-

frank

19kIt simply wasn't in the news. Only later we found out that the whole financial system had been close to collapsing. And just how much was given to banks and corporations. — ssu

frank

19kIt simply wasn't in the news. Only later we found out that the whole financial system had been close to collapsing. And just how much was given to banks and corporations. — ssu

It was pretty obvious when the chairman of the fed and the secretary of the Treasury appeared before Congress asking for money. Everyone knew that 55 trillion dollars had just disappeared and that the banking system was in credit freeze. Most of the bail out was legislation called TARP.

Perhaps the money that people have in banks should be secured — ssu

It's insured by the FDIC up to a certain amount.

But it should be absolutely clear that the Fed works for Wall Street. — ssu

Of course. -

Count Timothy von Icarus

4.3kI would have said "sell securities, raise rates," three weeks ago, but now it looks like that will risk sending the banking system into a crisis. I would also have said, "you could raise capital requirements, but why bother, since banks have been way above Fed requirements forever," as this was conventional, textbook window that had calcified since 2008.

Count Timothy von Icarus

4.3kI would have said "sell securities, raise rates," three weeks ago, but now it looks like that will risk sending the banking system into a crisis. I would also have said, "you could raise capital requirements, but why bother, since banks have been way above Fed requirements forever," as this was conventional, textbook window that had calcified since 2008.

But of course, if bank capital is offset by unrealized losses of securities, then the capital requirements aren't doing what they should be doing.

I am surprised. I thought rising rates were likely to trigger a crisis, but I assumed it would come from unhealthy corporations being unable to cheaply roll debt, not banks holding on to low yield LTD getting cleaned out. For one, we have had decades of low rates, it doesn't seem like there should be enough high rate issuances to suck up demand, unless they are cloning it again via derivatives. In that case, you'll have a secondary problem of high yield instruments getting cleaned out when rates fall as people do advanced refunding, call bonds, etc.

Also makes you wonder about the credibility of the Fed in a world where rates are high for years considering their gigantic balance sheet of low interest securities accumulated during the Pandemic.

Realistically, what is needed is major tax increases to address distorting levels of wealth and income inequality. No cap on Social Security or Medicare income, making the tax no longer regressive, plus full applicability of these taxes to capital gains, would go a long way. The Federal budget is set to start running a surplus later this decade not considering senior entitlement revenue or expenses, but runs an astounding deficit paying for seniors, who already received half of federal spending.

We also need austerity. It is trivial to cheat Medicaid and Medicare right now and attempts to recoup costs are arbitrary. $500,000 worth of heart surgery at age 85, step right up, that's the right sort of ailment. $500,000 worth of long term care for Alzheimer's? We need to liquidate all your assets to pay for things.

Taking steps to not pay for Medicaid costs is essentially standard now, only poor people get hit with all of it. It's a rent seeking niche. The fact is that if you accumulated $1M is securities and cash and had an expensive house, then you should pay for you care. Chances are that will liquidate much or all of your estate. People have a hard time wrapping their minds around this because senior care, by far and away the most expensive type, is arbitrarily free in some cases and not others. The arbitraryness and uneven burden needs to go, and a good way to do this might be an across the board estate tax on virtually all estates (say over $25,0000) instead of any attempt to recoup costs.

Baby Boomer can't expect $2 trillion plus a year in cash payments later this decade, free healthcare, and that their assets pass on untouched, it's unrealistic and will kill the system for their children.

Or, more unrealistically, they could nationalize healthcare and higher ed and put in cost controls seen elsewhere in the OECD. That will be very painful though and austerity itself as millions of admin staff in colleges and insurance whose positions don't exist in other countries become redundant.

Chronically low interest rates need to go, we now have tons of evidence that they increase inequality. Mortgage interest deductions need to be phased out because favoring homeowners just promoted inequality and any savings get priced into house sales anyhow.

A full carbon/pollution tax would also hit Chinese goods very hard and incentize near shoring, which could help fix some of the supply chain issues. -

frank

19kI would have said "sell securities, raise rates," three weeks ago, but now it looks like that will risk sending the banking system into a crisis. — Count Timothy von Icarus

frank

19kI would have said "sell securities, raise rates," three weeks ago, but now it looks like that will risk sending the banking system into a crisis. — Count Timothy von Icarus

:up: The foreign exchange market is showing that global sentiment doesn't expect the fed to raise rates any further. The dollar is getting weaker, not stronger as it would if a rate hike was expected.

