-

fdrake

7.2k(1) People sell a thing at a price, people are aware of the price it was sold at (this is a stock market mechanism), this establishes a standard that it sells at that price.

fdrake

7.2k(1) People sell a thing at a price, people are aware of the price it was sold at (this is a stock market mechanism), this establishes a standard that it sells at that price.

Asset prices are decreasing on average because of (1) in a feedback loop. It's not just that though. (1) happens even in times of market stability, it's just how they work. What makes this different is that a lot of people are selling, and (1) ensures this drives down the price (and people know it will). To answer that you've got to ask why they're selling.

(2) Some people will be selling simply because they can see the price is going down on average.

(3) Some people will be selling because there are mounting economic risks regarding the coronavirus in general; it's a (borderline) pandemic, everything conceivable will be disrupted in some way to some degree, all along production chains, in travel and logistics etc.

(4) Some people will be selling because they know (2) and (3) are happening and will turn a profit by selling now for (comparatively) lots and then buying stuff for cheaper in the case of an even more major economic disruption (if this starts looking too likely, governments will try to respond in some way, like they're doing now in the US with another "fiscal stimulus" package in congress).

The whole thing's just a movement of hot air, which may or may not currently be percolating around the insides of an overfilled financial balloon. The political north's largely been stagnant or declining in productivity since 2008, AFAIK the relative price of goods to median income's typically been increasing since then (this is the opposite trend expected from when there's growth rather than a bubble). Let's hope that all this is wrong, and that continued disruption won't lead to another 2008 wealth/power transfer. -

Metaphysician Undercover

14.8k3. There are no more tools available (nor the prospect of until now "unthought of" tools) that can encourage traders to believe the free market will be stabilized by collectivists schemes of one form or another. — boethius

Metaphysician Undercover

14.8k3. There are no more tools available (nor the prospect of until now "unthought of" tools) that can encourage traders to believe the free market will be stabilized by collectivists schemes of one form or another. — boethius

The unstable market is the trader's market. That's where the traders make easy money. So why would the traders want to stabilize the market? Traders will never allow for a stable market. And unfortunately, if traders are making easy money it usually means that other people are losing their hard earned money. If a stable market is desired, the solution is to ban traders. This was demonstrated by the 2008 crash. -

boethius

2.7kSo why would the traders want to stabilize the market? — Metaphysician Undercover

boethius

2.7kSo why would the traders want to stabilize the market? — Metaphysician Undercover

It does not matter what the the traders want. Or rather, what they want is incidental to how they will try to act.

If they think the market is going down they will tend to sell. If they think it's going up they will tend to buy. If they think it will stay the same they will tend to hold.

I say "encourage traders to believe the market will stabilize" not in the sense of encouraging them to want the market to stabilize and cooperate to achieve that end is a great way to run a free market economy (because the free market is efficient and therefore needs a lender of last resort whenever it collapses into dysfunction), but only in the sense of believing that it will actually happen (because they believe others believe it will happen due to believing the action of the FED will have this psychological effect on others, weaker minded people, that regardless of "fundamentals" the "smart money" needs to hop on the trend to fleece these fools later). If they think it will actually happen their behavior will change, and collectively they will make that change by anticipating it will actually happen.

So, previously, when the FED and other central banks had what they called "ammunition" left, their interference in the market in the name of saving a free market ideology as a basis for world government, would have both a primary numerical effect in the market as well as a secondary psychological effect.

If traders believe "geniuses in the FED obviously know what their doing, as otherwise they wouldn't wear suits and hold press conferences" they interpret any actions by the FED as "obviously going to work in stabilizing the market", regardless of the primary consequence of the FED's actions (indeed, the primary consequence of the interference could actually have a negative effect, because they don't know what their doing, but the secondary psychological effect could completely dwarf that; just like the placebo effect can completely dwarf negative side-effects and the treatment seems to "work great" reinforcing the placebo effect).

