recovery of the stockmarket, not the actual economy, which is in ruins during the ongoing pandemic.Data from the Fed shows that a broad measure of the stock of dollars, known as M2, rose from $15.34 trillion (£11.87 trillion) at the start of the year to $18.72 trillion in September. The increase of $3.38 trillion equates to 18 per cent of the total supply of dollars. It means almost one in five dollars was created in 2020.

M2 includes physical notes and coins, banks reserves held at the Fed, accounts at banks, and money market mutual funds.

Yet what makes the current financial markets and monetary policy so absurd is that to me, the most rational reasons given to these above phenomena are themselves absurd. The most reasonable explanation why some stocks are not attached to any normal pricing model of future growth (as with Tesla) is index investing: people invest passively in an fund trying to copy the index, which then means that the most risen stocks are bought...because they have risen in the first place, which then makes the stocks rise in price even more. Which actually doesn't make sense.

And then the monetary the monetary policy. I guess that the most rational reasoning of what is happening is given by modern monetary theory (MMT), which basically argues that if the US prints money, it doesn't matter, because it's the US. I'm not the only one confused with MMT, for example Nobel-prize winner Paul Krugman seems to be also confused. That the most accurate model to describe our economy is "Zombie economics" doesn't sound very nice.

And then there is the economy, which looks like to take the rout of Japan with Zombie companies starting to prevail, not the 'creative destruction' that Joseph Schumpeter argued that would make a free market economy healthy again.

In my view this all needs really to be viewed from a philosophical viewpoint as I think this all above looks to end in a massive crisis and genuinely an economy that avoids reality. Does economics have to make sense? Communists may be happy when capitalism is like this.

I am not. I think there might be a massive crisis just looming to happen this year.

But I'd like to hear what others say. -

Kenosha Kid

3.2kThe most reasonable explanation why some stocks are not attached to any normal pricing model of future growth (as with Tesla) is index investing: people invest passively in an fund trying to copy the index, which then means that the most risen stocks are bought...because they have risen in the first place, which then makes the stocks rise in price even more. Which actually doesn't make sense. — ssu

Kenosha Kid

3.2kThe most reasonable explanation why some stocks are not attached to any normal pricing model of future growth (as with Tesla) is index investing: people invest passively in an fund trying to copy the index, which then means that the most risen stocks are bought...because they have risen in the first place, which then makes the stocks rise in price even more. Which actually doesn't make sense. — ssu

It's much like a pyramid scheme. Each person is willing to pay more than the last because the next will pay yet more, until they don't, then the pyramid collapses. The last tier lose but everyone before them wins.

As such, the value of the stocks is independent of the trading value of the company. And yet it is the former value that dictates executive decisions, not the latter.

Communists may be happy. — ssu

Doesn't seem something they'd be happy about. The above is basically a divorcement of profit from production. It is quintessentially capitalist that production itself becomes a dummy variable. -

magritte

596Even when nothing is produced, desperate lives make for desperate measures. In a materialist world lotto fever can rule the markets. With the internet, small speculators can quickly create their own momentum for a while.

magritte

596Even when nothing is produced, desperate lives make for desperate measures. In a materialist world lotto fever can rule the markets. With the internet, small speculators can quickly create their own momentum for a while.

The Wall Street frenzy over X Corp., a losing retailer began when an army of small-pocket investors on Reddit started throwing dollars and buy orders at the stock — in direct opposition to groups of wealthy investors who, based on basics were counting on the stock price to plunge. ... shares of X Corp. have spiked well over 1000%. ... A pair of hedge funds that placed big bets that the money-losing retailer's stock will crash have largely abandoned their positions. The victors: an army of smaller investors who have been rallying online to support X's stock and beat back the professionals. -

synthesis

933It is quintessentially capitalist that production itself becomes a dummy variable. — Kenosha Kid

synthesis

933It is quintessentially capitalist that production itself becomes a dummy variable. — Kenosha Kid

Really. Where did you come up with that pearl?

For me, this is a spike in one of the most basic of human desires, trying to get something for nothing. It's my main criticism of capitalism (and all systems).