There's a lot of uncertainty right now -

Count Timothy von Icarus

4.3kI realize those are mostly revenue raising ideas for austerity, but there are plenty of moves to make on the expense side.

Count Timothy von Icarus

4.3kI realize those are mostly revenue raising ideas for austerity, but there are plenty of moves to make on the expense side.

Increasing the retirement age makes sense in the context of increasing life and health spans. Nationalizing healthcare and senior care is a expense reduction idea. Even if the US was still on top for spending, it could reduce healthcare costs by a extraordinary amount by moving costs closer to other nations.

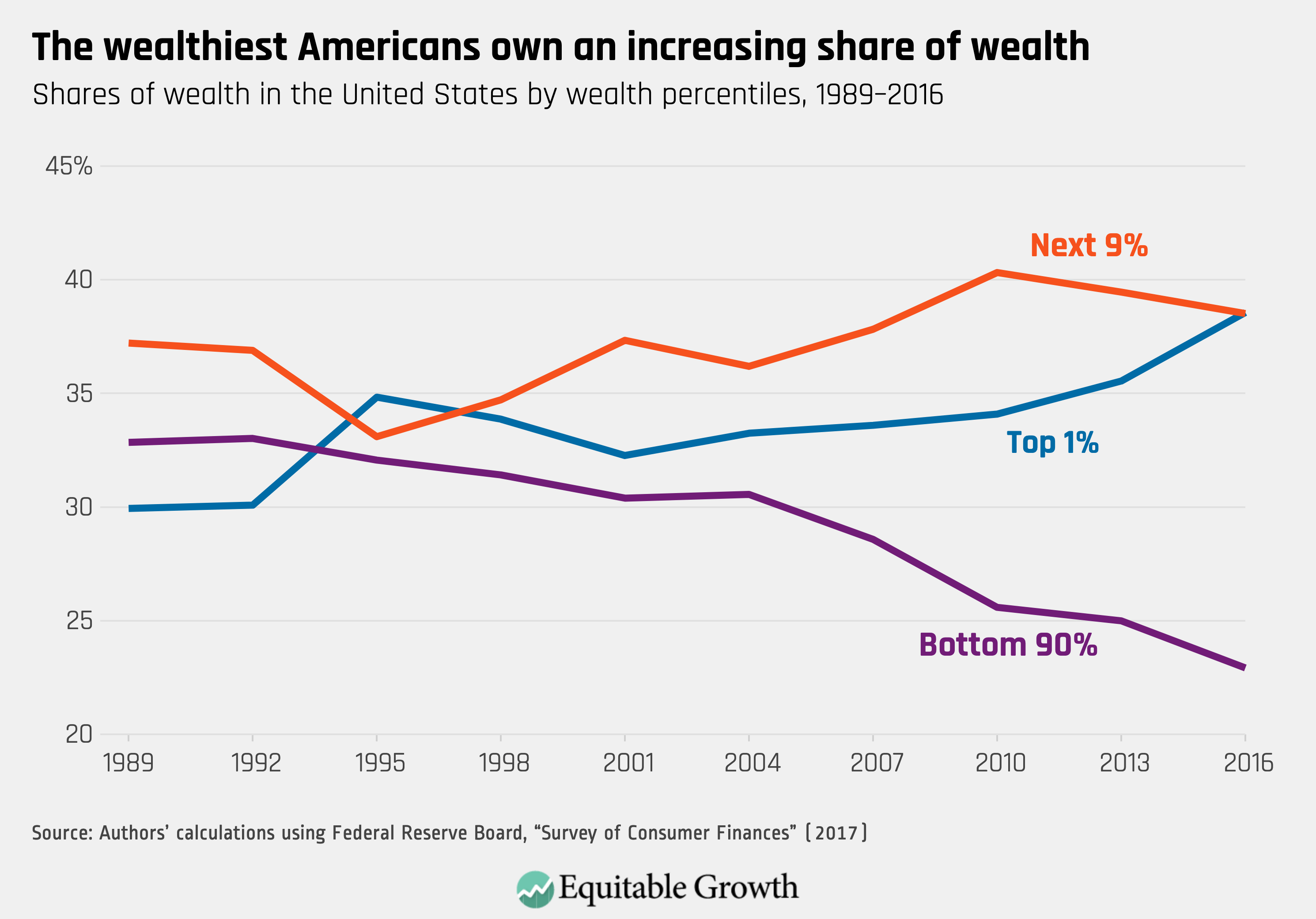

The reason you need to mostly target the income and taxes of the wealthy isn't ideological or moral. I think framing it this way hurts attempts to deal with the structural deficit, making reforms less politically palatable. You go after high networth households for the same reason you rob banks, "that's where the money is." The top 1% has over 15 times the networth of the bottom 50% in the US. The bottom 50% of households hold a fairly insignificant amount of wealth, about, and the next 25% doesn't fair that much better. You simply can't fix the problems by taxing them, only by denying them entitlements and means tested benefits, but here most of the spending is due to seniors, and so arguments that cutting benefits will "make them work more, backfilling lost income," are even more ridiculous.