So, if the FED has a carefully cultivated cult following that believe the public providing a private entity with the monopoly on what legislatively created entity people can pay taxes in, then basically anything it does or says to move the market will move the market because people believe it will work and thus anticipate it working, moving the market to were the FED wants it to be. And it works! Prediction came true! Reinforcing this psychological influence over traders.

When "placebo psychology" is not enough to counteract real changes in the market (such as a bank going bankrupt) then a "real action" is needed (such as bail out all the other banks and a select few giant corporations).

This real action has some real stabilizing affects, but also amplifies the psychological effect as traders say "wooeee, trillions dollars to me and my friends baby! FED's got this".

However, if traders lose confidence in the FED, then the psychological leverage can not only be zero, but can actually be negative. Whatever actions the FED takes will be anticipated not to work and only indicating how dire the situation is and, in anticipation of the FED's actions not working, traders will reinforce the opposite direction, and again regardless of the primary effect of the market interference (such as buying junk mortgages should support the junk mortgage market), the opposite of what they want will occur (that they can support the price only insofar as they are the only buyer, and as soon as they stop it tanks even more). And the market's prediction comes true! Reinforcing the belief that the FED is a pathetic bunch of has-beens that don't know anymore than your common stock of shoeshine boys.

Why people who care about this sort of stuff as "the most important thing you could possibly know about and cause of all good things in the universe" blabber on about "confidence".

Due to the 2009 crisis (and wanting to bail out their friends, and even make them richer, rather than pursue any sound fiscal policy even according to their own ideology, which is just a public position to keep useful-fools inline and not their private position of doing whatever idea, socialist or capitalist, will get them more power in any given situation), the FED and central banks have spent all their ammunition blasting holes in their own floor in which to shovel in trillions of dollars and lighting it on fire.

This ammunition is mainly rate cuts to the interest banks can loan new money at, large market interventions that represent "a lot" but not so much as to legitimately be on the path of central banks owning whole markets, as well as the fractional reserve limit.

Right now interest rates are zero or negative, the FED owns over a trillion dollars of mortgages and have announced buying some hundred billions more, and the fractional reserve limit has been place at zero (which means banks don't actually have to even loan money from the FED ... but can leverage 0 dollars to make their own infinity dollars anyways).

There's simply nothing of significance left central banks can really do (as far as I know), and so traders will simply ignore their actions, or even interpret any given action as signs of the financial armageddon.

But the central banks will be forced to keep creating money anyways. For instance, US federal government has a trillion dollar deficit, may need to go to 2 trillion due to this crisis (in a combination of not collecting taxes and bailouts for everyone and the direct costs of the crisis).

The crash of the stock market also means the crash of the junk bond market (there's no reason to have confidence in a company who's market cap is lower than their outstanding debt, and due to real changes in the economy there's no reason to believe they can bounce back and that bailouts will come to the rescue rather than postpone the inevitable). FED will need to take all these junk bonds onto their books because the banks tell them to or their crash the system.

All this is a lot of money entering the system to accomplish nothing.

At some point even economists will be going around saying "tut, tut, tut, no free lunch, tut, tut, tut, no free lunch" and wagging their fingers in the faces of every econ 101 students who is trying so desperately to believe regulators are playing some sort of arcane zero dimensional chess and have a point to their actions. (wagging those fingers through video-link of course).

The financial system was already on life support, and so anyone who even imagines that a pandemic walking slowly by regulators over three months as they just stare at it, then quickly jump on the patient in a bear hug squeezing out all the oxygen, as regulators slowly put down their issue of foreign affairs and prance elegantly across the room, careful not to spill their martinis, and then lightly paw at the pandemic while preparing 1000 shots of adrenaline for when the patient codes -- actually believes all this won't have a massive consequence, is a beautiful, beautiful dreamer, just unfortunately in a opiate induced coma at the moment.

