-

Echarmion

2.7kDon't these people care about the real victims, those of use with copies of Cyberpunk 2077 collecting dust on our shelves because our hardware can't run it? — Count Timothy von Icarus

Echarmion

2.7kDon't these people care about the real victims, those of use with copies of Cyberpunk 2077 collecting dust on our shelves because our hardware can't run it? — Count Timothy von Icarus

I know this is a joke, but the resource consumption of cryptocurrency and NFTs is a real concern. The amount of processing power uses a lot of energy and causes a lot of pollution, for something that's arguably not very different in principle from collecting bottle caps or postage stamps (in that there is zero actual value being generated).

Any thoughts? Criticisms? Am I horrible person for potentially jumping into this fray? — Noble Dust

See above. It's arguably the most destructive way to play pretend. -

ssu

9.8k

ssu

9.8k

When philosophers (or should we be more precise people who are interested in philosophy) are talking about investments, that is a sign for me. Basically this thread is active when the prices are high. A time to buy is when this thread hasn't been active for 6 months.This thread's activity probably isn't a good index for tracking bitcoin's value. The thread was last active, save a handful of posts, around 6 months ago before it went up all that much. It was silent during most of the steepest rises. — csalisbury

Yet I do respect especially the collective intelligence and understanding of what things are important. Cryptocurrencies aren't a fad or rubbish, they are something genuinely important. Just as, well, all those things that you had in the tech bubble in the turn of the Millennium. After 20 years those things have become really the norm. Even Amazon has made a profit now! Yet investing back then in Pets.com wasn't the greatest investment of all time. Who knows, bitcoin might be. Or not.

Sorry, but after experiencing few economic bubbles in my time gives me the chills of how things are now.

It's simply creepy.

(But I got finally my new computer from Asia. Whopee!) -

Noble Dust

8.1k

Noble Dust

8.1k

I'm very aware of the environmental impact of crypto. The reality is that anything involving computing power affects the environment, including this forum (and yes, the surge in crypto is affecting it in a much larger way). I'm certainly not convinced that crypto is the future, but I'm also not convinced otherwise. With that in mind, there are cryptocurrencies that are taking environmental issues into consideration. The future is unwritten and uncertain. Today's crypto-blows to the environment may be balanced by tomorrow's crypto-bandages. Or not. Who's to say? The market is so volatile.

So anyway, back to me; should I mint an NFT or nah? -

Echarmion

2.7kCryptocurrencies aren't a fad or rubbish, they are something genuinely important. — ssu

Echarmion

2.7kCryptocurrencies aren't a fad or rubbish, they are something genuinely important. — ssu

I guess the question is: what are they important for, exactly. Sure the technology is interesting, and it's certainly useful if you want untraceable transactions. That's not purely a positive though.

Apart from that, I get the feeling lots of the conversation about cryptocurrency misunderstands how money works and sounds a lot like Americans talking about how they need their guns in case the government suddenly turns tyrannical.

I'm very aware of the environmental impact of crypto. The reality is that anything involving computing power affects the environment, including this forum (and yes, the surge in crypto is affecting it in a much larger way). — Noble Dust

That seems like a cop-out. Yes writing on this forum has an environmental impact, and this has to be assessed against the individual and social value of the activity. What's the individual or social value of NFTs?

Today's crypto-blows to the environment may be balanced by tomorrow's crypto-bandages. Or not. Who's to say? The market is so volatile. — Noble Dust

Err, what? Polluting the environment is ok because "the future will happen"?

So anyway, back to me; should I mint an NFT or nah? — Noble Dust

What is your reason for wanting to do so? -

Benkei

8.1kI guess the question is: what are they important for, exactly. Sure the technology is interesting, and it's certainly useful if you want untraceable transactions. That's not purely a positive though. — Echarmion

Benkei

8.1kI guess the question is: what are they important for, exactly. Sure the technology is interesting, and it's certainly useful if you want untraceable transactions. That's not purely a positive though. — Echarmion

Blockchain has its uses and there's certainly a few interesting applications out there. The intrinsic value of cryptocurrencies at this time seems low. Black market transactions, people who are principled against centralised government power, a store for value.