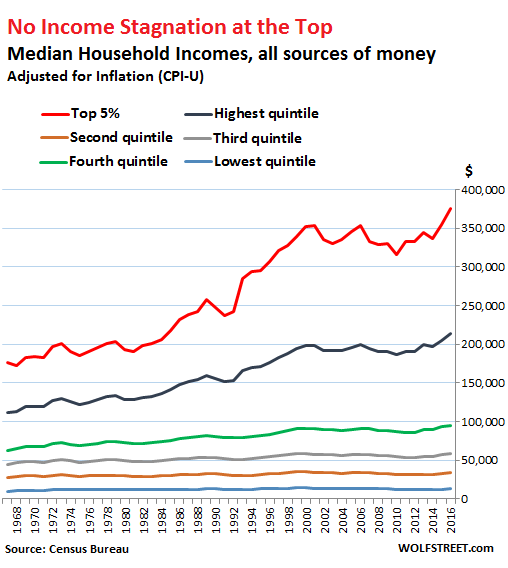

The above is also why arguments about rising wages for low income service employees driving inflation don't hold water. To be sure, this trend squeezed some industries quite hard, but these aren't even the sectors where prices have risen most rapidly. Overall price level increases can't be wholly due to growing wages for the the bottom half of the income distribution, since they only account for 12-14% of all income and their wage gains only outpaced inflation for a few months. Their real wages have since experienced negative growth.

One can only imagine the huge efforts at tax evasion any such effort to preempt an inevitable large scale crisis would kick off. I sometimes wonder if we are in store for a WWII scale financial conflict of sorts as developed countries are hit by a tsunami of pensioners but are unable to get recalcitrant elites to pay for the cost. Down the road, I can see some sort of international tax collection body existing, but unfortunately not until it is created to respond to a large scale crisis most likely. -

RogueAI

3.5kRealistically, what is needed is major tax increases to address distorting levels of wealth and income inequality. No cap on Social Security or Medicare income, making the tax no longer regressive, plus full applicability of these taxes to capital gains, would go a long way. — Count Timothy von Icarus

RogueAI

3.5kRealistically, what is needed is major tax increases to address distorting levels of wealth and income inequality. No cap on Social Security or Medicare income, making the tax no longer regressive, plus full applicability of these taxes to capital gains, would go a long way. — Count Timothy von Icarus

:up: -

ssu

9.8kSome remarks on the good comments made by @Count Timothy von Icarus:

ssu

9.8kSome remarks on the good comments made by @Count Timothy von Icarus:

We also need austerity. It is trivial to cheat Medicaid and Medicare right now and attempts to recoup costs are arbitrary. $500,000 worth of heart surgery at age 85, step right up, that's the right sort of ailment. $500,000 worth of long term care for Alzheimer's? We need to liquidate all your assets to pay for things. — Count Timothy von Icarus

The US simply should look just why it's health care costs are so insanely more than in any other country. When this has been discussed on PF, very obvious and clear reasons, like with people without proper medicare then being first treated at the ER. Among other obvious problems.

And of course there's the military spending. But the problem is that I cannot see any other way for these to be dealt than a huge crisis.

If the bank gets robbed too many times, people will not put money into the bank. The basic problem is that even if tax rates have varied, the tax income hasn't change as much as you would think. So doubling the tax rate will increase your revenues, but won't double them.The reason you need to mostly target the income and taxes of the wealthy isn't ideological or moral. I think framing it this way hurts attempts to deal with the structural deficit, making reforms less politically palatable. You go after high networth households for the same reason you rob banks, "that's where the money is." — Count Timothy von Icarus

Wages are the perfect culprit for central banks and governments. Anything else than loose monetary policy is given as the reason for inflation.Overall price level increases can't be wholly due to growing wages for the the bottom half of the income distribution, since they only account for 12-14% of all income and their wage gains only outpaced inflation for a few months. Their real wages have since experienced negative growth. — Count Timothy von Icarus