That's why no one's coming in here to say "market's at a record high douche bag; do you even know what a blockchain is bro, do you even know crypto isn't a code bro? do you even know anything bro?". -

Metaphysician Undercover

14.8kIf they think the market is going down they will tend to sell. If they think it's going up they will tend to buy. If they think it will stay the same they will tend to hold. — boethius

Metaphysician Undercover

14.8kIf they think the market is going down they will tend to sell. If they think it's going up they will tend to buy. If they think it will stay the same they will tend to hold. — boethius

Traders make their money from transactions. If they think the market Is staying the same (stable) they will hold, as you say, therefore they make no money. So the trader's livelihood is dependent on an unstable market, and they will do what they can (strategic buying and selling) to ensure that the market is unstable.

"encourage traders to believe the market will stabilize" — boethius

Impossible, because a stable market makes no money for the traders.

If traders believe "geniuses in the FED obviously know what their doing, as otherwise they wouldn't wear suits and hold press conferences" they interpret any actions by the FED as "obviously going to work in stabilizing the market", regardless of the primary consequence of the FED's actions (indeed, the primary consequence of the interference could actually have a negative effect, because they don't know what their doing, but the secondary psychological effect could completely dwarf that; just like the placebo effect can completely dwarf negative side-effects and the treatment seems to "work great" reinforcing the placebo effect). — boethius

Traders know they have more control over the market than the FED could ever hope to have.

So, if the FED has a carefully cultivated cult following that believe the public providing a private entity with the monopoly on what legislatively created entity people can pay taxes in, then basically anything it does or says to move the market will move the market because people believe it will work and thus anticipate it working, moving the market to were the FED wants it to be. And it works! Prediction came true! Reinforcing this psychological influence over traders. — boethius

Your analysis is faulty boethius, because you are not distinguishing between the general population and the traders. Perhaps the general public might believe that the FED has control over the market, but this is an illusion, and the traders know that. The traders will play along with the FED at strategic times, because it's in their interest to encourage the deception, which keeps the public money rolling in. The FED may claim to act in a predictive, preemptive way, but the fact is clear that its only significant acts are post hoc. Therefore the Fed's actions do not move the markets, stabilize them, or anything like that. This is an illusion created by the traders playing along with the Fed, to exercise what you've called "psychological influence" over the general population. In the end, what influences the general population in its perception of the market, is what happens in the market place, and this is where the traders have all the leverage.

However, if traders lose confidence in the FED, then the psychological leverage can not only be zero, but can actually be negative. — boethius

The traders don't give a fuck about the FED. The FED protects their livelihood, but when it's time to make their money they don't give a damn. It's not a symbiotic relation.

Due to the 2009 crisis (and wanting to bail out their friends, and even make them richer, rather than pursue any sound fiscal policy even according to their own ideology, which is just a public position to keep useful-fools inline and not their private position of doing whatever idea, socialist or capitalist, will get them more power in any given situation), the FED and central banks have spent all their ammunition blasting holes in their own floor in which to shovel in trillions of dollars and lighting it on fire. — boethius

See, now the traders are not only taking money from the general population, they are taking it from the FED as well, in the form of bailouts. Clearly the traders don't give a fuck, so long as they can feed the greed, and keep stuffing it in their pockets, they'll take it from wherever they can get it. Greed is an incorrigible disease.

At some point even economists will be going around saying "tut, tut, tut, no free lunch, tut, tut, tut, no free lunch" and wagging their fingers in the faces of every econ 101 students who is trying so desperately to believe regulators are playing some sort of arcane zero dimensional chess and have a point to their actions. (wagging those fingers through video-link of course). — boethius

So long as traders are allowed free access to the market there will be always be an abundant supply of free lunches. -

boethius

2.7kTraders make their money from transactions. If they think the market Is staying the same (stable) they will hold, as you say, therefore they make no money. So the trader's livelihood is dependent on an unstable market, and they will do what they can (strategic buying and selling) to ensure that the market is unstable. — Metaphysician Undercover

boethius

2.7kTraders make their money from transactions. If they think the market Is staying the same (stable) they will hold, as you say, therefore they make no money. So the trader's livelihood is dependent on an unstable market, and they will do what they can (strategic buying and selling) to ensure that the market is unstable. — Metaphysician Undercover

"Traders" (as a whole) do not engage in strategic buying and selling to create more volatility.

