-

baker

6kActually, given your authoritarian attitude, you've got the makings of someone who can get to the top.

baker

6kActually, given your authoritarian attitude, you've got the makings of someone who can get to the top.

I really am interested in how plutocracy can be abolished or at least minimized and how democracy can be strenghtened. But I don't see any realistic solutions. And neither do you, apparently:

But I have no illusions that any of this will happen any time soon. — Xtrix -

Mikie

7.4kI really am interested in how plutocracy can be abolished or at least minimized — baker

Mikie

7.4kI really am interested in how plutocracy can be abolished or at least minimized — baker

No, you’re not.

Notice I didn’t even bother asking “Why are they pipe dreams?” Why? Because as I said before, I was expecting this childish response. But secondly, you have no idea about most of what I was referring to anyway. For example, to say the repeal of rule 10b-18 is a “pipe dream”? Really? So you’re aware of that specific rule? You’re knowledgeable enough about it to make the judgment that its repeal is a “pipe dream”?

No. You’re not. Of course you’re not. You just wanted an opportunity to show how absurd it is to claim any solution at all. Which was entirely predictable and, as I said, I made the mistake of giving the benefit of the doubt. Believe me, it won’t happen again.

I don't see any realistic solutions — baker

You see no solutions at all. Because you’re interested only in posturing.

I’ll repeat— again — what I said before: my involvement is in unions and in state/local governing (aka “pipe dreams”). I could get into those solutions too — but I’ll save it for someone interested in something beyond posturing. -

NOS4A2

10.2k

NOS4A2

10.2k

Sorry, but your "solutions" sound like pipe dreams.

What you're suggesting would all need to happen from the top down. It's clear that those at the top are not going to do anything that would in any way endanger their position of power.

The solutions, if we can call them that, would require despotism to enact and enforce, exploitation to fund, and the expansion of state power and bureaucracy to govern. We have ample historical evidence to know know how all that works out. -

ssu

9.8k

ssu

9.8k

To believe in the independence of the Fed or the ECB on these matters is a bit naive.Politicians don’t “choose” anything about interest rates. — Xtrix

I'm not following you. Or do you think the EU didn't have it's own stimulus packages?As far as fiscal policy: yea, they passed stimulus bills. Arguing that

stimulus packages etc. […] got the inflation finally going.

— ssu

is simply an assertion. If it were so cut and dry, then Europe shouldn’t be experiencing inflation — according to your own chart. But they are as well. — Xtrix

Europe had it's own stimulus packages, including ECB the PEPP (pandemic emergency purchase programme). They had basically negative real interest rates and didn't anticipate higher inflation. The EU made an 750 billion euro ($857 billion) stimulus package as early as 2020 and then individual countries had their own stimulus packages. EU didn''t choose another path in this case.

It was already in 2021 a widely held assertion that the stimulus packages directly to the consumer would create inflation. Which assertions proved to be correct.

(NY TIMES, Oct 18th 2021) Inflation is likely getting a temporary boost from the $1.9 trillion coronavirus relief package that the Biden administration ushered in early this year, new Federal Reserve Bank of San Francisco research released on Monday suggested.

So perhaps these things take a little more time.

But do note a discussion from a year ago on the Forum here. -

NOS4A2

10.2kWe are fighting to impose a higher social justice. The others are fighting to maintain the privileges of caste and class. We are proletarian nations that rise up against the plutocrats.

NOS4A2

10.2kWe are fighting to impose a higher social justice. The others are fighting to maintain the privileges of caste and class. We are proletarian nations that rise up against the plutocrats.

- Mussolini

It is already war history how the German Armies defeated the legions of capitalism and plutocracy. After forty-five days this campaign in the West was equally and emphatically terminated.

- Hitler

This combat between proletariat and plutocracy is, after all, itself a civil war. Two inferiorities struggle for the privilege of polluting the world.

- HL Mencken -

Mikie

7.4kPoliticians don’t “choose” anything about interest rates.

Mikie

7.4kPoliticians don’t “choose” anything about interest rates.