The problem is that when the proper understanding of how our debt-based monetary system works is limited in public to basically to nearly conspiracy theories, it is no wonder that the people do not understand where the inflation really comes from. In schools, in universities, the example given is the wage increases etc. Not the financial sector controlled by the central banks. -

frank

19kThe US simply should look just why it's health care costs are so insanely more than in any other country. — ssu

frank

19kThe US simply should look just why it's health care costs are so insanely more than in any other country. — ssu

They have. I mean doctors have. I think the theory at this point is that Americans are unusually unhealthy. Not sure why, but I'm sure the American Sugar Association isn't helping. They actively squash research that clearly shows the dangers of over doing sugar. -

Count Timothy von Icarus

4.3k

Count Timothy von Icarus

4.3k

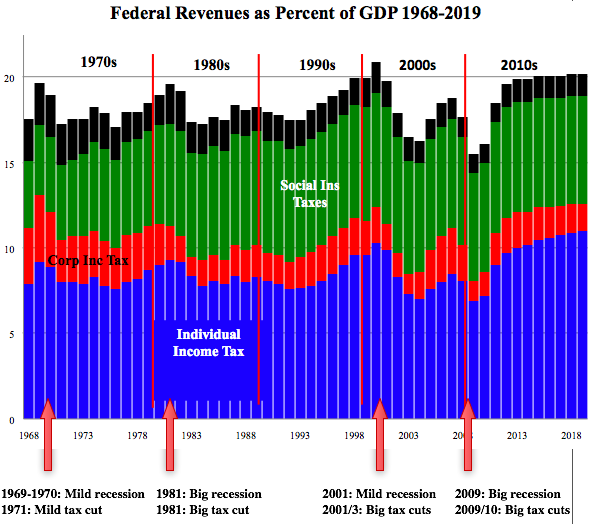

I would question the part about tax receipts being unable to go above 20%. This is a common argument made by opponents of tax hikes and I believe it is spurious. Plenty of countries maintain tax receipts well above this level, the UK has been around 30% for instance.

The graph is compelling until you realize that there is a historical reason for receipts never breaking 20%. Every time they have begun to eclipse that number there has either been massive tax cuts or a recession. Obviously, tax receipts can't make up a larger share of GDP if taxes get slashed every time receipts begin to breach a given level.

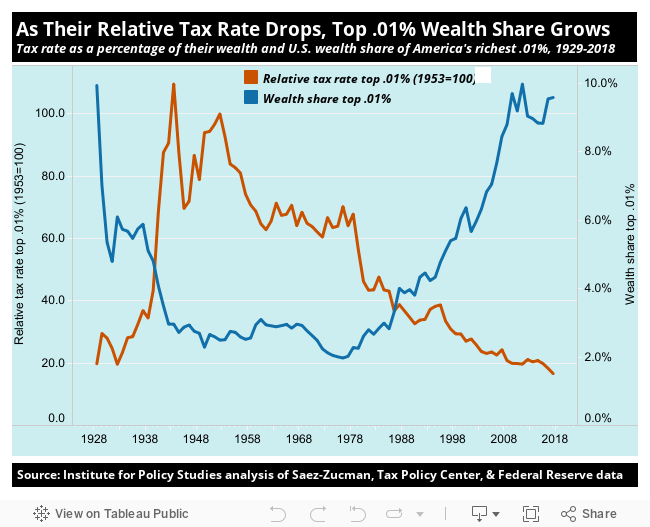

High top marginal rates meant far less 70 years ago when income inequality was drastically below today's levels. Much less of all income was in those high-level brackets. Also, it is somewhat spurious when marginal rates are represented only for income taxes, not the regressive payroll tax or effectively regressive capital gains tax.

I mean, I know these figures and they still look wild every time I see them, the bottom 90% holds less than 25% of wealth. The 1% is out distancing the bottom 90%.

Chronically low interest rates, a central bank policy, and low top marginal tax rates have been huge in creating this gap.

As for another strong relationship:

If you're into security policy, this is even more disturbing. Autonomous drones, rocket delivered drone cluster munitions, autonomous spotters paired with autonomous artillery systems, integrated augmented reality for infantry, squad level UGVs, etc. We're entering an era where a quite small cadre of well paid professionals, managing a military made up of autonomous systems is going to be able to crush a much larger military/revolt. I don't think the gap between professionals and the "people" will have been as big since the medieval period, where the armored knight with horse and couched lance could rely on routing peasant formations many times their size.

