-

Michael

16.9kThis is in principle less risk because it's irrelevant what the markets do, whereas index funds will crater during recessions. — Benkei

Michael

16.9kThis is in principle less risk because it's irrelevant what the markets do, whereas index funds will crater during recessions. — Benkei

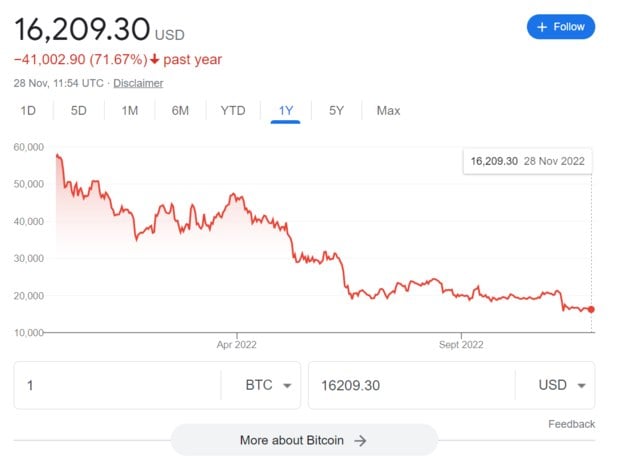

What to Expect From Crypto in a Recession

The cryptocurrency market simply hasn't been around long enough for us to get an idea on how it behaves in a significant recession. The first cryptocurrency invented was Bitcoin (BTC -2.21%) in 2009, and much has changed since then. However, there are a handful of periods of poor economic performance in the last 13 years that we can look at to get an idea on what crypto's future might hold if a full-scale recession ensues.

One of the few periods of economic instability since 2009 occurred in 2015. After 2014, GDP grew, albeit at incrementally slower rates each quarter and eventually bottoming out at a 0.1% growth rate in the fourth quarter of 2015.

The S&P 500 also posted its first negative year since the Great Recession in 2015. During this time, the crypto asset class was utterly pummeled. The collective market cap of all cryptocurrencies fell by nearly 70% from the beginning of 2014 before hitting a low in mid-2015.

Another period of recent economic instability came in 2018. Similar to 2015, the nation's GDP grew, but by a smaller amount each quarter and eventually fell to just a 1.3% growth rate. In 2018 the S&P 500 posted its worst year since the Great Recession and lost 6% of its value.

Crypto investors who have been around since 2018 are likely aware of the woes that year brought. After peaking at roughly $750 billion, the cryptocurrency market cap tumbled and eventually fell to as low as just $107 billion, representing a catastrophic 85% decline. Bitcoin fell from about $19,000 to just above $3,000.

It's abundantly clear that during periods of slowing economic growth cryptocurrencies are not spared. In fact, they're often hit the hardest. When recession fears arise, it isn't uncommon for cryptocurrencies to lose three-quarters of their value during these times.

Cryptocurrencies are far more volatile than normal stock, and unlike normal stock have no real underlying value. It's all just a confidence scam. -

Tzeentch

4.4kCryptocurrencies are far more volatile than normal stock, and unlike normal stock have no real underlying value. It's all just a confidence scam. — Michael

Tzeentch

4.4kCryptocurrencies are far more volatile than normal stock, and unlike normal stock have no real underlying value. It's all just a confidence scam. — Michael

FIAT currency is the real confidence scam.

The underlying value of cryptocurrency is that it is a scarce, independent means of exchanging value, much like gold and other precious metals. In fact, you'll find that a lot of people who invest in gold also invest in cryptocurrency for many of the same reasons.

With financial repression looming on the horizon, and irresponsible economic policies running rampant, I'd say there are very good reasons to invest in both. For one, it's a lot easier to pay for things with cryptocurrency as opposed to gold. I'd stick with Bitcoin though. -

Michael

16.9k

Michael

16.9k -

Michael

16.9kWell, that was the big hype period which was obviously not representative of the actual value of Bitcoin. — Tzeentch

Michael

16.9kWell, that was the big hype period which was obviously not representative of the actual value of Bitcoin. — Tzeentch

All cryptocurrency is a big hype period. It's all a confidence scam. It has no actual value.