— Xtrix

To believe in the independence of the Fed or the ECB on these matters is a bit naive. — ssu

I didn’t say that. But I also don’t say the board of governors are politicians. If you consider them politicians, fine. I think that’s misleading. If you think they make politically motivated decisions — OK. But not saying much. And has nothing to do with fiscal policy decisions.

is simply an assertion. If it were so cut and dry, then Europe shouldn’t be experiencing inflation — according to your own chart. But they are as well.

— Xtrix

I'm not following you. Or do you think the EU didn't have it's own stimulus packages? — ssu

Take a look at your own chart. Yes, they had stimulus packages — and FAR less than the US. So is their inflation still due to that fiscal stimulus?

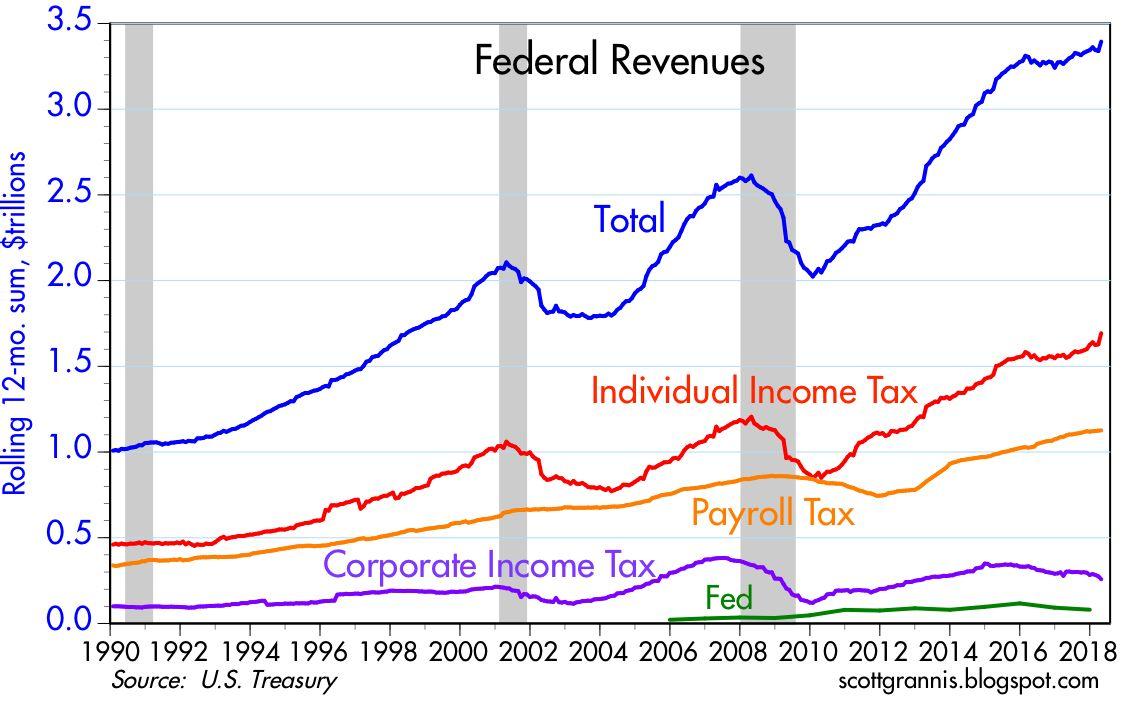

We had stimulus and QE in ‘09. No inflation.

Again, I think it’s time to let go of Friedman’s ideas. Things are just not so simple.

It would do well to distinguish fiscal and monetary stimulus for the sake of discussion and clarity from here onward. If by stimulus you refer to both, please say so.

(NY TIMES, Oct 18th 2021) Inflation is likely getting a temporary boost from the $1.9 trillion coronavirus relief package that the Biden administration ushered in early this year, new Federal Reserve Bank of San Francisco research released on Monday suggested. — ssu

Again, I agree with economists that say the fiscal stimulus (the CARES bill and AR bill) accounted for perhaps 1% of inflation. The monetary “stimulus” (QE) also accounts for inflation — particularly in the markets I mentioned: stocks, bonds, housing. (And cryptocurrency, incidentally.)