Not to mention the power of modern surveillance networks utilizing small drones to EW UAVs to high altitude balloons to satalies. AI monitoring communications channels, facial recognition, ubiquitous cameras on every street from small town squares and up, biomarker databases, etc. Taking out revolt before it starts is also way easier.

It's disturbing to think about how much military power wealth can buy when inequality is this high.

Not to be dramatic or anything lol... -

Count Timothy von Icarus

4.3kAlso of note, whenever someone brings up how Japan has stagnated so badly due to an aging population + lack of immigration...

Count Timothy von Icarus

4.3kAlso of note, whenever someone brings up how Japan has stagnated so badly due to an aging population + lack of immigration...

It is worth noting that while the US average keeps growing at a solid clip, inequality is so bad that this means absolutely nothing for most people.

Actually, the two are not unrelated. High levels of immigration, when said immigrants tend to be low skill/low net worth, necessarily increases income and wealth inequality. Income inequality goes up because, if the new arrivals command lower wages than the current population, that will bring down the average. You also have the problem of chronic low demand for lower skilled workers, meaning that increasing the labor supply may just be driving down wages and decreasing labor force participation rates (particularly among natives eligible for means tested benefits).

There is also evidence that higher rates of migration erode the ability of workers to unionize. A leaked document from Amazon showed that they tried to keep their warehouses diverse specifically because a language barrier tamped down the threat of unionization (we have similar documents from the Gilded Age). Employers also have more leverage when the workforce keeps growing faster than demand.

I only bring this up because it is sometimes claimed that much higher levels of migration to developed countries from the developing world can fix the pensioner crisis and relieve global inequality. This is highly unlikely to work.

First, higher rates of migration only kick the can down the road on pension systems and actually make the liability problem worse if the new arrivals tend to be low earners. It is often claimed that immigrants are a net asset vis-a-vis liabilities in the US, but this is when analysis specifically looks at the federal budget, which is misleading. Most of the federal budget is for entitlements that immigrants cannot receive (at least not until they flip categories), so of course they help there. The other big item is defense, and it does not cost more to defend the US if there are 390 million people versus 330. However, at the state and local level, where K-12 schools are funded, immigration can be a significant burden (e.g., the MA Ch. 70 funding allocation, widely considered the best in the nation, has a minimum funding level for low-income ESL students that is over twice that for a non-low income native speaker).

Second, any claim that global inequality can be addressed by migration is spurious. Just Bangladesh can supply more low-income migrants than Japan and the US can absorb. You're talking about over a billion people. Lifting them out of poverty has to involve investment in their nations. IMO, global inequality is a travesty and a systemic security threat. Aid budgets should be on par with defense budgets (and those also tend to be too low). -

frank

19kJust Bangladesh can supply more low-income migrants than Japan and the US can absorb. — Count Timothy von Icarus

frank

19kJust Bangladesh can supply more low-income migrants than Japan and the US can absorb. — Count Timothy von Icarus

Is this related to climate change? -

Count Timothy von Icarus

4.3k

Count Timothy von Icarus

4.3k

No, although that's a good reason to use it as an example. I just thought of it because it is one of many very poor countries (24% poverty rate but much higher if OECD standards are used). It is not anywhere near the population of India or where Nigeria will be in the future, but it is still 170 million people.

Lifting those people's living standards by moving them would mean 100 million people moving. This is on the one hand impractical and unfeasible, and on the other more than developed nations could absorb. It would also negatively affect the people left in country.

My point is simply that moving will at best still be an option for an extremely small share of the population when you consider the numbers.

Gallup did some polling on this and there are 750 million people today who want to relocate countries, 138 million to the US specifically. Obviously that's not a realistic figure. -

ssu

9.8kThanks for good commentary, @Count Timothy von Icarus

ssu

9.8kThanks for good commentary, @Count Timothy von Icarus

I think the recessions haven't happened because of tax increases, but lowering taxes in hope of increasing economic activity can happen and has happened. Just as lowering the price of money (the interest rate).Every time they have begun to eclipse that number there has either been massive tax cuts or a recession. — Count Timothy von Icarus

Income from a job may be important to many ordinary people, but for the rich it is the capital gains. And this presents a problem with taxation. Let's say for some reason the Leftist party would win here and would triple the capital gains tax here (that would be then a tax percentage of 99%). My reaction would to F-them and not sell anything before those crazies are out of office and the capital gains tax are normal again. For the rich, well, their assets can suddenly be then in a tax haven.Also, it is somewhat spurious when marginal rates are represented only for income taxes, not the regressive payroll tax or effectively regressive capital gains tax. — Count Timothy von Icarus