It's makes a complete mockery out of economics and will not end well. -

fdrake

7.2kAnd then the monetary the monetary policy. I guess that the most rational reasoning of what is happening is given by modern monetary theory (MMT), which basically argues that if the US prints money, it doesn't matter, because it's the US. I'm not the only one confused with MMT, for example Nobel-prize winner Paul Krugman seems to be also confused. That the most accurate model to describe our economy is "Zombie economics" doesn't sound very nice. — ssu

fdrake

7.2kAnd then the monetary the monetary policy. I guess that the most rational reasoning of what is happening is given by modern monetary theory (MMT), which basically argues that if the US prints money, it doesn't matter, because it's the US. I'm not the only one confused with MMT, for example Nobel-prize winner Paul Krugman seems to be also confused. That the most accurate model to describe our economy is "Zombie economics" doesn't sound very nice. — ssu

Yanis Varifoukas described the phenomenon very well:

-

Kenosha Kid

3.2kReally. Where did you come up with that pearl? — synthesis

Kenosha Kid

3.2kReally. Where did you come up with that pearl? — synthesis

If the aim is simply to make money, it doesn't matter much what it is you make, if anything. Production is much more abstract than it is for, say, a farmer. -

ssu

9.8k

ssu

9.8k

Thanks, that indeed is worth listening to.Yanis Varifoukas described the phenomenon very well — fdrake

Varifoukas describes very well why the 2008 Crisis never went away, but how the financial bubble was kept alive. We see how again this was done last year (with the V-shaped recovery of the stock market creating a "melt-up") He also explains well why savings and investment have been disconnected from each other. And in the end Varifoukas says an important thing: one cannot understand economics with one model, one economic school of thought. Better read both Marx and Hayek. One has to be eclectic. Have to say these are words of wisdom that in our polarization we tend to forget.

What isn't talked is the idea of MMT. And of course, Varifoukas makes similar (and correct) observations about what has happened (as many conservative commentators do also), the disagreement comes in what exactly to do. Where, who, how to invest etc. -

ssu

9.8k

ssu

9.8k

But the whole idea is that the pyramid scheme doesn't collapse, because central banks come to the rescue and push the prices back again into la-la-land prices.It's much like a pyramid scheme. Each person is willing to pay more than the last because the next will pay yet more, until they don't, then the pyramid collapses. The last tier lose but everyone before them wins. — Kenosha Kid

It would be terrible if suddenly Tesla would be half of the price it is now or just the value of Toyota, just imagine all those debts where that stock price is the collateral to the debt. These absurdities simply become the new norm. The example that gives just tells how it really is a casino. Didn't the event when oil prices went negative show us that people aren't in the markets to do trades with actual barrels of oil?

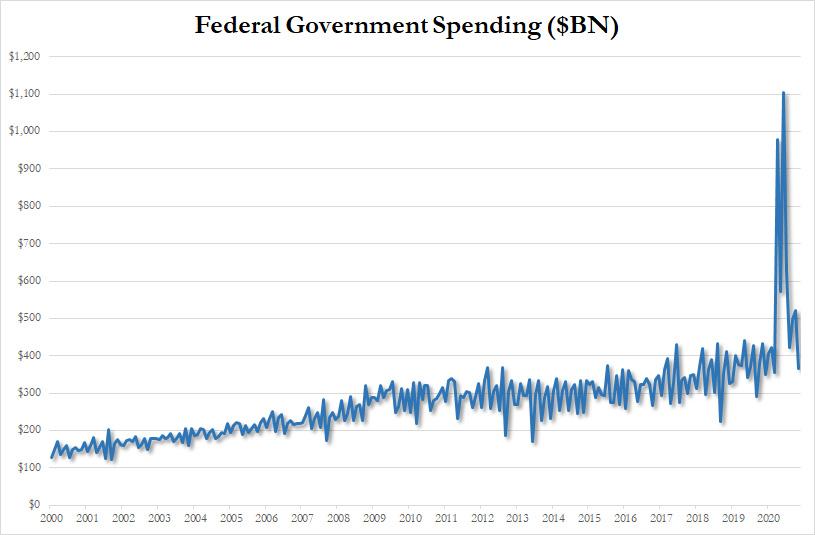

The issue that just nags my mind is that this isn't knowledge that only few have. If the global bond market is over 100 trillion $ and the global equity market nearly as much, how much then do the central banks put into propping the markets up. With "only" 7 trillion $, for the stats see see recent trends, how much can more can the balance sheet be increased? And how much does the new administration plan to spend also. Trump ended with a +3 trillion budget deficit. What if the banks and the corporations need another bail-out if the market crashes? People happy to bail them out again?