This is reflected in core inflation numbers — high, but not very high.

The majority of inflation is accounted for by COVID and Ukraine supply disruptions. Demand has been there as well — but to focus solely on demand, or claim that it’s demand that accounts for most of the inflation we see, is just not supported by the data. Oil prices aren’t soaring because people have more money to bid them up, for example. -

ssu

9.8k

ssu

9.8k

That's what I was trying to say.If you think they make politically motivated decisions — OK. — Xtrix

Making a huge separation between fiscal policy and monetary policy isn't fruitful. Perhaps better would be to talk about economic policy, as both fiscal and monetary policy (central bank) tools are used together. The idea that an administration uses fiscal policy and totally separately the central bank uses monetary policy and these would be thinking of totally different issues is not the case.And has nothing to do with fiscal policy decisions. — Xtrix

The simple fact is that if the economy isn't humming along (meaning there's huge economic expansion and it's basically peak times), the economy is viewed as a crisis and the administration has to do something. And usually also the central bank has it's hands full of things to do.

Inflation isn't confined to one country and the US affects very much other countries too. The old saying that when the US sneezes, Europe catches a cold is quite correct.and FAR less than the US. So is their inflation still due to that fiscal stimulus? — Xtrix

But do notice the crucial difference of where the stimulus / QE went during the great recession and during the COVID stimulus. Bursting of a speculative bubble is deflationary and the QE went to basically to prop up the banks and the financial sector. With the pandemic response this was done also, but a huge inflow was given directly to the consumer, which did have dramatic effects. When you give to the American consumer one trillion dollars, that is going to be a lot going into the real economy. And that does create inflation.We had stimulus and QE in ‘09. No inflation. — Xtrix

Perhaps then referring to economic policy would be better. Or perhaps to clarify this better: economic crisis management. Because things are smaller or larger crisis, from the view of the political leadership.It would do well to distinguish fiscal and monetary stimulus for the sake of discussion and clarity from here onward. If by stimulus you refer to both, please say so. — Xtrix

Right. And how many YEARS you think those disruptions will last? Because usually disruptions (which we saw during the pandemic with toilet paper getting scarce, protective masks etc) aren't permanent, they usually are cleared in six months or so. Yes, Russia and Ukraine do give us raw materials and agricultural products, but these are in the end small compared to the global market.The majority of inflation is accounted for by COVID and Ukraine supply disruptions. — Xtrix

I would just object to this rhetoric as it's usually the given anti-inflationary rhetoric given to the public. It is partly similar to the rhetoric that foreign entitities etc and lastly, hoarders are to blame for inflation. So in the later stages of high inflation the blame is put on the hoarders and the profiteers. And people can believe this. But what is very important to understand the link to economic policy and government spending. Now, if a recession happens, what do you think happens to government spending?

Oil prices aren’t soaring because people have more money to bid them up, for example. — Xtrix

Yes, well, it wasn't so long time ago when oil prices went negative. But high oil prices are like a hand brake to the economy. Which then will put things back to equilibrium. -

Mikie

7.4k

Mikie

7.4k

Slaveowners were true capitalists. We know you long for those days of true individual freedom. When they agree with you…

In case it’s not crystal clear: I’m not interested in your opinions about anything, and think you’re a repugnant human being. Please stop trolling this thread. -

Mikie

7.4kThe idea that an administration uses fiscal policy and totally separately the central bank uses monetary policy and these would be thinking of totally different issues is not the case. — ssu

Mikie

7.4kThe idea that an administration uses fiscal policy and totally separately the central bank uses monetary policy and these would be thinking of totally different issues is not the case. — ssu

Sorry, but fiscal policy and monetary policy are very different things. If you want to talk generally about the economy, fine. But when it comes to claims about inflation, getting these terms right actually matters.

Inflation isn't confined to one country and the US affects very much other countries too. — ssu

The claim was that inflation is due to fiscal stimulus. US did far more than Europe; both have inflation. So your response seems to be: it’s still fiscal stimulus because inflation isn’t confined to one country.

Think about this for a minute.