Well, at least those countries that have a steady inflow of educated young working emigrants don't have problems, if these foreigners are accepted. And they basically are accepted, if it is perceived that they bring more to the economy than they take. I mean, nobody hates tourists, even if there are those foreigners all the year around. Now if those tourists wouldn't spend anything, just hang out on the streets, people in any country wouldn't like them.I only bring this up because it is sometimes claimed that much higher levels of migration to developed countries from the developing world can fix the pensioner crisis and relieve global inequality. This is highly unlikely to work. — Count Timothy von Icarus

* * *

The fundamental problem in economics is that however preposterous the spending spree and debt bubble we have, it's always the normal, the "new economy", and we simply don't accept the natural market correction that would happen if we would let free markets to roam. And I'm not talking here about the little guy, who usually get's trampled, but a severe short recession, a deflationary correction, isn't accepted as it would transfer wealth from those having it now. And those who have the wealth usually have also the power and the strings to influence the government in their desperation. -

frank

19kMy point is simply that moving will at best still be an option for an extremely small share of the population when you consider the numbers. — Count Timothy von Icarus

frank

19kMy point is simply that moving will at best still be an option for an extremely small share of the population when you consider the numbers. — Count Timothy von Icarus

Are you saying that anti-immigration sentiment isn't just about racism? That it's also about this tool capitalists use to undermine the power of labor? -

Count Timothy von Icarus

4.3k

Count Timothy von Icarus

4.3k

I think there is an option between tripling the capital gains tax and leaving it where it is. You could simply have it taxed on a level with income. If someone has realized losses, the amount they are able to carry forward for multiple years would be based on their total asset levels. This would allow small business owners to write off significant losses, while also avoiding the current phenomena where someone like Donald Trump, an hier to a gargantuan fortune, avoids paying income taxes for years on end.

I mean, does anyone actually defend a system where a billionaire can go years without paying income taxes?

You could also close key loopholes. Right now, the very wealthy don't even need to realize capital gains. They just take out loans collateralized by their assets and spend down their value without realizing a gain. You could fix this easily by simply saying that, above a certain threshold, if you borrow against assets to receive cash, that cash is taxed as income. It is totally possible to allow someone to borrow $100,000 against assets for a home (it is very uncommon for the middle class to use these anyhow ) but to tell someone with a networth over $30 million that if they get cash on a loan collateralized with assets (at least of some classes, e.g. equities) they have to pay some sort of tax since they are, in effect, realizing a gain.

This change would also fix the issues with some asset classes becoming bubbles. We tax bonds as income but not realized gains on stocks or real estate, which incentivizes speculative bubbles.

IMO, gains on residential real estate for non-primary residences should have an extra tax assessed at a rate determined by the current gap between median income and median rents/mortgage payments. When there is a housing shortage, it automatically will become less attractive to buy up real estate, curbing the positive feedback loops that keeps leading to bubbles. Then revenue raised from this tax goes to a special fund used for building housing units. If states want access to this fund, they need to pass legislation allowing the funds to be used regardless of all the petty laws set up to block construction in order to keep home values inflated. Win/win. -

Count Timothy von Icarus

4.3k

Count Timothy von Icarus

4.3k

I don't think it's that simple; plenty of business elites have sunk a lot of their personal wealth into anti-immigration campaigns. There is a bidirectional relationship between growth in median wages, unemployment rates, the immigrant share of the economy, rates of immigration, segregation, etc. and sentiment towards immigration.

Certainly, in some cases businesses do see immigration as such a tool, but in general I think more is going on. Immigrants impose externalities on each other similar to congestion effects in traffic. How long it takes for a new group to assimilate (in terms of economic variables) depends on how many more people are coming at the same time (among other factors).

The modern liberal state has sublated elements of socialism and nationalism. These nationalist components say, "our state is for our people." Thus, even liberals didn't think Algerians rights would be satisfied by France giving them the right to vote, they wanted "an Algerian state for Algerians."

But this causes a contradiction. Socialism is justified by the idea of a group owing things to one another, arguments about the health of the state, etc. Extending these benefits to outsiders is not broadly popular in the same way, as the tiny size of foreign aid budgets relative to military ones demonstrates. National origin is most divisive, and is more of a factor in labor organization, when these issues are brought to the fire and are unresolved. -

javi2541997

7.2kAlso of note, whenever someone brings up how Japan has stagnated so badly due to an aging population + lack of immigration... — Count Timothy von Icarus

javi2541997

7.2kAlso of note, whenever someone brings up how Japan has stagnated so badly due to an aging population + lack of immigration... — Count Timothy von Icarus

Interesting data. Thanks for bringing it up because I am always so interested in Japan.