Did people notice the spending?

Btw, the actual production of cars in 2019, notice where on the list the most valuable car company is:

-

Benkei

8.1kIt's not a philosophical or economical discussion. It's raw politics. And what currently is happening has about 20% to do with MMT. See this fine article (in Dutch) by an acquintance:

Benkei

8.1kIt's not a philosophical or economical discussion. It's raw politics. And what currently is happening has about 20% to do with MMT. See this fine article (in Dutch) by an acquintance:

https://www.iexprofs.nl/Column/478919/centrale-banken/Pas-op-voor-de-nieuwe-monetaire-gekte.aspx

MMT in total might work, I dont known. But what we're doing now is bullshit and when people bring up MMT they're just trying to sell bullshit as a good idea because endlessly printing money is part of a theory that also requires you to flexibly raise taxes, depending on the rate of inflation, stop issuing bonds and guarantee everyone a job with the government! -

synthesis

933If the aim is simply to make money, it doesn't matter much what it is you make, if anything. Production is much more abstract than it is for, say, a farmer. — Kenosha Kid

synthesis

933If the aim is simply to make money, it doesn't matter much what it is you make, if anything. Production is much more abstract than it is for, say, a farmer. — Kenosha Kid

You have to keep in mind that all markets are horribly corrupt at present. What's going on now is a joke and pretty much has been getting worse and worse since going to 100% FIAT in 1971.

Going back to real money and no FRL (fractional reserve lending) will take care of many of the current issues we face.. -

Kenosha Kid

3.2kYou have to keep in mind that all markets are horribly corrupt at present. — synthesis

Kenosha Kid

3.2kYou have to keep in mind that all markets are horribly corrupt at present. — synthesis

Horribly being the key word here, not "corrupt". The idea of the free market is that the interests of the business are the same as the interests of the human being who happens to run it. They are meant to be tied. Any divergence of those two by people who espouse the ideal is a corruption. The problem is far more fundamental. -

synthesis

933Horribly being the key word here, not "corrupt". The idea of the free market is that the interests of the business are the same as the interests of the human being who happens to run it. They are meant to be tied. Any divergence of those two by people who espouse the ideal is a corruption. The problem is far more fundamental. — Kenosha Kid

synthesis

933Horribly being the key word here, not "corrupt". The idea of the free market is that the interests of the business are the same as the interests of the human being who happens to run it. They are meant to be tied. Any divergence of those two by people who espouse the ideal is a corruption. The problem is far more fundamental. — Kenosha Kid

Kid, it's a miracle that large groups of people are able to do anything besides beat the crap out of each other 24/7. Capitalism is what it is (and has many contradictions), but look at what it has done to lift billions of poor souls out of abject poverty.

You have a better idea? -

Echarmion

2.7kGoing back to real money and no FRL (fractional reserve lending) will take care of many of the current issues we face.. — synthesis

Echarmion

2.7kGoing back to real money and no FRL (fractional reserve lending) will take care of many of the current issues we face.. — synthesis

Without FRL, the economy would collapse. For better or worse, FRL is a central engine of capitalism, as it facilitates investment and makes it cheaper (via inflation).

To me it looks like a constantly expanding bubble, kept from popping by continually low interest rates and constant access to easy money. Because money is so cheap, there is a lack of investment opportunities. The only strategy that offers ever higher returns the more money you pump into it is gambling, and one of the ways one can gamble is via the stock market.

Noone has any interest in popping the bubble because everyone stands to loose. The relationship between the bubble and the real economy is also not straightforward. In theory it doesn't matter how much money is in circulation, what matters is the distribution. But chances are the current situation, as usual, will cause money to flow upwards and, when the bubble pops, leave lots of people without their savings. -

Benkei

8.1ksome people will do the choosing as others will do the suffering. Aka, the capitalist and government versus the worker and tax player.