The idea that decentralised verification of the transaction resolves the necessity of trust in middlemen is replaced by people wanting ease of use like a regular exchange or bank. So we end up with custodians and exchanges that we again need to trust and the unauditable transaction trail of most cryptos makes it impossible to recover losses when something happens. For now, cryptos aren't going to fulfil the role of an alternative currency as envisaged but are just another asset class. -

Benkei

8.1kDo you like the monetary policies currently enacted? If the answer is no, then that would be a good reason I think.

Benkei

8.1kDo you like the monetary policies currently enacted? If the answer is no, then that would be a good reason I think. -

Echarmion

2.7k

Echarmion

2.7k

I don't really see the connection. Monetary policy affects bitcoin just as well, regardless of the "alternative" label. It's after all a big part of the reason it's market value is so high.

A different currency isn't the same as a different monetary system. -

ssu

9.8k

ssu

9.8k

The "monetary policy" in Bitcoin is a) do governments allow it or not and b) do those using it believe in it's value or not. There's no government able to tax it's citizens behind it or any physical aspects that metals have. Bit off from what monetary policy currently is.I don't really see the connection. Monetary policy affects bitcoin just as well, regardless of the "alternative" label. It's after all a big part of the reason it's market value is so high. — Echarmion

In many countries buying and selling isn't so easy as in Western countries. Holding foreign currency can be limited and the banking system a joke. There having bitcoin can be truly helpful in the role of medium of change. Yet it's extremely lousy as a unit of account as it goes up and down in price like a delirious rabbit. It's basically more of a medium of speculation than "store of value", but then again this is the time of the "everything bubble" where all "stores of value" are going up and down.

It's really an interesting discussion if bitcoin is truly a "safe haven" investment or not. The real risk with any so-called "safe havens", be it gold, the swiss franc or bitcoin is that IF there's a bursting of this bubble, all financial vehicles go down simply because people need to take cash from where ever they have them. The wonderful aspect of a margin call or as others call the phenomenon, asset deflation. Governments going after bitcoin is a typical thing in Third World countries, where the government has little control of the economy and desperately want's income. It could possibly happen here too, but then a lot has to happen before that.

Far more likely "threat" to Bitcoin is that it is replaced by a more "acceptable" cryptocurrency by those in power, which is then taken to use by the masses. I don't think that the majority of people have cryptocurrencies of today. Just like they can control the internet today, even if earlier people viewed the net as this bastion of freedom. -

Benkei

8.1kIt's affected because exchanging from one crypto to another asset class requires the currency managed by the relevant central bank. Monetary policy of the US doesn't directly affect the purchasing power of EUR in Europe though. So having a currency that would be unaffected by central bank policies would be of value to many.

Benkei

8.1kIt's affected because exchanging from one crypto to another asset class requires the currency managed by the relevant central bank. Monetary policy of the US doesn't directly affect the purchasing power of EUR in Europe though. So having a currency that would be unaffected by central bank policies would be of value to many. -

Echarmion

2.7kThe "monetary policy" in Bitcoin is a) do governments allow it or not and b) do those using it believe in it's value or not. — ssu

Echarmion

2.7kThe "monetary policy" in Bitcoin is a) do governments allow it or not and b) do those using it believe in it's value or not. — ssu

Those have nothing to do with "monetary policy" the way I understand it. And governments cannot practically suppress currencies without some very draconian measures (which would also work against bitcoin) anyways.

There's no government able to tax it's citizens behind it or any physical aspects that metals have. — ssu

That seems pretty much strictly negative from a social point of view.