Some traders, who believe they can both A. contribute significantly to volatility and B. profit from that happening, do as you say. Others, who can not do A or B, or likely both, do not engage in such a strategy.

Traders tend to stop selling if they believe the market is stabilizing as to not lose money, as if they wait they may be able to profit from their current positions. Indeed, the market stabalizing in-between up-and-down is simply the definition of traders no longer selling more than others are buying and a new equilibrium reached (therefore, a net tendency not to now sell; and a stable market this tendency is only slightly out of balance leading to slow rises and falls).

The traders don't give a fuck about the FED. The FED protects their livelihood, but when it's time to make their money they don't give a damn. It's not a symbiotic relation. — Metaphysician Undercover

Explaining this is the whole point of my answer to your first comment.

The FED is effective insofar as traders believe it's effective. An individual trader can hate the FED and what it represents and believe it to be unconstitutional and created through conspiracy and moreover run by delusional cronies, but will still trade based on the assumption that the FED's actions will be effective (at accomplishing the FED's stated aims) if that trader believes other traders believe the FED's actions will be effective.

Your analysis is faulty boethius, — Metaphysician Undercover

You may misunderstand my analysis, and maybe it is faulty, but you have not uncovered that fault.

Mostly, we are saying the same thing, but you are considering all traders as some sort of "cohesive group" that have some sort of agreed on strategy. This is not true.

Traders are not cohesive, they trade against each other, and the net-result of this trading is "supposed to be" corralled and shepherded around by the FED and other central banks.

Yes, we agree, the system is corrupt and will result in bailouts (first tranche already announced; in order to avoid a 5-10% decrease in airline stock due to a major containment operation two months ago ... now their shares are tanking, they are on the brink of bankruptsy and they need a bailout ironically almost proportional to the stock-buybacks they performed using low-interest public loans debt from the previous continuous bailout scheme).

What I am describing is how those bailouts will result in uncontrolled inflation because all the "control inflation leavers" the FED has, have been already pulled due to the 2009 recession (to prop up their fellow cronies; we completely agree there).

Unlike last time, the wealthy will not simply bail themselves out and keep the system running in some semblance of "free market capitalism" while the left cries fowl and (many) libertarians explain that paying back a bailout in inflated currency retroactively deletes that bailout from existence and ta-da: capitalism is alive and well. The wealthy have completely borked the system this time. There's no putting humpty-dumpty back together again.

A monetary system starts to truly enter dysfunction in itself (rather than mere social dysfunction of inequality that is a "values question" plutocrats can ignore) when A. inflation can no longer be controlled and B. more inflation is needed to bailout friends and the government itself (so that it can continue to do its job of protecting the rich from the poor). We have already seen the first obvious but ineffective measure in the long term, measure at dealing with inflation: price controls. It starts small on just a few "necessities" but give it time, give it time. -

unenlightened

10kHere's my neighbour's position. He has a Bed & Breakfast. No one is staying so he is effectively unemployed and as the song goes, the mortgage is still working. So he cannot pay, and needs to cash in his savings - a few shares which have roughly halved in value. That's 6 months from thriving business to bankrupt.

unenlightened

10kHere's my neighbour's position. He has a Bed & Breakfast. No one is staying so he is effectively unemployed and as the song goes, the mortgage is still working. So he cannot pay, and needs to cash in his savings - a few shares which have roughly halved in value. That's 6 months from thriving business to bankrupt.

It's a tourist town, so basically 75% or more of the town is unemployed. About the same percentage of businesses are going to be broke quite quickly. Trade is seasonal, so there is no prospect of any upturn for a year.