When you give to the American consumer one trillion dollars, that is going to be a lot going into the real economy. And that does create inflation. — ssu

So again we’re back to the fiscal stimulus claim. Okay — yes, I realize that’s the theory.

We had fiscal stimulus in 09 as well. Not as much, but between that and QE, the money supply increased. Inflation was predicted — and there was none.

economic policy would be better. — ssu

Fine. Sounds good.

And how many YEARS you think those disruptions will last? — ssu

I have no idea.

Yes, Russia and Ukraine do give us raw materials and agricultural products, but these are in the end small compared to the global market. — ssu

Russia is a major exporter of oil and gas. That causes significant supply disruptions.

But it’s not only the war in Ukraine. Those are contributors to supply disruptions already underway due to COVID.

Or take used and new cars. Plenty of inflation there— which also helps drive up the CPI. Is that due to an abundance of money, a shortage of chips, or profiteering? Well, all three of course. But what if you take one factor out — like supply shortage? Well, again look at the CPI data. Control for supply problems: the cost all items, less energy and food, is 6%. But even that is misleading. Why? Because that number is driven up by used and new cars, which is included, and transportation — also affected by both cars and energy (gasoline, oil).

Not including those, and you’re looking at about 4%. “Normal” inflation is around 2%. So theoretically, without supply disruptions, we’re seeing some inflation — but nothing terrible.

Does extra money even explain all of that inflation? No, I don’t think so. You still have issues of corporations (many monopolies, like meat producers) price gouging, passing on extra labor costs (and then some) to consumers, a shift in demand for services over goods after lockdowns, etc.

Inflation due to extra money in the economy is a nice story — and there’s clearly some truth in it — but it’s simply not sufficient to explain what’s happening and, in my view, doesn’t account for more than perhaps a few hundred basis points of the inflation we’re seeing. -

Agent Smith

9.5kInflation is nothing other than an increase in the total amount of currency, thereby reducing the value of each individual unit of currency. — Tzeentch

Agent Smith

9.5kInflation is nothing other than an increase in the total amount of currency, thereby reducing the value of each individual unit of currency. — Tzeentch

So, money in a sense is just another commodity following the law of supply-demand (the more of it there is, the less valuable it is).

What puzzles me is that inflation nullifies the objective of printing more money (you havta pay "more" for the same goods). Why print more money then? Perhaps, there's a lead time to people discovering what's going on, providing the government a window of opportunity to carry out some activities which would've been impossible before. I dunno! -

Tate

1.4kInflation due to extra money in the economy is a nice story — and there’s clearly some truth in it — but it’s simply not sufficient to explain what’s happening and, in my view, doesn’t account for more than perhaps a few hundred basis points of the inflation we’re seeing. — Xtrix

Tate

1.4kInflation due to extra money in the economy is a nice story — and there’s clearly some truth in it — but it’s simply not sufficient to explain what’s happening and, in my view, doesn’t account for more than perhaps a few hundred basis points of the inflation we’re seeing. — Xtrix

They are multiple causes. As we've discussed, at this point, expectation of inflation is one of the causes.

Will the economy slump into stagflation? That's an important question now. -

ssu

9.8k

ssu

9.8k

Then you simply don't look at the big picture. Because the response to covid was done in tandem. Both by the Government and by the Federal Reserve.Sorry, but fiscal policy and monetary policy are very different things. I — Xtrix

Yet this is easy to explain:We had fiscal stimulus in 09 as well. Not as much, but between that and QE, the money supply increased. Inflation was predicted — and there was none. — Xtrix

Because of the a) the speculative bubble bursting during the great recession and above all, b) the differetn targets of the stimulus.

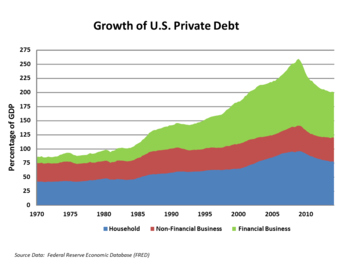

One trillion dollars directly to consumers had a huge effect during COVID. It actually made US citizens wealthier while the economy was slowing down thanks to the COVID restrictions. During the Great Recession the target of the QE was financial institutions, not consumers. They got that aid, but did they lent it out? No. And then debt was paid back, people cut their spending:

A housing boom created by a debt (bubble) will have severe effects on the real economy because houses aren't built by robots in China, but contribute to the local economies and employment a lot. And buying a home is one of the largest investments people can do (unlike investing sums in bitcoins). So housing boom and bust has a huge impact on the economy.