In many countries buying and selling isn't so easy as in Western countries. Holding foreign currency can be limited and the banking system a joke. There having bitcoin can be truly helpful in the role of medium of change. Yet it's extremely lousy as a unit of account as it goes up and down in price like a delirious rabbit. It's basically more of a medium of speculation than "store of value", but then again this is the time of the "everything bubble" where all "stores of value" are going up and down. — ssu

Sure. But then people have been pretty creative with that before bitcoin as well. You can use cigarrettes as currency if you have to.

It's really an interesting discussion if bitcoin is truly a "safe haven" investment or not — ssu

I'd argue it's not an investment in the traditional sense at all. It's purely speculative with no commodification attached.

The real risk with any so-called "safe havens", be it gold, the swiss franc or bitcoin is that IF there's a bursting of this bubble, all financial vehicles go down simply because people need to take cash from where ever they have them. The wonderful aspect of a margin call or as others call the phenomenon, asset deflation. Governments going after bitcoin is a typical thing in Third World countries, where the government has little control of the economy and desperately want's income. It could possibly happen here too, but then a lot has to happen before that. — ssu

At least gold would still be useable, and the swiss franc might still pay your taxes. But to be sure I'm not saying that speculating with Bitcoin is a terrible, no good idea on an individual level. I'm not an expert on investment or speculation strategies. I question the wisdom of elevating such speculation as a virtuous or subversive act.

Far more likely "threat" to Bitcoin is that it is replaced by a more "acceptable" cryptocurrency by those in power, which is then taken to use by the masses. I don't think that the majority of people have cryptocurrencies of today. Just like they can control the internet today, even if earlier people viewed the net as this bastion of freedom. — ssu

Possible, but bitcoin is already pretty well established. Though the chinese government will certainly be able to do something like this.

It's affected because exchanging from one crypto to another asset class requires the currency managed by the relevant central bank. — Benkei

So long as you don't conduct your entire business in bitcoin, it'll be tied to the monetary system of the rest of the world. With global financial capitalism, there's basically no way to have an unaffected currency unless you also want to run an entirely separate economy (which arguably is what happens in black market economies running on bitcoin).

Monetary policy of the US doesn't directly affect the purchasing power of EUR in Europe though. — Benkei

Not directly, but the effects will travel through the interconnected real economy to the EU regardless.

So having a currency that would be unaffected by central bank policies would be of value to many. — Benkei

For what purpose, exactly? It's not like anyone can stop you from using whatever you want as currency. Bitcoin is more sophisticated than trading postage stamps, but it's not in principle different as far as I can tell. -

Benkei

8.1kNot directly, but the effects will travel through the interconnected real economy to the EU regardless. — Echarmion

Benkei

8.1kNot directly, but the effects will travel through the interconnected real economy to the EU regardless. — Echarmion

Ok, explain the mechanism to me how monetary policy in the US affects the price of buying milk in the Netherlands. If you can say this with such conviction you certainly have this figured out.

Bitcoin is more sophisticated than trading postage stamps, but it's not in principle different as far as I can tell. — Echarmion

You can't divide post stamps to reflect the exact value you need to pay for something else. They're physical too. There's not enough of them to go around, they can be easily counterfeited. Etc. -

Echarmion

2.7kOk, explain the mechanism to me how monetary policy in the US affects the price of buying milk in the Netherlands. If you can say this with such conviction you certainly have this figured out. — Benkei

Echarmion

2.7kOk, explain the mechanism to me how monetary policy in the US affects the price of buying milk in the Netherlands. If you can say this with such conviction you certainly have this figured out. — Benkei

There isn't one precise mechanism, but e.g. a loose money policy leads to more money going into speculative investments like futures, which affect global pricing / supply and demand. So if feed prices go up due to futures, the cost of producing milk goes up globally, affecting milk prices in the Netherlands.