Japan and its Prefectures (都道府県, todōfuken) are a very complex places to live in. Culture adversities kick in when you try to make contact with them. I guess Tokyo and Osaka cannot be a problem, but it would be harder in little places such as Izu and Yamagata.

I read a book a few months ago called: Dynamics and immobilist politics in Japan. It shows key aspects of why Japan has the nowadays problems that you have shown in that data. The authors explain that some Prime Ministers tend to manage Japan in a very nationalist/isolation way.

That politics and the lack of immigration, plus low births, make for stagnant incomes. But do you know what is most interesting about it?

Japan will have the same GDP growth as Spain (my country, because I was interested in comparing both) in the next two decades. When I read the information, I couldn't believe it...

Well, furthermore, by GDP standards, Japan is clearly a developed country, with its ups and downs. I guess isolation cannot be a good decision. even for rich and industrialized countries.

They always had a lot of ups and downs. From the big increase in GDP in the 1960s to the stagnation of the 1990s due to the real estate bubble, Nonetheless, they are still there, maintaining themselves as a developed and rich country thanks to their culture of hard work and sacrifice. Interesting, right? -

ssu

9.8k

ssu

9.8k

Some real estate investors are like Trump: anything they get, any money, they put into new buildings and take as much debt as they can. Then when the building is finished and the sell it and they would basically make that profit that would be taxed, they can deduce their interest and debt and basically start a new project. Hence they can make no profit ever, but increase their assets with billions.I mean, does anyone actually defend a system where a billionaire can go years without paying income taxes? — Count Timothy von Icarus

Now I don't understand this. If there is a housing shortage, why discourage renting flats / investing in real estate?When there is a housing shortage, it automatically will become less attractive to buy up real estate, curbing the positive feedback loops that keeps leading to bubbles. — Count Timothy von Icarus

Even if this would be the case, even if the tax would go to a special fund, it would be peanuts and very inefficient to have any effect on housing. After all, profits are only taxed, and profits are a small cut from the actual investment to real estate. If the incentives for building apartments or renting them is nonexistent, then no matter where the taxes would go will not matter. There will continue to be a housing shortage.Then revenue raised from this tax goes to a special fund used for building housing units. — Count Timothy von Icarus

Housing markets work if investing in housing is simply made easy and profitable enough for people and possibly companies to investment in real estate. Usually government micromanagement doesn't work. It is the ground rules and the effectiveness of the institutions that governments should be concerned about.

Housing bubbles happen because of loose monetary policy and because usually some smaller banks or alternative financial institutions try to grow "aggressively" by ditching all caution on just who to shovel money at: if anybody that can walk into the bank (or go to the website) can get a mortgage, . -

creativesoul

12.2kAn increase in consumer cost of good and services is inflation. The amount of money printed does not increase cost. Supply shortage does not increase cost. High demand does not increase cost.

The desire to increase profit margin is the only cause of inflation.

Wage increases are post hoc corrections for inflation. When the same goods and services cost far more than they used to, people cannot afford them any longer when and if they have the same earnings. To blame wage increases for inflation is to blame the bandaid for the bleeding cut. -

frank

19kA draconian rate hike would not be a good idea, but something above the 5.1% might be appropriate. Yes, banks are in turmoil and seeking cash and not happy with the higher CD rates they are forced to pay.

frank

19kA draconian rate hike would not be a good idea, but something above the 5.1% might be appropriate. Yes, banks are in turmoil and seeking cash and not happy with the higher CD rates they are forced to pay.

However, I'm a novice in financial affairs. — jgill

Me too. I think the hesitation to raise interest rates is related to the threat of bank failures. One theory is that the liquidity is resulting from the COVID19 stimulus, which turned out to be bigger than we realized at the time. There's no way to forcefully reduce that liquidity without setting off a downturn that could go deeper than necessary.

It's an interesting story that's unfolding. -

Mikie

7.4kThe desire to increase profit margin is the only cause of inflation.

Mikie

7.4kThe desire to increase profit margin is the only cause of inflation.

Wage increases are post hoc corrections for inflation. When the same goods and services cost far more than they used to, people cannot afford them any longer when and if they have the same earnings. To blame wage increases for inflation is to blame the bandaid for the bleeding cut. — creativesoul

:up: Well said.