The pandemic had a different effect. The restrictions were a government intervention to the economy, which hit hard the service sector. But just for a while. And this was compensated with direct money transfers to the consumer AND huge actions by the Fed (QE was restarted in March 15, 2020, it expanded it's repo operations and set up new lending programs and naturally dramatically lowered it's interest rates). -

ssu

9.8k

ssu

9.8k

Because inflation happens well after the money has been printed.What puzzles me is that inflation nullifies the objective of printing more money (you havta pay "more" for the same goods). Why print more money then? — Agent Smith

Let's have a simple model.

The government has to pay it's employees and assist it's citizens and companies, but hasn't go at all enough tax income to do this. Doesn't matter, it prints the money. The people who first get this money are the winners, assuming they can spend it immediately or invest it in something that isn't affected by inflation. The new money then starts to circulate in the economy and while there's more money going after same level of products and services, prices rise. Then workers / employees see that their cost of living has gone up and demand more in pay. And if there's a demand for workers, companies have to pay more. This is then publicly scrutinized and declared to be the reason for the inflation and is called wage inflation. But do note that this is NOT the actual first action, it was the government money printing to pay for it's expenses.

Hence it's usually the last persons (workers) who are blamed for inflation, not the government itself. -

Agent Smith

9.5k

Agent Smith

9.5k

What a mind job, eh? Everyone knows it's just a silly game, a game where everybody loses, and still they play it as though clueless! Intriguing to say the least. Merci beaucoup! -

ssu

9.8k

ssu

9.8k

There's one thing the old 19th Century name, political economy, tells immediately about economics. And that is that it's very political, not some clinical neutral "social science" as it can be portrayed. Hence politics and political rhetoric is an integral part of it.Everyone knows it's just a silly game, a game where everybody loses, and still they play it as though clueless! — Agent Smith -

Agent Smith

9.5kC'est la vie! Like @schopenhauer1 often reminds us: we're arm-twisted into playing the game of life. Play OR Die!

Agent Smith

9.5kC'est la vie! Like @schopenhauer1 often reminds us: we're arm-twisted into playing the game of life. Play OR Die! -

Mikie

7.4kThen you simply don't look at the big picture. Because the response to covid was done in tandem. Both by the Government and by the Federal Reserve. — ssu

Mikie

7.4kThen you simply don't look at the big picture. Because the response to covid was done in tandem. Both by the Government and by the Federal Reserve. — ssu

Fiscal and monetary policy are very different things. That has nothing to do with the “big picture.” It’s a matter of being clear. They’re very different in how they function, and when we want to go deeper than speaking in generalities, it happens to matter.

That being said— yes, the Fed and congress happened to act together during COVID. Fiscal and monetary policies are still very different things.

During the Great Recession the target of the QE was financial institutions, not consumers. — ssu

This is exactly why getting our terms correct is important. QE is part of monetary policy, which is what the Fed does. It was and remains targeted towards the financial sector.

To argue that “this time” it was directed towards consumers is just confusing what happened. It’s not true. The stimulus that was directed to consumers was FISCAL POLICY. That means the bills passed in congress — the checks sent out directly to citizens, the child tax credit, expanded unemployment benefits, etc. These actions had nothing to do with QE — nothing. Nor the buying of corporate debt.

At least get your own argument right. You’re arguing that the government gave people too much money. It’s what Summers and Manchin were arguing last year.

To that point, I’ll simply repeat what I’ve been saying: this seems to account for very little of the inflation we see — maybe a few basis points. I already explained the evidence for this in my prior response.