You can't divide post stamps to reflect the exact value you need to pay for something else. They're physical too. There's not enough of them to go around, they can be easily counterfeited. Etc. — Benkei

That's true, cryptocurrency is much more sophisticated. I just wonder whether it's worth the negative side effects. -

Benkei

8.1kThere isn't one precise mechanism, but e.g. a loose money policy leads to more money going into speculative investments like futures, which affect global pricing / supply and demand. So if feed prices go up due to futures, the cost of producing milk goes up globally, affecting milk prices in the Netherlands. — Echarmion

Benkei

8.1kThere isn't one precise mechanism, but e.g. a loose money policy leads to more money going into speculative investments like futures, which affect global pricing / supply and demand. So if feed prices go up due to futures, the cost of producing milk goes up globally, affecting milk prices in the Netherlands. — Echarmion

OK, good, we've established you don't know what you're talking about. I can stop investing time in this. -

ssu

9.8k

ssu

9.8k

As I said, bit off from actual monetary policy. But I guess what is considered and accepted as money is monetary policy in the broader sense.Those have nothing to do with "monetary policy" the way I understand it — Echarmion

Those measures start from what is legal tender.And governments cannot practically suppress currencies without some very draconian measures (which would also work against bitcoin) anyways. — Echarmion

Oh you would prefer 18th Century style dealings where your employer would pay your salary with his own currency, which you can use in your employers shops?That seems pretty much strictly negative from a social point of view. — Echarmion

There's many negative aspects to private currencies also, you know.

Well, the structure how it uses a peer-to-peer network and blockchain might be things on the plus side to it.I'd argue it's not an investment in the traditional sense at all. It's purely speculative with no commodification attached. — Echarmion

Likely it's the Western Central banks that may look at this.Possible, but bitcoin is already pretty well established. Though the chinese government will certainly be able to do something like this. — Echarmion

A note to another conversation here:

Monetary policy of the US doesn't directly affect the purchasing power of EUR in Europe though. — BenkeiNot directly, but the effects will travel through the interconnected real economy to the EU regardless. — EcharmionOk, explain the mechanism to me how monetary policy in the US affects the price of buying milk in the Netherlands. If you can say this with such conviction you certainly have this figured out. — BenkeiThere isn't one precise mechanism, but e.g. a loose money policy leads to more money going into speculative investments like futures, which affect global pricing / supply and demand. So if feed prices go up due to futures, the cost of producing milk goes up globally, affecting milk prices in the Netherlands. — Echarmion

Ok, perhaps here it's good to remind you that money in your country is a foreign currency in other countries. And this is how US monetary policy can indeed effect the price of milk in the Netherlands. And this is why actually the "demise of the Dollar" thanks to reckless spending isn't at all a clear cut case as the US is part of the global economy...and everything effects everything.

Let's take the hypothetical scenario that Joe and Kamala amp up the spending spree and print ten trillion dollars and the markets don't take it so well and finally truly panic. The Central banks are at each others throats so they let the dollar fall. So assume that the US dollar then collapses in one day to 1/3 of the price before of roughly in parity with the euro.

Now what do you think will happen?

Suddenly US milk is 1/3 cheaper in Netherlands and hence it's a great trade to export milk from the US to the Netherlands: many Dutch people will likely prefer to pay less for their milk and opt for the cheaper US milk. Also every goddam exporter in the Euro-area to the US (also those Dutch dairy product exporters) suddenly has this obstacle at the next day that the prices of their products just tripled in the US. Even worse for the Euro-area, the Chinese Yuan is pegged to the dollar and hence the Chinese would be crushing Euro-area exporters.

The simple outcome would be that the Dutch, alongside every Euro country, would have their export sector demanding ease with the "strict" monetary policy and for the ECB to devalue the Euro. Meanwhile in the US a Big Mac will likely cost what it cost yesterday before the dollar collapse as it takes time for inflation to happen and the US isn't your average run-of-the-mill Third World country.