Benkei

8.1ksome people will do the choosing as others will do the suffering. Aka, the capitalist and government versus the worker and tax player. -

ssu

9.8k

ssu

9.8k

Yet in the US, just to give an example, the most rapid economic growth happened during the gold standard in the 19th Century.Without FRL, the economy would collapse. For better or worse, FRL is a central engine of capitalism, as it facilitates investment and makes it cheaper (via inflation). — Echarmion

I disagree on the idea that everyone stands to lose. Popping the speculative bubble will get the economy over the issue and get back on a healthy track. It will be past, not something that will have an effect decades later, just as now with the 2008. If it is not let to burst, many people will lose from the current malaise while the richest that can get the cheap money will become more richer.Noone has any interest in popping the bubble because everyone stands to loose. — Echarmion

Those who benefit from the present system are the richest people and the vast majority of ordinary people suffer. This for example Yanis Varifoukas explained very well.

Free market mechanism, if it would be let to happen, would deal with the bursting of the bubble with a quick deflation and sharp recession that would give way then for a healthy recovery. What is now done, to patch the bubble and help zombie banks and corporations to limp on, leads to a similar anemic growth that Japan had. And likely will result sooner or later in an system crisis. Popping the bubble will simply lead to brief transfer of wealth. Sustaining the bubble will lead those that have caused the bubble to enrich themselves even more. -

Kenosha Kid

3.2kKid, it's a miracle that large groups of people are able to do anything besides beat the crap out of each other 24/7. Capitalism is what it is (and has many contradictions), but look at what it has done to lift billions of poor souls out of abject poverty.

Kenosha Kid

3.2kKid, it's a miracle that large groups of people are able to do anything besides beat the crap out of each other 24/7. Capitalism is what it is (and has many contradictions), but look at what it has done to lift billions of poor souls out of abject poverty.

You have a better idea? — synthesis

We are already at the point where, for many countries, the benefits of capitalism are waning. My generation is effectively poorer than my parents'. The number of unemployed people and people in poverty is rapidly growing. Life expectancy is starting to fall, and not because of Covid. It is little comfort that the Chinese are doing so well, though more power to them.

It is only promising that there are fewer people in poverty if that is sustainable, and capitalism does not know the meaning of the word 'sustainable'. A better sentiment might be, "Yeah, but it was fun while it lasted" ;)

As for a better idea, yes, a capitalism tempered and augmented by long-termist social policy. -

ssu

9.8k

ssu

9.8k

Well, don't political issues have philosophical views behind them?It's not a philosophical or economical discussion. It's raw politics. — Benkei

But I do agree:

When the US had it's Savings & Loans crisis in the 1980's, bankers went to jail and 1000 S&L banks went belly up. And the US then preached Japan to take similar action with it's banking crisis. When Wall Street had a similar crisis, the Secretary of the Treasury was a Wall Street banker, his former bank didn't fail, nobody went to jail and we are facing the unresolved problems of that time today. Yeah, it's about power. -

synthesis

933Without FRL, the economy would collapse. For better or worse, FRL is a central engine of capitalism, as it facilitates investment and makes it cheaper (via inflation). — Echarmion

synthesis

933Without FRL, the economy would collapse. For better or worse, FRL is a central engine of capitalism, as it facilitates investment and makes it cheaper (via inflation). — Echarmion

So let it collapse. That's what needs to happen. Then you can re-start the economy based on sound money/policy. -

synthesis

933We are already at the point where, for many countries, the benefits of capitalism are waning. My generation is effectively poorer than my parents'. The number of unemployed people and people in poverty is rapidly growing. Life expectancy is starting to fall, and not because of Covid. It is little comfort that the Chinese are doing so well, though more power to them.

synthesis

933We are already at the point where, for many countries, the benefits of capitalism are waning. My generation is effectively poorer than my parents'. The number of unemployed people and people in poverty is rapidly growing. Life expectancy is starting to fall, and not because of Covid. It is little comfort that the Chinese are doing so well, though more power to them.

It is only promising that there are fewer people in poverty if that is sustainable, and capitalism does not know the meaning of the word 'sustainable'. A better sentiment might be, "Yeah, but it was fun while it lasted" ;) — Kenosha Kid

You need to widen your perspective a little bit. Most young people act as if the ten years they can remember the the entirety of human history.