If that wasn't enough, quite a lot are going to get ill and because it is a retirement town as well, quite a lot are old and vulnerable.

So when the olds die, and the businesses go broke, property prices will crash, and mortgage companies will be in difficulty. Government has already promised payouts of £330 billion which it hasn't got and will not get because no one will be working and paying taxes.

Traders will take advantage if they can, but when the town goes tits up the best advantage is to be able to leave town. Mars anyone?

-

Streetlight

9.1kMars anyone? — unenlightened

Streetlight

9.1kMars anyone? — unenlightened

Why Mars? Nah, just cancel all debt, cancel all mortgages, communalize the means of production, appropriate the rich, destroy capitalism, and we're all good, right here on earth. -

boethius

2.7kFor instance, to demonstrate the loss of credibility:

boethius

2.7kFor instance, to demonstrate the loss of credibility:

Wall Street slumps at open as stimulus high fades — Reuters front page

Obviously, no one has confidence in this "stimulus" and everyone wants out. If the FED steps in to make sure their friends can get out ok too (what they are already doing) one way or another, as well as step into monetize huge leveraged losses, it only delays the inevitable, while creating a ton of new money.

"Fiscal responsibility" based crony capitalism, however, is premised on the ability to provide welfare to the investor class while implementing harsh austerity on the government and everyone else (yes, you have inflation from the bailouts, but only the investor class benefit and the inflation can be balanced somewhat by austerity; it's not completely uncontrollable over the time span of a decade at least; which is all the time you need to build bunkers on islands). If problems are self created in the financial system, they've been pretty successful at doing this bailout-austerity trick (it's a good trick spins things this way), but since this current crisis isn't only a self-created problem of the financial system, yes it one of those too, but also a real world problem; austerity is impossible and inflation will start to get out of control as soon as the dust settles on the immediate crisis. -

unenlightened

10kWhy Mars? Nah, — StreetlightX

unenlightened

10kWhy Mars? Nah, — StreetlightX

It's a really great place to trade, because everything's in short supply. Honest. It's where all the smart money is going.

destroy capitalism, and we're all good. — StreetlightX

I'm doing my bit to undermine confidence - Capitalism is a confidence trick, right? -

Metaphysician Undercover

14.8kMostly, we are saying the same thing, but you are considering all traders as some sort of "cohesive group" that have some sort of agreed on strategy. This is not true. — boethius

Metaphysician Undercover

14.8kMostly, we are saying the same thing, but you are considering all traders as some sort of "cohesive group" that have some sort of agreed on strategy. This is not true. — boethius

I agree that "traders" are not a cohesive group, and they don't have an agreed strategy. Nevertheless, they have the same intention, which is to make money off the market. And they make money in similar ways, so they develop similar strategies, which feeds the herd mentality. -

Gregory

5kLast December my best friend had what was likely corona. He said he felt like he was talking underwater, and the doctor said it sounded like he was! Just today he read a description of corona which said "feeling like your talking underwater". So it sounds like you feel sick and get a brief waterboarding. When it spreads further, deal with it at home. Hospitals are for the high risk individuals, not for the pussies. We need to keep open drive thrus and stores. There is no way to get food to everyone without exposure. Exposure or starve

Gregory

5kLast December my best friend had what was likely corona. He said he felt like he was talking underwater, and the doctor said it sounded like he was! Just today he read a description of corona which said "feeling like your talking underwater". So it sounds like you feel sick and get a brief waterboarding. When it spreads further, deal with it at home. Hospitals are for the high risk individuals, not for the pussies. We need to keep open drive thrus and stores. There is no way to get food to everyone without exposure. Exposure or starve -

BC

14.2kAn axiom is that the stock market is driven by fear and greed. It's a repulsion/attraction trap. On the one hand, investors FEAR losing money in the market, but they are driven by GREED to stay in the market. As it happens, there are usually reciprocal responses to fear and greed. My fear fits your greed. I might think Apple Corp. is going to start losing money, but you are pretty sure that they will soon unveil a new product which will result in their continued growth. I want to sell Apple, you want to buy Apple.