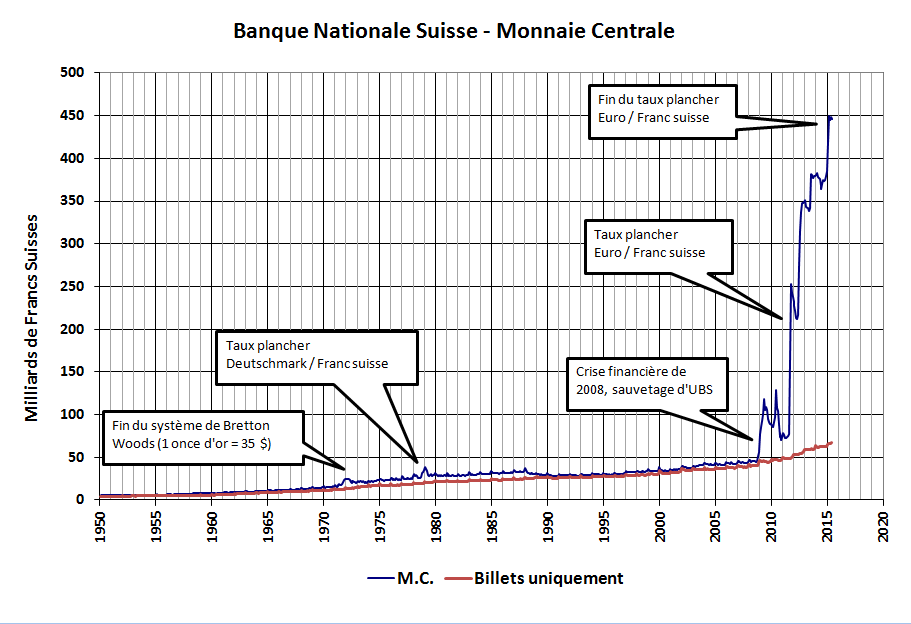

This isn't far fetched as during the financial crises Switzerland suddenly found itself as a "safe haven" currency having it's franc roughly revaluing +20% towards the dollar and the euro. They had to go to negative interest rates (that people have to pay them for holding Swiss francs) and increase their monetary base, because the +20% jump in the Swiss franc was killing the important export market in a situation when the global market was already in a recession.

-

Echarmion

2.7kAs I said, bit off from actual monetary policy. But I guess what is considered and accepted as money is monetary policy in the broader sense. — ssu

Echarmion

2.7kAs I said, bit off from actual monetary policy. But I guess what is considered and accepted as money is monetary policy in the broader sense. — ssu

Yeah, I can see where you're coming from. I understand it more as trying to impact the real economy by regulating the flow of money, but it's difficult to really pin down the difference between money and currency, because we always think of money in terms of a specific currency.

Those measures start from what is legal tender. — ssu

Arguably, yes. Though I find it hard to treat bitcoing as "being suppressed" given it's popularity.

Oh you would prefer 18th Century style dealings where your employer would pay your salary with his own currency, which you can use in your employers shops?

There's many negative aspects to private currencies also, you know. — ssu

I think we have a misunderstanding here, I dont see the connection to what I wanted to say. I just wanted to say that being able to avoid taxes is not necessarily a good thing.

Well, the structure how it uses a peer-to-peer network and blockchain might be things on the plus side to it. — ssu

I agree. The technology is interesting and may have important future applications.

Likely it's the Western Central banks that may look at this. — ssu

Given the recent competence of western governments, I wouldn't be too worried.

Ok, perhaps here it's good to remind you that money in your country is a foreign currency in other countries. And this is how US monetary policy can indeed effect the price of milk in the Netherlands. And this is why actually the "demise of the Dollar" thanks to reckless spending isn't at all a clear cut case as the US is part of the global economy...and everything effects everything. — ssu

Sure, that's another scenario where a "currency barrier" doesn't stop the effects of a crisis. My point was that while something like bitcoin is in and of itself immune to inflation, it's not decoupled from the monetary system as a whole, which today is global and, as you say, everything affects everything.