We happen to be in a low point, no doubt, but these things are cyclical. You need to study up on your economic cycles and history, in general. And believe me, socialism is not going to save anybody more than the time it takes to destroy whatever generated the wealth it absconds. -

Benkei

8.1k:rofl: Yeah, as if a good economic crisis has ever led to a change in economic policy. Not in recent history at least. Crises compound stupidity because when people are confronted with change, especially unwanted change, they cling to what they know.

Benkei

8.1k:rofl: Yeah, as if a good economic crisis has ever led to a change in economic policy. Not in recent history at least. Crises compound stupidity because when people are confronted with change, especially unwanted change, they cling to what they know. -

Pfhorrest

4.6kindex investing: people invest passively in an fund trying to copy the index, which then means that the most risen stocks are bought — ssu

Pfhorrest

4.6kindex investing: people invest passively in an fund trying to copy the index, which then means that the most risen stocks are bought — ssu

You probably already know this and just misspoke, but it's not the "most risen" stocks that get bought more, it's the stocks with highest market capitalization, which is the product of share price and number of outstanding shares. Phrasing it as "most risen" makes it sound like the faster a stock goes up the more the index funds buy it, but if it's a penny stock with almost no market capitalization, even a huge percent increase in it will make very little difference in the overall portfolio of an index fund.

It's much like a pyramid scheme. Each person is willing to pay more than the last because the next will pay yet more, until they don't, then the pyramid collapses. The last tier lose but everyone before them wins. — Kenosha Kid

If you're talking about index funds here like ssu was, then this collapse doesn't happen, at least not overall. The fund is just following the market at a whole, by investing proportional to market capitalization. If one overvalued stock collapses, that reduces their amount of market capitalization, and so proportionally increases the fraction of market capitalization of all the other stocks in the portfolio, so the fund reallocates money from the collapsing stock to the others.

In this way index funds perform definitionally as well as the average investor, but with none of the expensive overhead of actively making decisions on which stocks to invest in, resulting in greater overall profit. So long as the market as a whole is doing well, the index fund does well.

Interestingly, this incentivizes index fund investors to root for the collective benefit of all participants in the market, not the victory of any one over the other, and so in this way the best investors under capitalism in a way mimic some aspects of socialism:

-

Echarmion

2.7kI disagree on the idea that everyone stands to lose. Popping the speculative bubble will get the economy over the issue and get back on a healthy track. It will be past, not something that will have an effect decades later, just as now with the 2008. If it is not let to burst, many people will lose from the current malaise while the richest that can get the cheap money will become more richer. — ssu

Echarmion

2.7kI disagree on the idea that everyone stands to lose. Popping the speculative bubble will get the economy over the issue and get back on a healthy track. It will be past, not something that will have an effect decades later, just as now with the 2008. If it is not let to burst, many people will lose from the current malaise while the richest that can get the cheap money will become more richer. — ssu

Yet in the US, just to give an example, the most rapid economic growth happened during the gold standard in the 19th Century. — ssu

The gold standard is not directly related to fractional reserve banking, as you can have both. The gold standard only limits the primary currency, but banks and everyone can work with derived currencies just fine. But the gold standard does of course have an effect on the domestic money supply since it makes it much more apparent should virtual currencies run out of hand.

As for the economic growth, the 19th century was the century of rapid industrialisation and expansion for the US, so it's not clear to me how much monetary policy mattered.

My personal lay opinion (and this is just me soapboxing, I'm not addressing you personally) is that the power of monetary policy to affect actual production is often overstated. Money is not magic, nor is there a simple answer to the question of how virtual money should be. It's often assumed that virtual money is something new and dangerous. But it's actually a fairly normal thing in history. For example, after the collapse of the Western Roman empire, the successor states kept using Roman currency denominations to calculate debts, but the actual coins were no longer in circulation.

Well, everyone with easy access to power stands to loose. It's difficult to say what effect such a collapse would have on the overall economy, at least I don't feel confident making any judgement.

Free market mechanism, if it would be let to happen, would deal with the bursting of the bubble with a quick deflation and sharp recession that would give way then for a healthy recovery. — ssu

I'm not sure what free market mechanism this would be. The free market model says nothing about monetary policy, nor about limits to speculation.

So let it collapse. That's what needs to happen. Then you can re-start the economy based on sound money/policy. — synthesis

The problem is that the short time consequences are difficult to predict (for me, anyways) and might be catastrophic.