BC

14.2kAn axiom is that the stock market is driven by fear and greed. It's a repulsion/attraction trap. On the one hand, investors FEAR losing money in the market, but they are driven by GREED to stay in the market. As it happens, there are usually reciprocal responses to fear and greed. My fear fits your greed. I might think Apple Corp. is going to start losing money, but you are pretty sure that they will soon unveil a new product which will result in their continued growth. I want to sell Apple, you want to buy Apple.

Another axiom is "buy low/sell high". A good share of the sales sending the stock market down are still profitable for those who bought the stock LOW a while ago, and are (from their point of view) selling high.

Of course, that won't be true for a lot of people. A good share of the sales sending the stock market down are people who bought high and are bailing out as fast as they can. There is apparently a huge flight to cash, with all sorts of assets (gold, stocks, etc.) being liquidated.

A plunging stock market is an opportunity for those with piles of cash to acquire assets that will, in the long run, PROBABLY appreciate. Some investors can afford to wait years for their bets to pay off. When their cheaply acquired stocks have appreciated a lot, they will sell at a profit -- maybe in the next big crash a decade (or less) down the line.

Another axiom: what goes up must come down. -

Punshhh

3.6k

Punshhh

3.6k -

Antidote

155The corona virus and it's effect on the markets is a question of "good timing". The economy was in trouble before the corona virus started as the actions of the FED showed late last year 2019. The virus has just brought forward an already inevitable effect, being a massive market crash. It has been brewing for nearly 11 years following the last "botched" propping up of the crisis from 2007/8 or "kicking the can down the road".

Antidote

155The corona virus and it's effect on the markets is a question of "good timing". The economy was in trouble before the corona virus started as the actions of the FED showed late last year 2019. The virus has just brought forward an already inevitable effect, being a massive market crash. It has been brewing for nearly 11 years following the last "botched" propping up of the crisis from 2007/8 or "kicking the can down the road".

An opportunity was presented in 2008 whereby the financial system (which really is only a shadow of the real economy system) was at breaking point. As Roosevelt (who was a reasonable man) did in the 1930s around the Great Depression, he took reasonable action by breaking up the banks. The banks got too big to be an accurate shadow of the real economy. Recognising this, he took action. And what followed, was real growth.

Unfortunately, when the same opportunity was presented in 2008, our leaders at that time relied on logical outcomes, instead of reasonable ones and DIDN'T break up the banks. The result of such is likened to a forest fire.

There is a natural sequence of events in a forest. A forest grows and grows. When it grows to big and the conditions are right, there is a fire. The fire "thins" out the excess growth and creates the ground for a new growth to occur. That's the natural sequence.

In our financial system, when the fire took hold in 2008, instead of allowing it to be, they put the fires out by adding more money to the financial system. If we liken this back to the forest, to put the forest fire out, they quickly planted loads more trees which the logical argument of, "well if we create enough trees, there wont be enough oxygen for the fire to breath". This is logical and makes sense. However, it is not reasonable and creates an even bigger problem. Now we have 10 times as much fuel available for the next fire.

What we are seeing now is a new fire. The financial system, swelled with so much "fake money" means that the shadow it produces of the real economy is completely, and madly out of proportion.

The fires have started, and they are taking hold. But this is precisely as it should be. If we look at the forest again (and we do this in real forests too) we put the fires out. But then we have created the grounds for a "super forest fire" when the next one strikes and there is little chance of putting it out. Because there are only so many trees we can plant before there is no more space.

The only real, and sensible and reasonable thing to do, it let nature takes it course and let the fires burn. This is painful but necessary. Once they have burnt out all the excess, we can then start re-growth. And re-growth will actually mean something this time because it will be "real" growth, not just a growing of the shadow.