This isn't far fetched as during the financial crises Switzerland suddenly found itself as a "safe haven" currency having it's franc roughly revaluing +20% towards the dollar and the euro. They had to go to negative interest rates (that people have to pay them for holding Swiss francs) and increase their monetary base, because the +20% jump in the Swiss franc was killing the important export market in a situation when the global market was already in a recession. — ssu

Interesting. Did this have anything to do with the swiss economy / banking sector or was it merely the perception that the swiss franc was "safe" because of the reputation of the swiss banking sector? -

Deleteduserrc

2.8k

Deleteduserrc

2.8k

Congrats on the computer!

I'm still bullish on pets.com . It's a long game. On the dark web, we holders of the pets.com/bitcoin/sega/crystal pepsi ETF have invented marvelous new financial instruments that work even for non-existent assets. It's very heidegerrean - we play cards while the nothing noths, and always-already profit. -

ssu

9.8k

ssu

9.8k

Hyperinflation is basically the universal distrust in a currency being a store of value: people may need to use it, but know it's basically worthless. That the supply of a cryptocurrency is limited isn't a reason why the trust in the currency being a store of value couldn't be shaken too. Simply put it, both with a fiat currency and a cryptocurrency there has to be people who think it's worth it's price as payment and willing to trade or exchange it to something else.My point was that while something like bitcoin is in and of itself immune to inflation, it's not decoupled from the monetary system as a whole, which today is global and, as you say, everything affects everything. — Echarmion

The Swiss franc has had this role of being a "safe haven" currency, but naturally as the country is small there aren't so many Swiss franc going around.Did this have anything to do with the swiss economy / banking sector or was it merely the perception that the Swiss franc was "safe" because of the reputation of the swiss banking sector? — Echarmion

As the Chairman of the Swiss National Bank puts it:

As a small open economy, Switzerland is highly exposed to external disruptions. Exchange rate movements in particular exert a major influence on inflation and economic activity in our country.

A further characteristic of Switzerland is that the Swiss franc, as a safe-haven currency, tends to appreciate when global risk sentiment deteriorates. In recent years, a number of crises – notably the global financial crisis and the European sovereign debt crisis – have led to appreciations of the franc. What does the strong influence of developments abroad on inflation in our country mean for our monetary policy? It means that inflation can be controlled with even less precision than in the large currency areas. It is not possible – or only with disproportionate use of monetary policy instruments and correspondingly marked side effects – to always fully offset spillovers from abroad.

So basically what the Swiss are doing now is printing money and then buying financial assets with those francs...in order for the franc not to appreciate too much and make a problem. Which is crazy, but then a lot of things are indeed crazy now.

Here's a short video telling the incredible story of what the Swiss Central Bank is doing now. From last year (starts at 1min25s):

Central banks turning into hedge funds isn't something that is going to end well in my view.

Thanks! -

Noble Dust

8.1kWhat is your reason for wanting to do so? — Echarmion

Noble Dust

8.1kWhat is your reason for wanting to do so? — Echarmion

A friend of mine hired me to write music for a series of short films which he plans to mint as NFTs. I love working with him, so it was a no-brainer. If they sell, I'll be paid in ETH. This inevitably led me to researching the NFT world. At first I was philosophically against everything about it, but I suddenly (out of nowhere) came up with my own concept for an NFT that I really love. -

ssu

9.8k

ssu

9.8k

If I'm true to my word, I'll have to postpone my buying of cryptocurrencies as not six months, but just two months went with inactivity on this thread. Seriously thinking of investing in bitcoin, but....hell I just hate passwords! Yet as this is a quite progressive site with forward looking people and bitcoin has built a nice base after the highs two months ago, it looks to be an OK investment. Looks like a fair time to start. Not a great time to invest as there's no a) pandemic outbreak, b) major war or c) financial crisis which make people panic. In a panic with all this debt around, everything goes down.