Though it’s a neat story, for sure. Stick to it dogmatically if you wish. -

ssu

9.8k

ssu

9.8k

You genuinely think that there isn't the link in the central bank money printing and fiscal policies? The biggest holder for US treasury bonds is the Federal Reserve. It owns far more US treasery bonds than foreigners do (the second biggest owner group).Fiscal and monetary policy are very different things. That has nothing to do with the “big picture.” — Xtrix

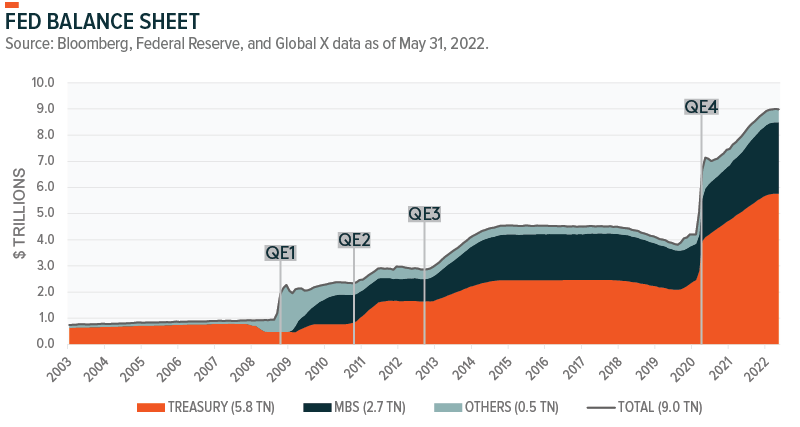

On March 15, 2020, the Fed shifted the objective of QE to supporting the economy. It said that it would buy at least $500 billion in Treasury securities and $200 billion in government-guaranteed mortgage-backed securities over “the coming months.”

Just to show how much is a half trillion dollars to the income to the US government:

@Xtrix, during the Great Recession there wasn't any 1 trillion dollar direct transfer for the consumer. "Cash for clunkers" wasn't at all so big... and neither others. The QE was said to have gone into infrastructure, largely. (Which I doubt).To argue that “this time” it was directed towards consumers is just confusing what happened. It’s not true. — Xtrix -

Mikie

7.4kYou genuinely think that there isn't the link in the central bank money printing and fiscal policies? — ssu

Mikie

7.4kYou genuinely think that there isn't the link in the central bank money printing and fiscal policies? — ssu

Of course there is.

Fiscal and monetary policy are also very different things.

To be clear:

Monetary policy and fiscal policy play a large role in the economy. That’s obvious. When it comes to explaining inflation, there are also other important factors to consider outside of these policies — like COVID and its effects; climate change and its effects; and geopolitical problems (war).

I can only reiterate what I said before. It looks to me like many economists are attributing the bulk of inflation to too much money, when that’s only one factor and by no means the biggest.

Or take used and new cars. Plenty of inflation there— which also helps drive up the CPI. Is that due to an abundance of money, a shortage of chips, or profiteering? Well, all three of course. But what if you take one factor out — like supply shortage? Well, again look at the CPI data. Control for supply problems: the cost all items, less energy and food, is 6%. But even that is misleading. Why? Because that number is driven up by used and new cars, which is included, and transportation — also affected by both cars and energy (gasoline, oil).

Not including those, and you’re looking at about 4%. “Normal” inflation is around 2%. So theoretically, without supply disruptions, we’re seeing some inflation — but nothing terrible.

Does extra money even explain all of that inflation? No, I don’t think so. You still have issues of corporations (many monopolies, like meat producers) price gouging, passing on extra labor costs (and then some) to consumers, a shift in demand for services over goods after lockdowns, etc.

Inflation due to extra money in the economy is a nice story — and there’s clearly some truth in it — but it’s simply not sufficient to explain what’s happening and, in my view, doesn’t account for more than perhaps a few hundred basis points of the inflation we’re seeing. — Xtrix

This is not only a demand issue. It’s also largely a supply issue. To minimize the supply-side of this situation is ideologically motivated. -

ssu

9.8k

ssu

9.8k

Can you explain a bit what your meaning here.When it comes to explaining inflation, there are also other important factors to consider outside of these policies — like COVID and its effects; climate change and its effects; and geopolitical problems (war). — Xtrix

Inflation is a monetary phenomenon.