If we use logic without reason, we are insane in our actions. We can use reason on its own, or we can use reason and logic together to solve our problems. But we cannot use just logic to solve our problems without reason. -

ssu

9.8kNow the ugly side of just how corrupt and sleazy politicians are:

ssu

9.8kNow the ugly side of just how corrupt and sleazy politicians are:

Senate Intelligence Committee Chairman Richard Burr, R-N.C., sold as much as $1.7 million in stocks just before the market dropped in February amid fears about the coronavirus epidemic.

Senate records show that Burr and his wife sold between roughly $600,000 and $1.7 million in more than 30 separate transactions in late January and mid-February, just before the market began to fall and as government health officials began to issue stark warnings about the effects of the virus. Several of the stocks were in companies that own hotels.

And of course, Burr isn't the only one, across party lines...

Sens. Dianne Feinstein and Jim Inhofe sold as much as $6.4 million worth of stock in the weeks before panic about the coronavirus sparked a worldwide selloff, according to disclosure filings first reported by the New York Times. -

BitconnectCarlos

2.8k

BitconnectCarlos

2.8k -

Metaphysician Undercover

14.8kNow the ugly side of just how corrupt and sleazy politicians are: — ssu

Metaphysician Undercover

14.8kNow the ugly side of just how corrupt and sleazy politicians are: — ssu

How is that corrupt? Corruption is when one acts on inside information, private to the company. Coronavirus was public information, and if some savvy individuals could foresee problems coming for specific types of companies, and sold, you cannot call that corruption. The market was extremely high anyway, and it was obviously time to sell, if you are inclined toward making money off the market.

What would be glaring is if they don't even get a slap on the wrist. — ssu

What would the slap on the wrist be for? The people were just doing what we are all entitled to do. If there was evidence of inside information that would be punishable, but Coronavirus is fully and completely an external condition. But only so many stocks can be sold before a crash. First come first served.

And despite the fact that Trump insisted it was not a problem, there is no indication that any evidence was withheld from the public, which would constitute a conspiracy within the governing body. It's just a matter of which media companies one would source their information from. Trump's fake news tweets can hit you in the pocket book. Some poor innocent people were taken advantage of, to make them even poorer. What else is new in the world of Trump? -

ssu

9.8k

ssu

9.8k

Perhaps politicians know what they will do and can understand the consequences. And that isn't public information. That's the point.How is that corrupt? Corruption is when one acts on inside information, private to the company. Coronavirus was public information, and if some savvy individuals could foresee problems coming for specific types of companies, and sold, you cannot call that corruption. The market was extremely high anyway, and it was obviously time to sell, if you are inclined toward making money off the market. — Metaphysician Undercover

This actually isn't about Trump. Note the party of Dianne Feinstein.And despite the fact that Trump insisted it was not a problem, — Metaphysician Undercover

Yeah, and any finance minister and central banker will insist that they won't devalue their currency (if it's a fixed rate) until they do. But of course, you could then argue that "Everybody know that the economy was in a bad shape". You see, it is about timing. -

ssu

9.8k

ssu

9.8k

Well, it's a law. But who cares in this administration...if it's not Joe Biden etc.

And it goes on, but I think anyone interested gets the picture...Public Law 112–105 112th Congress

An Act

To prohibit Members of Congress and employees of Congress from using nonpublic

information derived from their official positions for personal benefit, and for

other purposes.

Be it enacted by the Senate and House of Representatives of

the United States of America in Congress assembled,

SECTION 1. SHORT TITLE.

This Act may be cited as the ‘‘Stop Trading on Congressional

Knowledge Act of 2012’’ or the ‘‘STOCK Act’’.

* * *

SEC. 3. PROHIBITION OF THE USE OF NONPUBLIC INFORMATION FOR

PRIVATE PROFIT.