That might be an acceptable risk if we could be sure we had "sound money and policy" to go forward, but I am not confident that we do without some significant paradigm shift in the way we approach growth, debt and profit. -

Kenosha Kid

3.2kYou need to widen your perspective a little bit. Most young people act as if the ten years they can remember the the entirety of human history.

Kenosha Kid

3.2kYou need to widen your perspective a little bit. Most young people act as if the ten years they can remember the the entirety of human history.

We happen to be in a low point, no doubt, but these things are cyclical. You need to study up on your economic cycles and history, in general. And believe me, socialism is not going to save anybody more than the time it takes to destroy whatever generated the wealth it absconds. — synthesis

Thanks for the uplifting (if somewhat simultaneously condescending) presumption of youth, I'll take it. :)

I'm well aware that the capitalist clergy take all the credit for progression in technology, medicine, worker's rights, and social investment while championing parties that have to prop up a capitalism that, even in its Moore-esque law of exponentially increasing dubiousness of conduct, cannot support itself. I guess capitalism in the west can take credit for bringing people in the east out of poverty, as ssu frequently points out, but that's no more sustainable than anything else capitalism comes up with. Ultimately it's fortunate that, for now, debt is a lucrative industry, since right now it is debt that keeps that poverty line low. -

Kenosha Kid

3.2kIf you're talking about index funds here like ssu was, then this collapse doesn't happen, at least not overall. — Pfhorrest

Kenosha Kid

3.2kIf you're talking about index funds here like ssu was, then this collapse doesn't happen, at least not overall. — Pfhorrest

I was talking particular stocks rather than entire portfolios. ssu was questioning the sanity of self-inflating stocks within a portfolio, not of moving investment within it, e.g. how a company like Tesla can become so overvalued. -

ssu

9.8k

ssu

9.8k

Yes, the index is most defined by the largest stocks that make it. Better to say it more clearly as you do. Also it should be mentioned that indexes are actively changed. That's why the DJIA, which just takes 30 stocks and doesn't use the weighted arithmetic mean, isn't a fair representation to overall stocks and people use the S&P 500 or the Russell 3000.You probably already know this and just misspoke, but it's not the "most risen" stocks that get bought more, it's the stocks with highest market capitalization — Pfhorrest

Still, just seven or so stocks of the S&P 500 make up 40% of the market cap of the index. And if you want to mimic the index, guess what seven stocks you have to buy? -

ssu

9.8k

ssu

9.8k

Which does represent a limit to a totally reckless monetary policy.The gold standard is not directly related to fractional reserve banking, as you can have both. The gold standard only limits the primary currency, but banks and everyone can work with derived currencies just fine. But the gold standard does of course have an effect on the domestic money supply since it makes it much more apparent should virtual currencies run out of hand. — Echarmion

I think the best formulation of what would be close to a gold standard is to think of situation inside the Eurozone: with the Euro, the members states cannot prop up their export sector by devaluation and hence the euros end up in the best performing countries like Germany and make it difficult for weak countries like Greece, that were accustomed to devaluate their currencies to gain an advantage in selling their exports. Yet not that those countries (like Greece) which used extensively devaluation to prop up their industry, aren't the most prosperous ones. That the German Mark was for so long strong meant also that the Germans were prosperous.

I think many simply don't understand it. Especially the effects on the long term that what easy monetary policy does to a country. And in the economic circles the differences start from things like what is money.My personal lay opinion (and this is just me soapboxing, I'm not addressing you personally) is that the power of monetary policy to affect actual production is often overstated. — Echarmion -

synthesis

933:rofl: Yeah, as if a good economic crisis has ever led to a change in economic policy. Not in recent history at least. Crises compound stupidity because when people are confronted with change, especially unwanted change, they cling to what they know. — Benkei

synthesis

933:rofl: Yeah, as if a good economic crisis has ever led to a change in economic policy. Not in recent history at least. Crises compound stupidity because when people are confronted with change, especially unwanted change, they cling to what they know. — Benkei

There has not been an economic crisis since the recession of the early 90's (and even that one was semi-bailed). I am talking about a proper depression (people jumping off of buildings, etc.). This is what is needed to clear out the dead wood (write of trillions in bad loans, redistribute capital to productive enterprises, and normalize interest rates (better yet, get rid of the FED altogether) .