What makes one cryptocurrency worth what it is, or worth more than some other cryptocurrency? It's all make believe. -

Michael

16.9kFiat currencies are legal tender. We get paid in it, we pay our taxes in it, and I can go to the shops and buy milk with it. It's mostly stable, with any big fluctuations the result of real world economic changes.

Michael

16.9kFiat currencies are legal tender. We get paid in it, we pay our taxes in it, and I can go to the shops and buy milk with it. It's mostly stable, with any big fluctuations the result of real world economic changes.

What can you do with Bitcoin? It's just a speculative vehicle that people buy with real money in the hopes that they can sell it for even more real money, and which is ridiculously volatile, often with no rhyme or reason as to why it's perceived value changes.

I think it's foolish to think of cryptocurrencies as being a "better" currency, or a good investment. I think you need to be more honest and accept that it's just a get rich quick scheme that some get lucky with. -

Tzeentch

4.4kFiat currencies are legal tender. We get paid in it, we pay our taxes in it, and I can go to the shops and buy milk with it. — Michael

Tzeentch

4.4kFiat currencies are legal tender. We get paid in it, we pay our taxes in it, and I can go to the shops and buy milk with it. — Michael

It's value is controlled by whoever controls the printing press.

Scarcity is perhaps the most important characteristic of money, and fiat currency does not check that box.

I think you need to be more honest and accept that it's just a get rich quick scheme that some get lucky with. — Michael

The fact is that that is exactly what it is not. The hordes of people with zero market understanding who voluntarily jumped on the crypto bandwagon and treated it like it was a way to "get rich quick" have no one but themselves to blame. Investing isn't for everyone, and it certainly isn't for the ignorant.

It has nothing to do with the inherent value of cryptocurrency - an independent, scarce means of exchanging value. -

Benkei

8.1kMarket movements in crypto are irrelevant to me because I'm only holding stable coins with a guaranteed 1 on 1 conversion. Downward fluctuations in market value in crypto need to be covered by additional collateral by borrowers or part of their collateral gets sold to pay off part of the loan until the LTV is within range again. I'm not running any market risk, whereas index funds do.

Benkei

8.1kMarket movements in crypto are irrelevant to me because I'm only holding stable coins with a guaranteed 1 on 1 conversion. Downward fluctuations in market value in crypto need to be covered by additional collateral by borrowers or part of their collateral gets sold to pay off part of the loan until the LTV is within range again. I'm not running any market risk, whereas index funds do. -

Benkei

8.1kSo BlockFi also crashed which is a competitor of Nexo offering a similar service as I'm using. Turns out Nexo moved all its crypto out of FTX beginning of November before it crashed. I wonder what tipped then off.

Benkei

8.1kSo BlockFi also crashed which is a competitor of Nexo offering a similar service as I'm using. Turns out Nexo moved all its crypto out of FTX beginning of November before it crashed. I wonder what tipped then off.

There's a lot of incestuous lending going around in the background which creates all sorts of counterparty risk without any level of transparancy or oversight. It does seem so far, on average, European crypto institutions are not as leveraged or risk taking as their US counterparts. -

javi2541997

7.3kBuffett and Munger's predictions about Bitcoin that seem more true = Doubts on cryptocurrency.

javi2541997

7.3kBuffett and Munger's predictions about Bitcoin that seem more true = Doubts on cryptocurrency.

Buffet: "If you were to say ... for a 1% share of all the farmland in America, pay our group $25 billion, I'd write you a check this afternoon," Buffett said. "[For] $25 billion I now own 1% of the farmland. [If you offer me 1% of all the housing in the country and you want another $25 billion, I'll write you a check, it's very simple. Now Well, if you told me you own all the bitcoin in the world and you offered it to me for $25, I wouldn't take it because what would I do with it? I would have to sell it back to you one way or another. It's not going to do anything. The apartments will produce rent and the farms will produce food,"

Assets, to have value, have to contribute something to someone. And there is only one currency accepted.