Yes, COVID, wars, etc. do increase the spending of governments, which the take more debt (and basically print money), which then create inflation.

Shortages due to a war is a bit different: Russia's naval blockade has halted Ukraine's shipments of agricultural products to many countries, and these countries have depended on Ukraine, then naturally this means that prices go up because of the shortages. But note that this case isn't inflation: do notice that prices simply going up don't mean inflation.

Inflation is usually defined as:

a general increase in prices and fall in the purchasing value of money.

Shortage on Ukrainian wheat isn't the same as general increase in prices. -

Mikie

7.4k

Mikie

7.4k

COVID and War and climate change effect supply, which drives up prices. That’s not monetary policy. That’s my point.

naturally this means that prices go up because of the shortages. But note that this case isn't inflation: do notice that prices simply going up don't mean inflation. — ssu

That’s exactly what it means. Purchasing power will decrease, so it’s related.

I’m not denying that pumping a lot of money into the economy has no role to play; it certainly does. But when looking at the current situation it seems that supply issues are playing a bigger role. -

ssu

9.8k

ssu

9.8k

Well, this is the point I really look forward to have a discussion.I’m not denying that pumping a lot of money into the economy has no role to play; it certainly does. But when looking at the current situation it seems that supply issues are playing a bigger role. — Xtrix

How long should you believe this "supply shock" argument? How long people believe the "Present inflation is just transitory and will quickly go away" argument?

Before it was Covid. Fine. But now?

War in Ukraine? Really? I think Daniel Lacalle's argument is convincing:

The Ukraine war has created another excuse to blame inflation on oil and natural gas. However, it seems that all those who blame inflationary pressures on commodities continue to ignore the massive price increases in housing, healthcare, and education, as well as in goods and services where there was evident overcapacity. Global food prices show a similar problem. The United Nations and Food and Agriculture Organization Food Price Index has been rising steadily and reached all-time highs even before the covid crisis.

Oil and gas will be used as an excuse for inflation as long as low interest rates and massive currency creation remain. But the reality is that when both deflate somehow, the problem of currency debasement will remain.

Inflation was already higher than the CPI measure suggested before the covid-19 crisis. The rise in the prices of non-replicable goods and services, shelter, healthcare, fresh food, and education was significantly higher than the CPI percentage. According to Deutsche Bank, these were rising up to five times faster than the CPI. There was high inflation in the things that we consume every day even in the days when some said there was “no inflation.”

So the real issue here is what are the real reasons and what are just consequences. And are we actually blaming consequences. With high inflation in the present, usually that happens. Yet history and economic history point the finger on government policies. -

Tate

1.4k

Tate

1.4k

I don't think the US government prints a lot of extra money. They sell treasury bonds to pay for things like the COVID response. The Fed was slow to respond to early warnings that inflation was ticking up, supposedly to protect the economy during the pandemic. When they finally got around to responding, it was too late, so I think the Fed is being blamed. We could just as easily blame the pandemic.

Welcome to The Philosophy Forum!

Get involved in philosophical discussions about knowledge, truth, language, consciousness, science, politics, religion, logic and mathematics, art, history, and lots more. No ads, no clutter, and very little agreement — just fascinating conversations.

Categories

- Guest category

- Phil. Writing Challenge - June 2025

- The Lounge

- General Philosophy

- Metaphysics & Epistemology

- Philosophy of Mind

- Ethics

- Political Philosophy

- Philosophy of Art

- Logic & Philosophy of Mathematics

- Philosophy of Religion

- Philosophy of Science

- Philosophy of Language

- Interesting Stuff

- Politics and Current Affairs

- Humanities and Social Sciences

- Science and Technology

- Non-English Discussion

- German Discussion

- Spanish Discussion

- Learning Centre

- Resources

- Books and Papers

- Reading groups

- Questions

- Guest Speakers

- David Pearce

- Massimo Pigliucci

- Debates

- Debate Proposals

- Debate Discussion

- Feedback

- Article submissions

- About TPF

- Help

More Discussions

- Other sites we like

- Social media

- Terms of Service

- Sign In

- Created with PlushForums

- © 2026 The Philosophy Forum