Some common folks got 1200 bucks three years ago, and some raises for working during the pandemic, and now they must pay dearly for that. That’s all that’s happening. Blame the people for raising prices. Meanwhile corporate profits continue to soar.

A good example from the Times just today:

https://www.nytimes.com/2023/05/29/opinion/inflation-groceries-pricing-walmart.html?unlocked_article_code=WjEk23ZSH7lfiOdBi1KQHWDZJWW3ygSsdjnAEabZBgexPhuyctNH2Bedpk13aaO19LOlAek-DYIlX7OC40G6dJCpbe_XKBNJzHshEgnGq6VDYHyjTiRZoAickk5VsW9d7aS6vIfjCk5gR0RNvI5NXDOHoVJFqlU7QAJFTPyNHV_KjvDUgsYXWx8U1fxJvhEeqb-atbiTIruDlEBUHYTz9vVp2kqvtDHZlfnClEuIAJKhpe79NwcVWOwAyvQPfsayytXe8LTeTdJqlG_QX-oFtjjwxFF3stF7jg-aBZGhZSteeD4vWlmmXZskFFWuN4XlhRIIQvYOKWHrJseYCbPFz8s2CENJ10e9_4_KFok&smid=url-share -

ssu

9.8k

ssu

9.8k

As I've mentioned (somewhere else), a friend that works in the local central bank (part of ECB) said years ago that the Fed is between a rock and a hard place. It simply cannot move anymore in similar fashion, as the inflation mouse is already feasting on people's cash.Paul Volcker, where are you? The current feds are too timid, IMO. — jgill

Yeah, and we started from the lowest interest rates ever recorded in human history. So it's not difficult where there will likely go for the remainder of this decade. I assume they hope they can keep inflation at 5% for the rest of the decade. Negative real interest rates is the helper here.

Uh, but the price will rise because of the higher demand. It's the fundamentals of demand and supply. I mean, if a hundred people would desperately want something that costs 10$ and there's only one item left, you think that nobody of them would buy it for 11$ or even 20$?An increase in consumer cost of good and services is inflation. The amount of money printed does not increase cost. Supply shortage does not increase cost. High demand does not increase cost. — creativesoul

Ah! Similar ideas were floated even in Antiquity: it's the greedy baker that hikes the prices of bread! Shame on him. (Never mind things like was the state minting more coins with less silver in them to pay for everything starting from the military.)The desire to increase profit margin is the only cause of inflation. — creativesoul

Some of us think inflation happens when you print too much money, or simply create from nothing new debt to pay back the old debt. If you would keep it in the banks, it basically wouldn't create inflation, but for example give money to people because there's a pandemic or something... Now add a war to the picture and other stuff, you will have inflation. But people will a) politicize this and b) believe what politicians say to them who the culprit is.

At least you are correct in that the last people usually left holding the bad are workers, who see their living cost rise and then demand more pay. And naturally the state itself portrays them as the culprit for inlfation, when the real culprit have been themselves. The ones who profit from inflation are those who get the new money first. And those are the ones that can print more money. Not the workers.Wage increases are post hoc corrections for inflation. When the same goods and services cost far more than they used to, people cannot afford them any longer when and if they have the same earnings. To blame wage increases for inflation is to blame the bandaid for the bleeding cut. — creativesoul

Welcome to The Philosophy Forum!

Get involved in philosophical discussions about knowledge, truth, language, consciousness, science, politics, religion, logic and mathematics, art, history, and lots more. No ads, no clutter, and very little agreement — just fascinating conversations.

Categories

- Guest category

- Phil. Writing Challenge - June 2025

- The Lounge

- General Philosophy

- Metaphysics & Epistemology

- Philosophy of Mind

- Ethics

- Political Philosophy

- Philosophy of Art

- Logic & Philosophy of Mathematics

- Philosophy of Religion

- Philosophy of Science

- Philosophy of Language

- Interesting Stuff

- Politics and Current Affairs

- Humanities and Social Sciences

- Science and Technology

- Non-English Discussion

- German Discussion

- Spanish Discussion

- Learning Centre

- Resources

- Books and Papers

- Reading groups

- Questions

- Guest Speakers

- David Pearce

- Massimo Pigliucci

- Debates

- Debate Proposals

- Debate Discussion

- Feedback

- Article submissions

- About TPF

- Help

More Discussions

- Other sites we like

- Social media

- Terms of Service

- Sign In

- Created with PlushForums

- © 2026 The Philosophy Forum