Munger: "In my life, I try to avoid things that are stupid and evil and make me look bad compared to someone else, and bitcoin does all three," [Munger said.] "First, it's stupid because it's likely to go to zero. It's evil because it undermines the Federal Reserve System... and third, it makes us look foolish compared to China's communist leader. He was smart enough enough to ban bitcoin in China." -

Tzeentch

4.4kIt's evil because it undermines the Federal Reserve System. — javi2541997

Tzeentch

4.4kIt's evil because it undermines the Federal Reserve System. — javi2541997

There are few institutions more evil and less preoccupied with the welfare of the ordinary person than the Federal Reserve.

Undermining it is exactly the point; undermining people's dependence on state currencies the quantity and thus value of which is controlled by the state. Politcians and politicized government institutions like the Federal Reserve have time and again proven not to be able to wield power responsibly. Moreover, states are already flirting with totalitarian levels of surveillance and control over people's financial behavior, state-owned digital currencies being the latest iteration of that.

Undermining that is not evil - it's essential freedom. No wonder the CCP banned it - freedom is the last thing they want their citizens to have. -

javi2541997

7.3kInteresting point of view.

javi2541997

7.3kInteresting point of view.

Despite the fact that Federal Reserve or CCP are evil institutions and probably they are not specially the ones who should speak about economical ethics, I personally think that cryptos still lack of security, transparency and effectiveness.

We don't know what the future holds and maybe the tables can be turned. Nevertheless, we should be cautious in terms of investing big money in cryptocurrencies. -

Tzeentch

4.4kIn my opinion, investing should always be done with a great deal of care.

Tzeentch

4.4kIn my opinion, investing should always be done with a great deal of care.

Before one invests into anything, one should have a thorough understanding of what it is and what it derives its value from.

A lot of laypeople jumped on the crypto bandwagon knowing practically nothing and throwing all caution to the wind, and predictably got burned. In my opinion, that is primarily their own fault.

Now that the hype is over, cryptocurrency will probably stabilize around a more honest price that more accurately reflects its true value. My view is that as long as cryptocurrency is an effective means of maintaining financial independence, it will retain its value.

I believe when/if financial repression becomes more widespread, its value will go up. However, there is a risk that if cryptocurrency continually undermines governmental drives for more control over citizens' wallets, governments will try to find ways to ban it like China did. If that happens it may swiftly crash. -

ssu

9.8kThere's a lot of incestuous lending going around in the background which creates all sorts of counterparty risk without any level of transparancy or oversight. — Benkei

ssu

9.8kThere's a lot of incestuous lending going around in the background which creates all sorts of counterparty risk without any level of transparancy or oversight. — Benkei

What has happened is that a convincing story based on reality and genuine facts was successfully sold to people desperately looking for the new thing to invest causing a classic mania with all the side effects of it. I could refer also to the dot.com bubble. All that tech is quite in use today, quite real, but not every tech investment, tech fund and especially tech start up made wonderful results. And it was crazy before the bubble burst.I personally think that cryptos still lack of security, transparency and effectiveness. — javi2541997

It may simply be that without the role of legal tender cryptocurrencies stay as this small alternative speculative investment while the technology behind them is adapted to use. -

javi2541997

7.3kAll that tech is quite in use today, quite real, but not every tech investment, tech fund and especially tech start up made wonderful results. And it was crazy before the bubble burst. — ssu

javi2541997

7.3kAll that tech is quite in use today, quite real, but not every tech investment, tech fund and especially tech start up made wonderful results. And it was crazy before the bubble burst. — ssu

:up:

One of the craziest moments related to this investment was an "international" meeting which took place in Madrid. European and Spanish institutions such as The National Securities Market Commission warned about the risks associated with cryptos and ask the organisers to please don't let teenagers to go there. They didn't care and many people believed in whatever they listened in the meeting.

Well, a few months later, cryptos plummeted and one of the main responsibles of the meeting kill himself. Now, some courts are collapsed with hundreds of claims for compensation when those citizens were already advised of the dangers of this investment...