IOW, allow the system to work! -

synthesis

933The gold standard is not directly related to fractional reserve banking, as you can have both. The gold standard only limits the primary currency, but banks and everyone can work with derived currencies just fine. But the gold standard does of course have an effect on the domestic money supply since it makes it much more apparent should virtual currencies run out of hand. — Echarmion

synthesis

933The gold standard is not directly related to fractional reserve banking, as you can have both. The gold standard only limits the primary currency, but banks and everyone can work with derived currencies just fine. But the gold standard does of course have an effect on the domestic money supply since it makes it much more apparent should virtual currencies run out of hand. — Echarmion

Just as important is that under a gold standard, international trade is balanced in gold. Had this not changed in 1971, this would be an entirely different global economy. This was the single policy change that destroyed the Western middle class (sent their manufacturing jobs to low-wage Asian countries). -

synthesis

933Thanks for the uplifting (if somewhat simultaneously condescending) presumption of youth, I'll take it. :) — Kenosha Kid

synthesis

933Thanks for the uplifting (if somewhat simultaneously condescending) presumption of youth, I'll take it. :) — Kenosha Kid

Not much you can do about your age. You speak like the bright young person I am sure you are.

I'm well aware that the capitalist clergy take all the credit for progression in technology, medicine, worker's rights, and social investment while championing parties that have to prop up a capitalism that, even in its Moore-esque law of exponentially increasing dubiousness of conduct, cannot support itself. I guess capitalism in the west can take credit for bringing people in the east out of poverty, as ssu frequently points out, but that's no more sustainable than anything else capitalism comes up with. Ultimately it's fortunate that, for now, debt is a lucrative industry, since right now it is debt that keeps that poverty line low. — Kenosha Kid

People who are in favor of capitalism (and I've debated this for centuries, well, decades, anyway :) understand the contradictions. Personally, I believe that all systems are horrendous, but some are worse than others. I also understand how inherently unfair this system appears (and especially over the past 20 years) but that's because corruption is completely out of control. It's like the entire Western world is a banana republic.

There is too much socialism in this system now. Add more and it will become even more inefficient. This system desperately needs to cleans itself by going through a massive recession (depression) which will allow it to at least work the best it can. Right now it's a complete farce, a combination of mafia politics and corporatism. -

Kenosha Kid

3.2kThere is too much socialism in this system now. Add more and it will become even more inefficient. This system desperately needs to cleans itself by going through a massive recession (depression) which will allow it to at least work the best it can. Right now it's a complete farce, a combination of mafia politics and corporatism. — synthesis

Kenosha Kid

3.2kThere is too much socialism in this system now. Add more and it will become even more inefficient. This system desperately needs to cleans itself by going through a massive recession (depression) which will allow it to at least work the best it can. Right now it's a complete farce, a combination of mafia politics and corporatism. — synthesis

Such as..? Actually, this is derailing ssu's thread. It would be welcome on mine though if you want to grind it out, old man :p

Welcome to The Philosophy Forum!

Get involved in philosophical discussions about knowledge, truth, language, consciousness, science, politics, religion, logic and mathematics, art, history, and lots more. No ads, no clutter, and very little agreement — just fascinating conversations.

Categories

- Guest category

- Phil. Writing Challenge - June 2025

- The Lounge

- General Philosophy

- Metaphysics & Epistemology

- Philosophy of Mind

- Ethics

- Political Philosophy

- Philosophy of Art

- Logic & Philosophy of Mathematics

- Philosophy of Religion

- Philosophy of Science

- Philosophy of Language

- Interesting Stuff

- Politics and Current Affairs

- Humanities and Social Sciences

- Science and Technology

- Non-English Discussion

- German Discussion

- Spanish Discussion

- Learning Centre

- Resources

- Books and Papers

- Reading groups

- Questions

- Guest Speakers

- David Pearce

- Massimo Pigliucci

- Debates

- Debate Proposals

- Debate Discussion

- Feedback

- Article submissions

- About TPF

- Help

More Discussions

- Other sites we like

- Social media

- Terms of Service

- Sign In

- Created with PlushForums

- © 2026 The Philosophy Forum