The Select Committee on Ethics of the Senate and the Committee on Ethics of the House of Representatives shall issue interpretive guidance of the relevant rules of each chamber,

including rules on conflicts of interest and gifts, clarifying that a Member of Congress and an employee of Congress may not use nonpublic information derived from such person’s position as

a Member of Congress or employee of Congress or gained from the performance of such person’s official responsibilities as a means for making a private profit.

SEC. 4. PROHIBITION OF INSIDER TRADING.

(a) AFFIRMATION OF NONEXEMPTION.—Members of Congress and employees of Congress are not exempt from the insider trading prohibitions arising under the securities laws, including section 10(b) of the Securities Exchange Act of 1934 and Rule 10b–5 thereunder. -

ssu

9.8kThen there's no reason to argue with you how governments work.

ssu

9.8kThen there's no reason to argue with you how governments work.

But why at least I am suspicious:

Now, which politicians have that information first?US intelligence officials reportedly warned President Donald Trump and Congress about the threats posed by the novel coronavirus beginning in early January — weeks before the White House and lawmakers began implementing stringent public health measures -

ssu

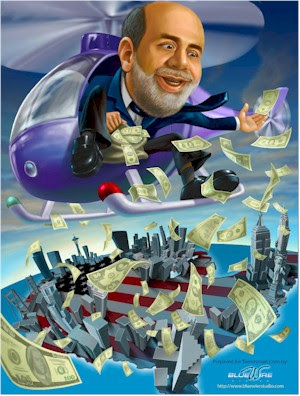

9.8kNow we genuinely and totally openly have Helicopter-money.

ssu

9.8kNow we genuinely and totally openly have Helicopter-money.

The Federal Reserve just pledged asset purchases with no limit to support markets

Remember this picture from the financial crisis with Fed Chairman Ben Bernanke? At least now they are open about it!

So now we have the chance perhaps for that monetary crisis afterwards... -

fishfry

3.4kSo now we have the chance perhaps for that monetary crisis afterwards... — ssu

fishfry

3.4kSo now we have the chance perhaps for that monetary crisis afterwards... — ssu

Price of gold is shooting up. That reflects the fact that the dollar is being destroyed. Mnuchin said the total bailouts are adding up to $6 trillion. There's no corresponding increase in productivity or actual wealth. The dollars in your pocket are simply worth less ... soon to be worthless. -

ssu

9.8kI think there's a proper way to do it. Follow the protocol given in these kind of situations. The Congress has it's disciplinary system.

ssu

9.8kI think there's a proper way to do it. Follow the protocol given in these kind of situations. The Congress has it's disciplinary system.

And in the end it ought to be the voters who decide what to do, if nothing is done and it's just business as usual. Unfortunately these kind of things will just die out because there is much bigger news. And the real corruption will happen when giving those trillions away of the freshly created money.

Welcome to The Philosophy Forum!

Get involved in philosophical discussions about knowledge, truth, language, consciousness, science, politics, religion, logic and mathematics, art, history, and lots more. No ads, no clutter, and very little agreement — just fascinating conversations.

Categories

- Guest category

- Phil. Writing Challenge - June 2025

- The Lounge

- General Philosophy

- Metaphysics & Epistemology

- Philosophy of Mind

- Ethics

- Political Philosophy

- Philosophy of Art

- Logic & Philosophy of Mathematics

- Philosophy of Religion

- Philosophy of Science

- Philosophy of Language

- Interesting Stuff

- Politics and Current Affairs

- Humanities and Social Sciences

- Science and Technology

- Non-English Discussion

- German Discussion

- Spanish Discussion

- Learning Centre

- Resources

- Books and Papers

- Reading groups

- Questions

- Guest Speakers

- David Pearce

- Massimo Pigliucci

- Debates

- Debate Proposals

- Debate Discussion

- Feedback

- Article submissions

- About TPF

- Help

More Discussions

- Other sites we like

- Social media

- Terms of Service

- Sign In

- Created with PlushForums

- © 2026 The Philosophy Forum