Craziness... Cryptocurrency is dangerous to the people. -

Agent Smith

9.5kIt's just a matter of time before regulators swoop down on alternate banking systems. A coupla million is peanuts, but let the volume of cryptos hit the billions and you'll feel the noose tightening. It's one of those schemes that was never meant for greatness. Me talking outta my arse again. Pardon, pardon. Ignore me, oh, you have already. :pray:

Agent Smith

9.5kIt's just a matter of time before regulators swoop down on alternate banking systems. A coupla million is peanuts, but let the volume of cryptos hit the billions and you'll feel the noose tightening. It's one of those schemes that was never meant for greatness. Me talking outta my arse again. Pardon, pardon. Ignore me, oh, you have already. :pray: -

Agent Smith

9.5kAny investment is essentially an alternate banking system. — Tzeentch

Agent Smith

9.5kAny investment is essentially an alternate banking system. — Tzeentch

True, true. Then there's something different about crypto. Does it bypass some regulations? It must otherwise it's just a geeky way of doing regular business. -

javi2541997

7.3kThen there's something different about crypto. — Agent Smith

javi2541997

7.3kThen there's something different about crypto. — Agent Smith

Yes, the main cause is substitute the money and banking system as we know nowadays. Nonetheless, it is used just for speculative conspiracies and opaque businesses. -

Agent Smith

9.5kYes, the main cause is substitute the money and banking system as we know nowadays. Nonetheless, it is used just for speculative conspiracies and opaque businesses. — javi2541997

Agent Smith

9.5kYes, the main cause is substitute the money and banking system as we know nowadays. Nonetheless, it is used just for speculative conspiracies and opaque businesses. — javi2541997

It's a money laundering scheme. How fascinating. -

Tzeentch

4.4kWhere it differs most from normal investments is that you can pay directly with crypto, whereas with a 'normal' investment you would first have to liquidize your investment before you can pay with it.

Tzeentch

4.4kWhere it differs most from normal investments is that you can pay directly with crypto, whereas with a 'normal' investment you would first have to liquidize your investment before you can pay with it.

I'd say that's not necessarily a ground-breaking difference, but it certainly is convenient in today's day and age. On top of that, being able to make purchases online without any kind of bank involved means there's a high level of anonymity.

But all in all there's nothing "special" about cryptocurrency, other than that it was hyped at some point and a lot of gullible people lost money. -

Agent Smith

9.5kCrypto then was a shadow banking system - it must be part of the so-called dark web.

Agent Smith

9.5kCrypto then was a shadow banking system - it must be part of the so-called dark web. -

ssu

9.8k

ssu

9.8k

Well, actually gold and other precious metals you can barter / pay directly and make a physical transaction with ease. And keep the possession of the metal out from the knowledge of the tax collector. A good "investment" to give to the next of kin if there is an inheritance tax in the country.Where it differs most from normal investments is that you can pay directly with crypto, whereas with a 'normal' investment you would first have to liquidize your investment before you can pay with it. — Tzeentch

Welcome to The Philosophy Forum!

Get involved in philosophical discussions about knowledge, truth, language, consciousness, science, politics, religion, logic and mathematics, art, history, and lots more. No ads, no clutter, and very little agreement — just fascinating conversations.

Categories

- Guest category

- Phil. Writing Challenge - June 2025

- The Lounge

- General Philosophy

- Metaphysics & Epistemology

- Philosophy of Mind

- Ethics

- Political Philosophy

- Philosophy of Art

- Logic & Philosophy of Mathematics

- Philosophy of Religion

- Philosophy of Science

- Philosophy of Language

- Interesting Stuff

- Politics and Current Affairs

- Humanities and Social Sciences

- Science and Technology

- Non-English Discussion

- German Discussion

- Spanish Discussion

- Learning Centre

- Resources

- Books and Papers

- Reading groups

- Questions

- Guest Speakers

- David Pearce

- Massimo Pigliucci

- Debates

- Debate Proposals

- Debate Discussion

- Feedback

- Article submissions

- About TPF

- Help

More Discussions

- Other sites we like

- Social media

- Terms of Service

- Sign In

- Created with PlushForums

- © 2026 The Philosophy Forum