So I'm not so sure if in a situation where all stock indexes are all time high, when gold is close to all time high and the leverage used in unreal, there could be that deflationary correction that everybody is talking about when all that investment with debt panics and sells the best assets. Even if inflation has picked up. Thinking more of divesting partly out of stocks now. -

Baden

16.7k

Baden

16.7k

My take is if the fed scares investors and there's a stock market correction, btc will break support and crash. If not, it'll likely grind up again. Long term it's a good investment as long as it keeps doing what it always has, but I'd rather wait for a bit more certainly. -

BitconnectCarlos

2.8k

BitconnectCarlos

2.8k

Crypto markets looking shaky, indecisive right now. Stablecoins yields quite generous though. excellent apys and fairly safe investment. I'm surprised this doesn't receive a little more attention. -

Shawn

13.5kI'm sure some group of people will pump Shiba as much as possible.

Shawn

13.5kI'm sure some group of people will pump Shiba as much as possible.

What do you think is shiba the next rockstar? — TheQuestion

At the time I thought Monero was going to be all that;, but, Elon Musk started tweeting about Dogecoin more.

I'm sure the mountain is insurmountable. -

T_Clark

16.1kWhat do you think is shiba the next rockstar? — TheQuestion

T_Clark

16.1kWhat do you think is shiba the next rockstar? — TheQuestion

As far as I can see, all the digital currencies are just pyramid schemes. The coins have no intrinsic value, so when the bottom drops out, and it will, you'll left with a hand full of turd. Do you think you are one of the few who will be able to jump in and jump back out at just the right time to make a fortune? If so, you're are probably wrong. -

ssu

9.8kHi @TheQuestion, there has been a long debate about cryptocurrencies started four years ago in 2017 and many have been active on this front (the thread is 12 pages). Usually when the prices have gone lower the debate has faded away and the thread hasn't been used for months.

ssu

9.8kHi @TheQuestion, there has been a long debate about cryptocurrencies started four years ago in 2017 and many have been active on this front (the thread is 12 pages). Usually when the prices have gone lower the debate has faded away and the thread hasn't been used for months.

There's a somewhat "philosophical" debate about it.

Link to the Forums thread about the cryptocurrencies -

TheQuestion

76Maybe shiba being a rockstar is over exaggerating but I think is a good prospect because is dirt cheap.

TheQuestion

76Maybe shiba being a rockstar is over exaggerating but I think is a good prospect because is dirt cheap.

The logic is simple if you can burn $500 at a casino why not just buy shiba for that price and set the stop/gain and forget it.

If it tanks oh well you can get that money back with a single paycheck.

If a miracle happens like DogeCoin did in 2020 where it peaked at 70 cents. Or not even that much say 5 cents. You still walk away with a fat wallet.

Welcome to The Philosophy Forum!

Get involved in philosophical discussions about knowledge, truth, language, consciousness, science, politics, religion, logic and mathematics, art, history, and lots more. No ads, no clutter, and very little agreement — just fascinating conversations.

Categories

- Guest category

- Phil. Writing Challenge - June 2025

- The Lounge

- General Philosophy

- Metaphysics & Epistemology

- Philosophy of Mind

- Ethics

- Political Philosophy

- Philosophy of Art

- Logic & Philosophy of Mathematics

- Philosophy of Religion

- Philosophy of Science

- Philosophy of Language

- Interesting Stuff

- Politics and Current Affairs

- Humanities and Social Sciences

- Science and Technology

- Non-English Discussion

- German Discussion

- Spanish Discussion

- Learning Centre

- Resources

- Books and Papers

- Reading groups

- Questions

- Guest Speakers

- David Pearce

- Massimo Pigliucci

- Debates

- Debate Proposals

- Debate Discussion

- Feedback

- Article submissions

- About TPF

- Help

More Discussions

- Other sites we like

- Social media

- Terms of Service

- Sign In

- Created with PlushForums

- © 2026 The Philosophy Forum